Annuity Sales Data for First Quarter Released

Total annuity sales for the first quarter reached $98.2 billion, representing a 1.9% decrease from the previous quarter and a 5.7% decline compared to the same period last year, according to Wink, Inc.’s Sales and Market Report. The data encompasses various annuity types, including multi-year guaranteed, traditional fixed, indexed, structured, variable, immediate income, and deferred income annuities.

Top Performers in Annuity Sales

Athene USA led the market with a 9.7% share of total annuity sales, followed by New York Life, Equitable Financial, Corebridge Financial, and Allianz Life. The top five carriers maintained their positions across different annuity categories, with some variations in ranking.

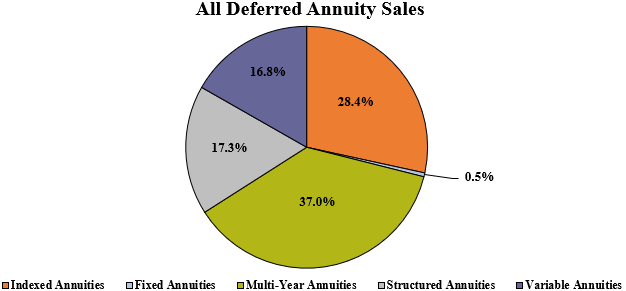

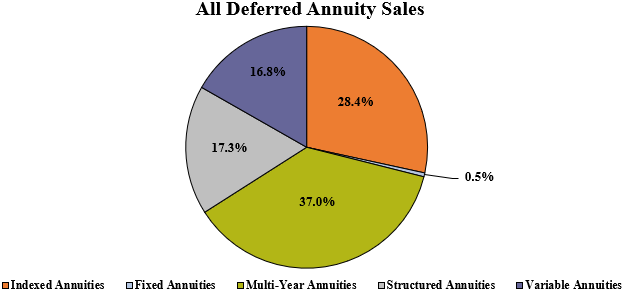

Deferred Annuity Sales

Deferred annuity sales totaled $95 billion, down 1.6% from the previous quarter and 5.4% from the same period last year. Athene USA again ranked first, with a 10% market share, followed by New York Life, Equitable Financial, Corebridge Financial, and Allianz Life.

Equitable’s Structured Capital Strategies Plus 21 was the top-selling deferred annuity across all channels for the second consecutive quarter.

Non-Variable Deferred Annuity Sales Rise

Non-variable deferred annuity sales increased 1.7% to $62.7 billion compared to the previous quarter, although they were down 14.6% from the same period last year. Athene USA led this category with a 14.6% market share.

Athene Annuity’s Athene MYG 5 with MVA was the top-selling non-variable deferred annuity for the quarter.

Variable Deferred Annuity Sales Decline

Variable deferred annuity sales decreased 7.7% to $32.3 billion compared to the previous quarter but remained up 19.3% from the same period last year. Equitable Financial led this category with a 17% market share.

Equitable’s Structured Capital Strategies Plus 21 was again the top-selling variable deferred annuity for the fourth consecutive quarter.

Income Annuity Sales Decrease

Income annuity sales dropped 10.3% to $3.1 billion compared to the previous quarter and 13.2% from the same period last year. New York Life led this category with a 43.7% market share.

Multi-Year Guaranteed Annuity Sales Surge

Multi-year guaranteed annuity (MYGA) sales saw a significant 20.8% increase to $35.2 billion compared to the previous quarter, although they were down 19.5% from the same period last year. Athene USA was the top seller with a 16.3% market share.

Sheryl Moore, CEO of Wink, Inc., noted that the increase in MYGA sales from the fourth quarter to the first quarter was unusual.

Other Annuity Types

- Traditional fixed annuity sales remained relatively stable, increasing 1% to $496.5 million.

- Indexed annuity sales declined 15.6% to $27 billion.

- Structured annuity sales decreased 4.7% to $16.4 billion.

- Variable annuity sales dropped 10.5% to $15.9 billion.

Market Insights

Moore commented on the trends, stating, “While structured annuities have been around for more than a decade, we are still seeing new entrants regularly.” She also noted that variable annuity sales might not continue their year-over-year growth due to recent market volatility.

The comprehensive data from Wink, Inc. provides insights into the diverse trends within the annuity market, highlighting both declines and growth areas across different product types.