Analysis of Samsung Life Insurance Co., Ltd.’s Low Price-to-Earnings Ratio

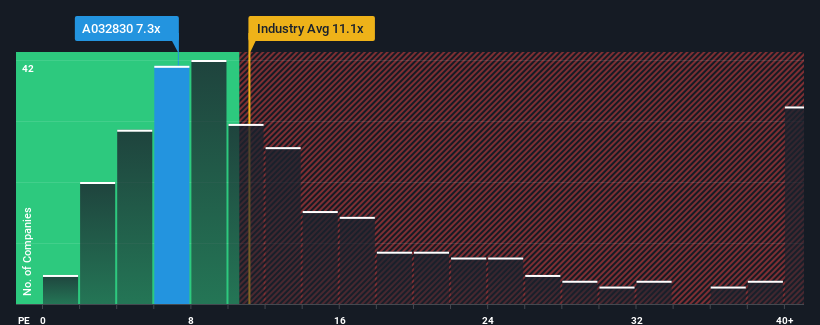

Samsung Life Insurance Co., Ltd.’s (KRX:032830) current price-to-earnings (P/E) ratio of 7.3x appears attractive compared to the Korean market, where about half of the companies have P/E ratios above 12x. To understand this discrepancy, we need to examine the underlying factors.

Despite recent strong earnings performance, with an 11% gain in the last year and a 43% overall rise in EPS over the last three years, the company’s P/E ratio remains low. Analysts predict EPS growth of 4.3% per annum for the next three years, which is weaker than the market’s expected 18% annual growth. This disparity contributes to the low P/E ratio, as investors anticipate limited future growth.

Key Factors Influencing the P/E Ratio

- Earnings Growth: Samsung Life Insurance has demonstrated strong earnings growth in recent years.

- Future Projections: Analysts expect slower earnings growth compared to the market average.

- Market Comparison: The company’s P/E ratio is significantly lower than many of its Korean peers.

The low P/E ratio reflects investor skepticism about the company’s future growth prospects. Unless there are improvements in these conditions, the share price is likely to remain constrained.

Investors should also be aware of potential risks. For instance, we’ve identified one warning sign for Samsung Life Insurance that warrants attention.

In conclusion, while Samsung Life Insurance has shown strong recent performance, its low P/E ratio is largely due to expected weaker future growth compared to the broader market. Investors considering the stock should weigh these factors carefully.