After eight consecutive years of financial losses, Florida’s personal property insurance market has turned a corner, reporting an underwriting profit and substantial growth in operating income for 2024. According to a recent report by AM Best, a renowned rating and analytics firm, this positive shift is largely attributed to legislative reforms enacted in the state.

The analysis examined 45 insurers operating in Florida, excluding large national carriers and Citizens Property Insurance Corp., a state-created entity. These insurers collectively reported a combined ratio of 93.1 for 2024, a significant improvement from nearly 100 in the previous year. Underwriting gains for these companies surged to $207 million in 2024, a stark contrast to the $174 million loss recorded in 2023.

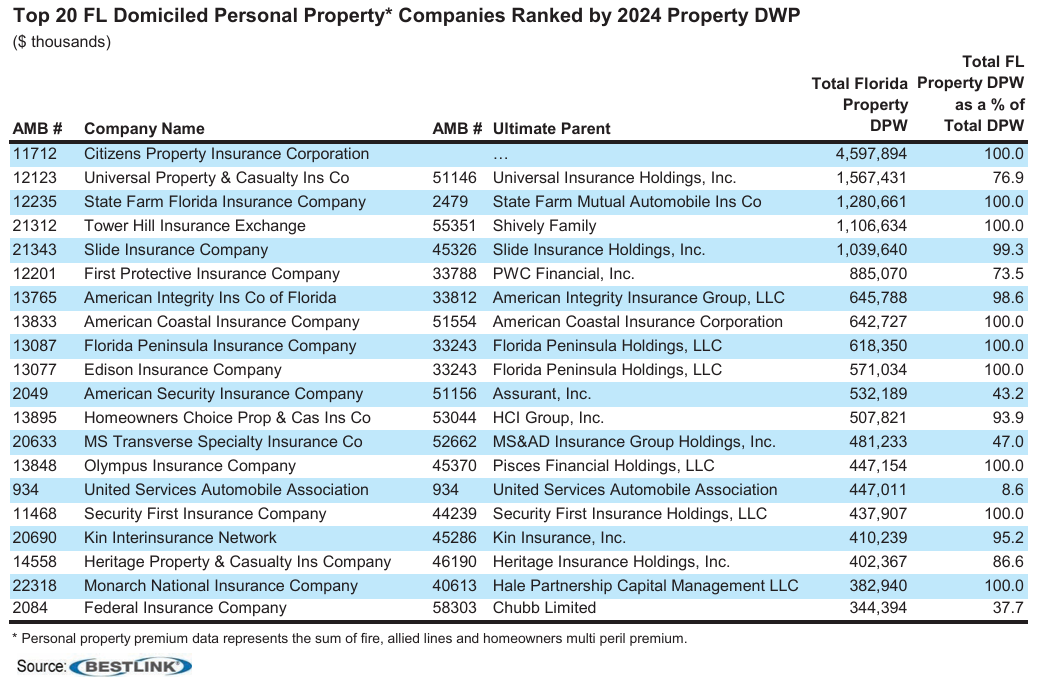

Josie Novak, a senior financial analyst at AM Best, noted that Florida’s legislative reforms have been instrumental in creating a more favorable environment for both existing insurers and new entrants. The reforms have effectively increased market capacity and allowed new companies to establish a presence, thereby reshaping the competitive landscape. The withdrawal of certain carriers from the market, either through reduced participation or suspension of new business, has also created opportunities for new companies to gain a foothold.

The report highlighted a steady rise in direct premiums written by active Florida insurers, growing from approximately $5 billion in 2020 to over $11 billion in 2024. While this growth indicates a stabilizing market, the report also cautioned that hurricane-related risks remain a significant concern for the industry.

The AM Best analysis also revealed that active Florida insurance companies have a much higher reinsurance dependency compared to the national average for personal property insurance. The reinsurance dependency for Florida companies stood at 519.4%, far exceeding the US personal property composite average of 62.2%. This elevated reliance on reinsurance is attributed to Florida’s unique exposure to catastrophic weather events.

The findings from AM Best echo a 2024 analysis by S&P Global Market Intelligence, which also observed improvements in underwriting losses for Florida’s top 50 property insurers following the legislative reforms. The full AM Best report is available on their official website.