The Unraveling of U.S. Homeowner’s Insurance: Climate Change and Urban Development Challenges

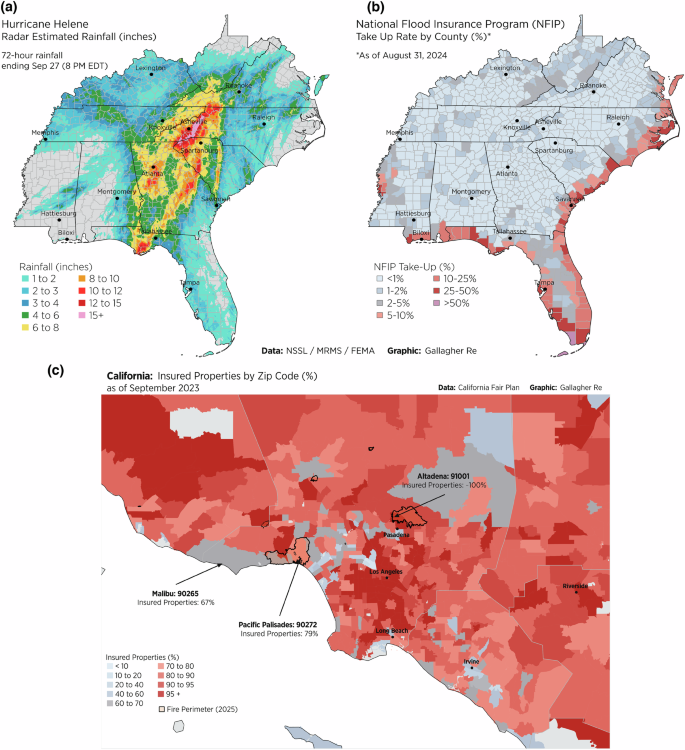

In late 2024, Hurricane Helene made landfall on Florida’s west coast as a Category 4 storm, affecting not only coastal areas but also penetrating inland to impact communities in several states. The hurricane’s intense rainfall led to unprecedented dam failures and landslides, particularly in North Carolina’s mountainous regions. This disaster, followed by major urban wildfires in southern California in early 2025, highlighted a disturbing trend: many U.S. homeowners lack adequate insurance coverage for such disasters.

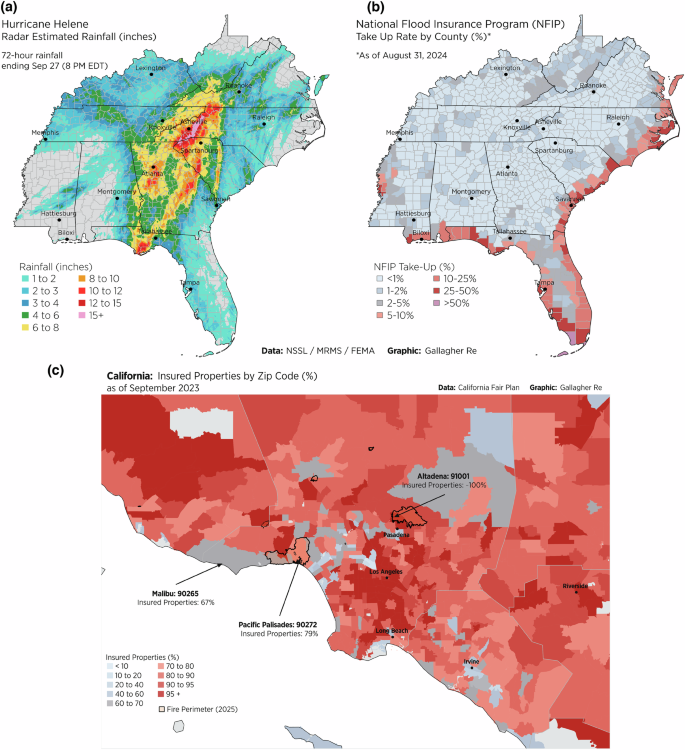

Many homeowners affected by Hurricane Helene were insured against wind hazards but lacked separate flood policies, which are crucial for recovery. The National Flood Insurance Program (NFIP) provides these policies, but coverage remains poorly understood and insufficiently purchased. Similarly, the California wildfires exposed gaps in insurance coverage, with the state-backed California FAIR plan facing liquidity challenges as it became the insurer of last resort.

The insurance industry’s challenges are intensified by climate change, which exacerbates the frequency and severity of natural disasters. Insurers have responded by increasing premiums, reducing coverage, or withdrawing from high-risk markets altogether. This has significant implications for homeowners, renters, and the broader economy, affecting property values, mortgage accessibility, and local economies.

Cascading Effects of Insurer Retreat

The ongoing retreat of insurers from climate risk-exposed regions creates substantial gaps in insurance coverage where it’s needed most. Prospective homeowners face challenges obtaining private insurance, a requirement for traditional mortgage loans. Existing homeowners may face steep premium hikes or non-renewal notices, stripping them of adequate protection against potential disasters.

The situation affects not only homeowners but also renters, as landlords pass on higher insurance costs through increased rent or neglect property maintenance. Local real estate markets suffer, with broader economic repercussions that could be profound. Properties in high-risk areas may never recover their value, unlike during the subprime mortgage crisis.

A Multi-Faceted Approach to Safeguarding Communities

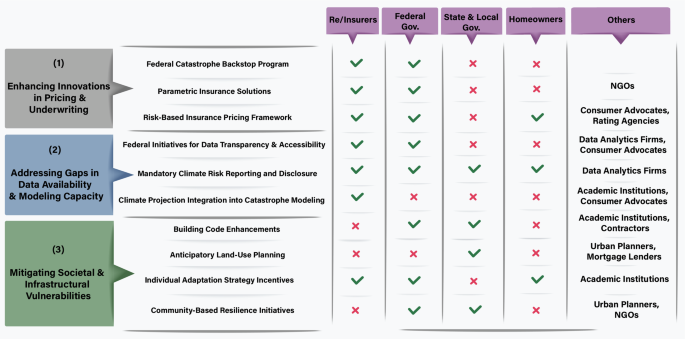

Addressing the insurance crisis requires a multi-faceted approach structured around three critical problem domains: enhancing innovations in pricing and underwriting, addressing gaps in data availability and modeling capacity, and mitigating societal and infrastructural vulnerabilities.

Enhancing Innovations in Pricing and Underwriting

A federal catastrophe backstop program could bolster reinsurance capacity for highly climate-vulnerable areas. Parametric insurance offers a quicker alternative to traditional indemnity insurance, automatically triggering payouts when predefined weather parameters are met. Risk-based premium pricing, leveraging granular hazard data, can discourage development in high-risk areas and encourage enhanced building codes and protective measures.

Addressing Gaps in Data Availability and Modeling Capacity

Governments must enhance climate resilience by improving climate risk data accessibility to homebuyers through public disclosure regulations. This can help individuals navigate real estate purchases that may become future climate risks. Stakeholder platforms should be convened to devise balanced public policies considering diverse interests.

Mitigating Societal and Infrastructural Vulnerabilities

State and municipal authorities must strengthen building codes and adopt anticipatory land-use planning to protect communities. Homeowners should be encouraged to adopt individual adaptation measures, such as implementing fire-resistant materials or elevating structures. Financial mechanisms like tax credits, rebates, or insurance premium discounts can incentivize these adaptations.

Conclusion

The U.S. homeowner’s insurance market faces significant challenges from climate change and urban development. A comprehensive approach is necessary, focusing on pricing and underwriting innovations, data availability, and vulnerability mitigation. Continued research, pilot projects, and collaborative partnerships among governments, insurers, communities, and urban planners are essential to create adaptable, equitable, and scalable solutions for various geographic and socio-economic contexts.