Colorado Law Aims to Reduce Insurance Premiums for Wildfire-Resilient Homes

The state of Colorado has taken a significant step towards lowering insurance premiums for residents who take proactive measures to mitigate wildfire risk on their properties. According to a report from the Steamboat Pilot & Today, a daily newspaper serving Steamboat Springs and Routt County, state lawmakers have passed House Bill 1182, which was signed into law by Governor Jared Polis in May.

This legislation mandates that insurance companies be transparent about potential discounts related to wildfire risk mitigation and requires them to consider homeowners’ mitigation efforts when assessing properties for insurance. The goal is to incentivize homeowners to strengthen their properties’ resilience to wildfires while potentially lowering their insurance premiums.

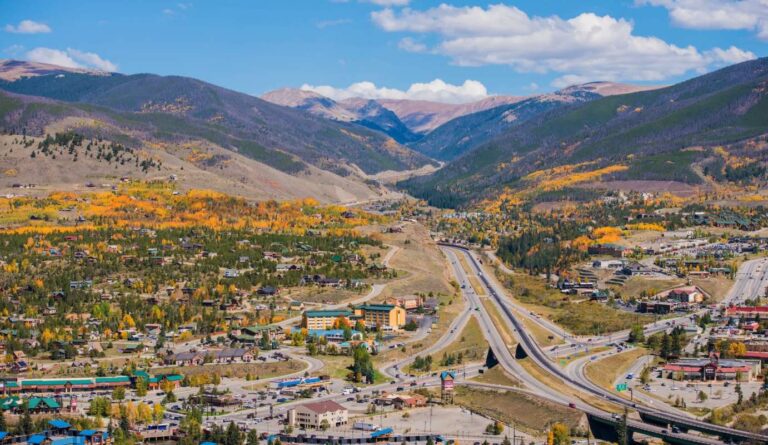

Colorado, like much of the American West, has seen an increase in wildfire risk in recent years due to a prolonged drought exacerbated by climate change. The drier conditions in the state’s grasslands and forests have made wildfires more common, leading to a significant rise in insurance premiums.

Carol Walker, executive director of the Rocky Mountain Insurance Association, views the new law as a positive step, particularly for insurance availability in mountain areas. However, she notes that insurance companies still face challenges due to heightened wildfire risk and other catastrophe risks that continue to pressure rates.

The law also encourages community-level mitigation efforts by requiring insurance companies to consider “community-level mitigation activities or designations, including forest treatment and other fuel reduction activities.” This provision suggests that residents who participate in local wildfire mitigation initiatives may also benefit from reduced premiums.

By promoting transparency and rewarding proactive measures, Colorado’s new law aims to create a more balanced approach to wildfire risk management, benefiting both homeowners and insurance providers.