Q2 2025 UK Pet Insurance Digital Benchmarking Report Analysis

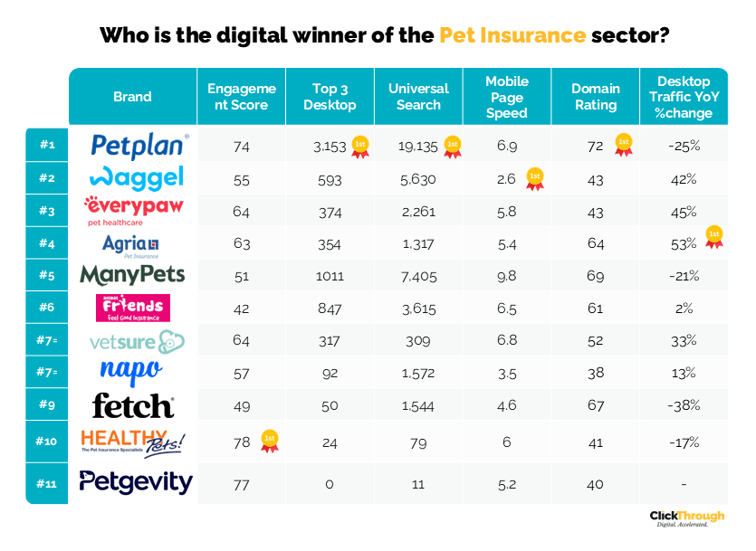

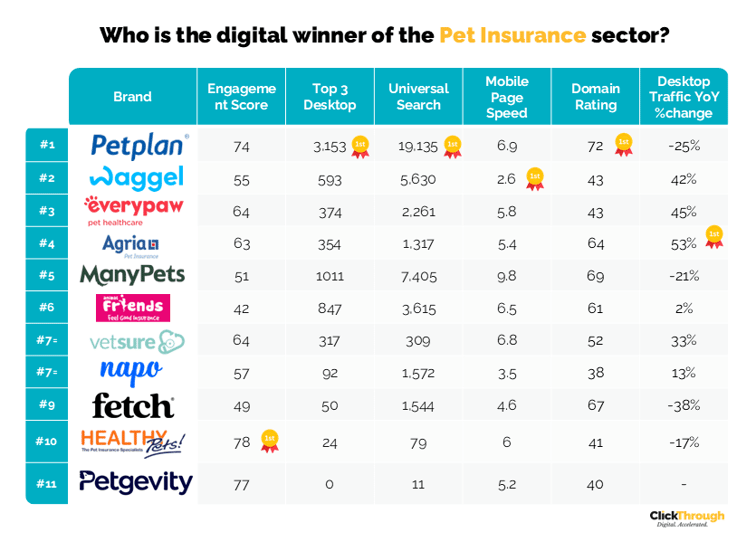

The latest Q2 2025 benchmarking report for the UK pet insurance market has been released, providing insights into the digital performance of the top 11 companies in this sector. The report, spanning over 70 pages, evaluates these major players across more than 50 metrics, offering a comprehensive view of their digital strategies and performance.

Key Findings and Performance Metrics

The benchmarking report covers various aspects of digital performance, including organic visibility, domain authority, paid media ads, conversion performance, technical performance, site speed, universal search, content strategy, social ads, accessibility, and mobile performance. The analysis reveals significant insights into how these companies are performing in the digital landscape.

Paid Media Performance

The report highlights that some leading pet insurance companies are heavy spenders on paid media channels like Google, Bing, and Facebook. However, many lack sophisticated conversion strategies to maximize their return on investment. The average monthly budget wastage across these companies was £18,654, with some spending considerably on areas unlikely to deliver returns. The average monthly cost per click (CPC) was £16, emphasizing the competitive nature of the market.

Agria Pet Insurance reported the lowest monthly CPC at £9, while Healthy Pets Insurance had the highest at £62. The report suggests that focusing on driving CPC down while maintaining campaign performance is crucial for maximizing budget efficiency.

Technical Performance and Website Compliance

The report emphasizes the importance of having a technically sound website. ManyPets had the highest number of 4xx errors (560), which can lead to user frustration and potential loss of business. Pinnacle Pet UK had the slowest mobile site speed, which is critical given that 62% of consumers are less likely to convert with a negative mobile site experience.

Organic Performance

The report notes fluctuations in organic traffic, with four companies reporting a loss in organic traffic on desktop and five on mobile. Fetch Pet Insurance saw the biggest decline in both desktop (-38%) and mobile (-44%) traffic. The report stresses the importance of an effective keyword strategy to improve search engine rankings.

Universal Search and Longtail Keywords

Petplan UK secured the most Universal Search appearances (19,135), primarily through ‘images’ (9,500). The report highlights the importance of optimizing for longtail keywords, which are considered high intent and potentially more likely to convert. Petplan UK reported the most longtail keyword appearances for position 3 (2,605) and positions 4–10 (6,115).

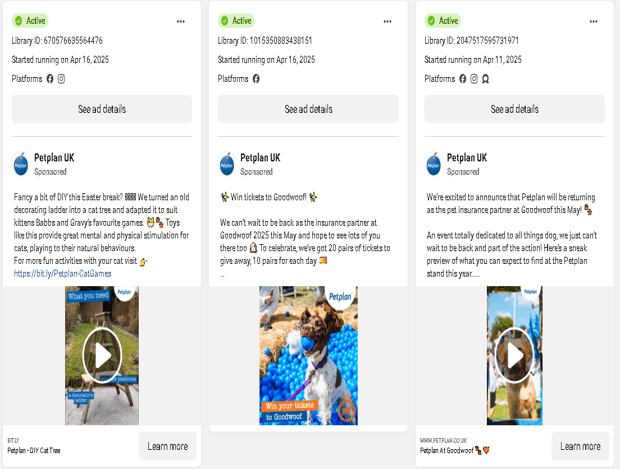

Social Media and Content Strategy

The report suggests that creating ‘evergreen’ content is crucial for brand engagement and Google recognition. Petplan UK has the most Facebook Likes (156,600), while Fetch Pet Insurance has the most Instagram followers (35,900). Companies are advised to use social media not just for selling but also for customer engagement and building a community.

Accessibility Concerns

Animal Friends reported the highest accessibility alerts (156), followed by PetPlan UK (114 alerts). The report emphasizes the need for pet insurance companies to ensure their websites are accessible to all users, including those with disabilities.

Conclusion

The Q2 2025 benchmarking report provides valuable insights into the digital performance of UK pet insurance companies. By understanding these metrics and addressing areas of improvement, companies can enhance their digital strategies, improve their online presence, and ultimately drive better business outcomes.

For the full 70-page Q2 2025 report, interested parties can complete an enquiry form or contact the research team directly.