Canada Property and Casualty Insurance Market Overview

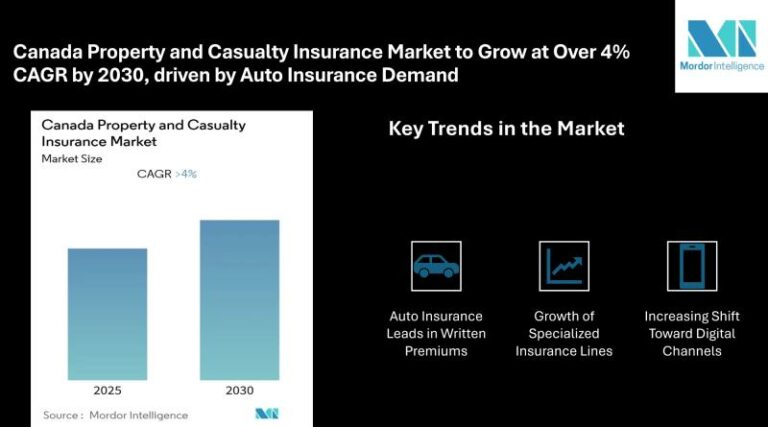

The Canadian property and casualty (P&C) insurance market is experiencing moderate growth, supported by a mature regulatory framework and increasing technology adoption. As of 2024, the market covers both personal and commercial risks across key lines such as auto, property, liability, and specialized coverage.

Key Trends in Canadian P&C Insurance

- Auto Insurance Dominance: Auto insurance remains the largest segment, accounting for approximately 43% of net written premiums. Its mandatory nature across all provinces and a large insured vehicle base contribute to its dominance. Provinces like British Columbia, Saskatchewan, and Manitoba operate public auto insurance systems, while others rely on private insurers, creating a diversified risk landscape.

- Growth of Specialized Insurance Lines: Specialized categories like boiler and machinery, marine, aircraft, and surety & fidelity products are gaining significance, contributing over 7% of total market premiums. These lines serve commercial and industrial sectors, particularly in construction, logistics, and infrastructure maintenance.

- Digital Transformation: While traditional agents and brokers remain dominant, direct-to-consumer channels are gaining traction. Consumers are increasingly using digital platforms to compare, purchase, and manage policies, particularly for personal auto and tenant insurance.

Market Segmentation

The Canadian P&C insurance market is segmented by type and distribution channel:

- By Type: Auto Insurance, Property Insurance, Liability Insurance, Specialized Lines, and Accident & Sickness Insurance.

- By Distribution Channel: Direct Sales, Agents & Brokers, Banks and Affiliated Institutions, and Other Channels.

Agents and brokers continue to dominate commercial insurance, while direct channels are preferred for standard products.

Key Players

Major players in the Canadian P&C insurance market include:

- Intact Financial Corporation: One of Canada’s largest P&C insurers with a strong digital focus.

- Aviva Canada Inc.: Known for auto and home insurance with significant investments in digital platforms.

- Desjardins General Insurance Group: Offers personal and business insurance with a strong presence in Quebec and Ontario.

- The Co-operators Group Limited: A Canadian-owned cooperative offering a full suite of insurance products.

- TD Insurance: A bank-owned insurance arm focusing on digital accessibility and affordability.

Conclusion

The Canadian P&C insurance market is expected to maintain moderate growth through 2030, driven by steady consumer demand and industry innovation. While challenges such as climate risks and pricing pressures exist, the market benefits from a healthy mix of public and private participants and a strong regulatory foundation.