Global Pet Insurance Market Overview

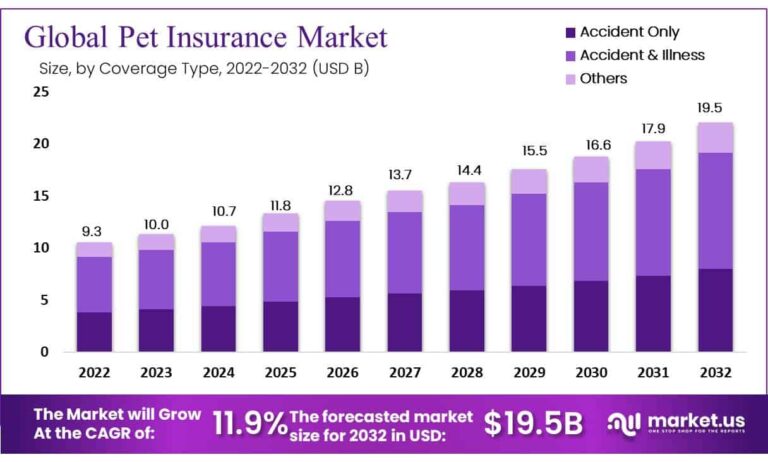

The global pet insurance market is experiencing substantial growth, expected to reach USD 27.8 billion by 2032, up from USD 9.3 billion in 2022, at a CAGR of 11.9%. The accident & illness insurance segment dominated the market in 2022, reflecting the increasing focus on comprehensive coverage for pets. Cats are projected to dominate the market by animal type during the forecast period, while direct sales channels remained the primary distribution method.

US Tariff Impact on Market

The imposition of US tariffs on pet insurance-related products has had a mixed effect on the market. While the impact on premium prices is likely limited, tariffs on imported pet products could increase overall operational costs by up to 10%. This rise in expenses may hinder the affordability of policies, especially in lower price segments. Regions dependent on imports, like the US and parts of Europe, face price hikes in pet care products, potentially lowering the uptake of pet insurance.

Key Takeaways

- The global pet insurance market is set to grow from USD 9.3 billion in 2022 to USD 27.8 billion by 2032, at a CAGR of 11.9%.

- Accident & illness insurance remains the leading market segment.

- Cats are expected to dominate the market by animal type.

- Direct sales channels remain the top distribution method.

- Europe led the market in 2022 with a 30% share, while Asia-Pacific is set to have the highest CAGR.

Regional Analysis

Europe is the dominant region in the global pet insurance market, holding a 30% share in 2022. North America follows closely, with steady expansion in pet insurance, though high pet care costs and tariff-induced price increases may limit adoption. Asia-Pacific is projected to experience the highest CAGR due to rapid pet ownership growth in countries like China and India.

Business Opportunities

The pet insurance market presents several opportunities, particularly in the accident & illness insurance segment and the growing cat ownership demographic. The Asia-Pacific region represents a promising area for expansion due to increasing disposable incomes and a growing pet care culture. Providers who innovate in coverage and distribution can tap into emerging markets.

Key Player Analysis

Key players in the pet insurance market focus on offering flexible and comprehensive coverage. Companies like Trupanion, Nationwide Mutual Insurance Company, and Healthy Paws Pet Insurance are expanding their portfolios to include specialized insurance for accidents, illnesses, and preventive care. The integration of telemedicine and mobile applications for pet care is enhancing customer experiences.

Conclusion

The pet insurance market is on track for significant growth, driven by increased consumer demand for comprehensive coverage and the growing number of pet owners globally. While challenges like tariffs may create cost pressures, companies that adapt to changing consumer needs and offer innovative solutions will thrive in this expanding market.