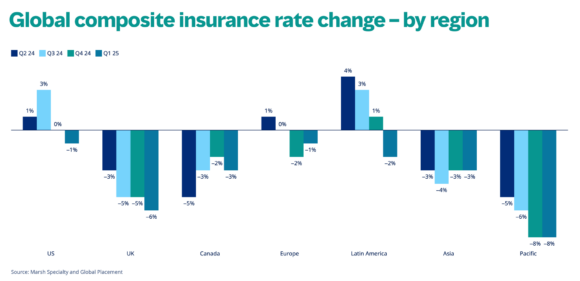

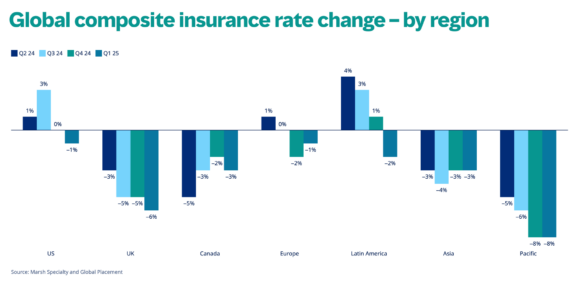

Global commercial insurance rates continued their downward trend in the first quarter of 2025, decreasing by 3% on average, according to the Marsh Global Insurance Market Index. This marks the third consecutive quarter of declining rates, following seven years of steady increases. The decline was observed across all global regions, with varying degrees of decrease.

Regional Rate Changes

The Pacific region experienced the largest decrease at 8%, followed by the UK at 6%, and India, Middle East, and Africa (IMEA) at 4%. Asia and Canada saw a 3% decrease, while Latin America and the Caribbean (LAC) fell by 2%. The US and Europe recorded the smallest declines at 1% each.

Line-Specific Trends

Despite the overall decline, casualty insurance rates bucked the trend by increasing globally by 4%, consistent with the Q4 2024 rate. This increase was largely driven by an 8% rise in US casualty rates, attributed to the severity of claims and large jury verdicts, often termed ‘nuclear verdicts.’ Conversely, other lines such as property, financial and professional, and cyber insurance saw rate decreases.

Property Insurance

Property rates declined by 6% globally, with the US and Pacific regions experiencing the largest decreases at 9% each. The global property market is seeing increased capacity due to insurers’ improved financial performance and lower reinsurance costs.

Financial and Professional Lines

Rates for financial and professional lines decreased by 6% globally, consistent with the previous quarter. This decrease was observed across all regions, driven by robust competition and available capacity.

Cyber Insurance

Cyber insurance rates also decreased by 6% globally, following a 7% decline in the previous quarter. Insureds are increasingly adopting proactive risk management approaches and using premium savings to enhance coverage and reduce retentions.

Market Outlook

John Donnelly, president of Global Placement at Marsh, noted that the trend of declining rates is expected to continue as insurer competition intensifies. Many insurance buyers are leveraging the competitive environment to negotiate better terms and explore alternative risk transfer solutions.

The report highlights that insurers are actively seeking new business opportunities and expanding their offerings, particularly in non-casualty lines. This increased competition is likely to drive further rate decreases and improved market conditions for commercial insurance buyers.