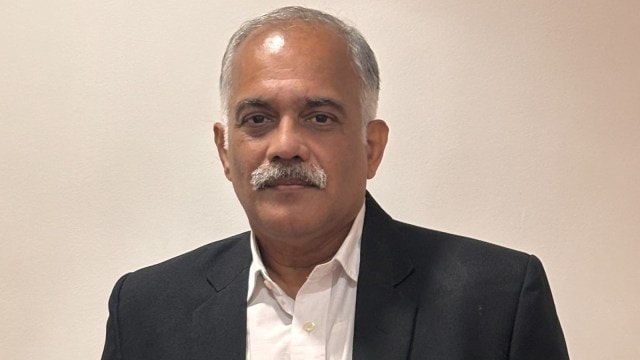

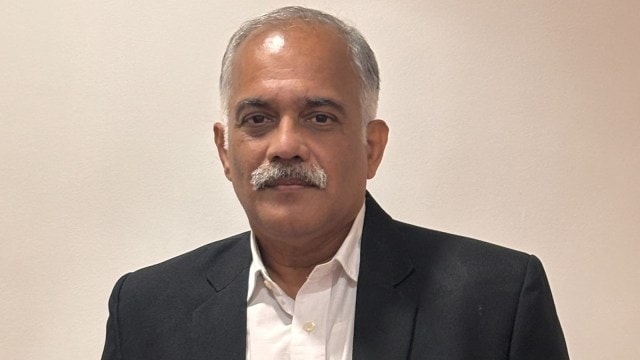

GIC Re Chief on Insurance Industry Challenges

Ramaswamy Narayanan, Chairman and MD of General Insurance Corporation of India (GIC Re), has identified fraud as the biggest problem facing the insurance industry, affecting various sectors including health, motor, and agriculture insurance. In an interview, Narayanan highlighted the need for a regulator in the unregulated healthcare sector and discussed the potential introduction of catastrophe insurance in India.

Insurance Penetration and Growth

Narayanan noted that while the insurance industry is growing, particularly in infrastructure and corporate levels, there’s a significant gap in reaching tier 3 cities and villages. The industry’s growth is hindered by the lack of presence in smaller towns and villages, mainly due to the high cost of establishing operations in these areas. He emphasized the need for the industry to expand its reach to the ‘last man in the country’ to increase penetration levels.

Health Insurance Premiums and Fraud

The GIC Re chief pointed out that higher claims and fraud are major concerns in the health insurance segment. He criticized the practice of hospitals charging differently based on whether a patient has insurance, stating that the cost of service should remain the same regardless of insurance coverage. Narayanan emphasized the need for regulation in the healthcare sector to control costs and prevent fraudulent practices.

Catastrophe Insurance and Risk Management

Narayanan discussed the potential for catastrophe insurance in India, citing the high percentage of uninsured losses during such events. He mentioned that GIC Re is in talks with the government to introduce catastrophe insurance, potentially using parametric insurance models that trigger payouts based on predefined parameters rather than actual loss assessments.

Impact of FDI on Insurance Sector

Regarding the impact of 100% FDI on the general insurance and reinsurance sectors, Narsanian expressed a cautious view. He believes that while foreign investment can bring in global best practices and products, having a local partner is crucial for success in the Indian market due to their understanding of the local distribution network and market dynamics.

Challenges and Future Outlook

The GIC Re chief highlighted fraud as a pervasive issue across all insurance sectors and noted that the industry is working to address this through initiatives like the Bima Sugam platform, which aims to share insurance data to detect fraud. He also discussed the challenges faced by the agriculture insurance sector, particularly with schemes like the 80-110 scheme, which he believes does not effectively transfer risk.

Conclusion