Malaysian Insurers Face Challenges in Medical Insurance Sector

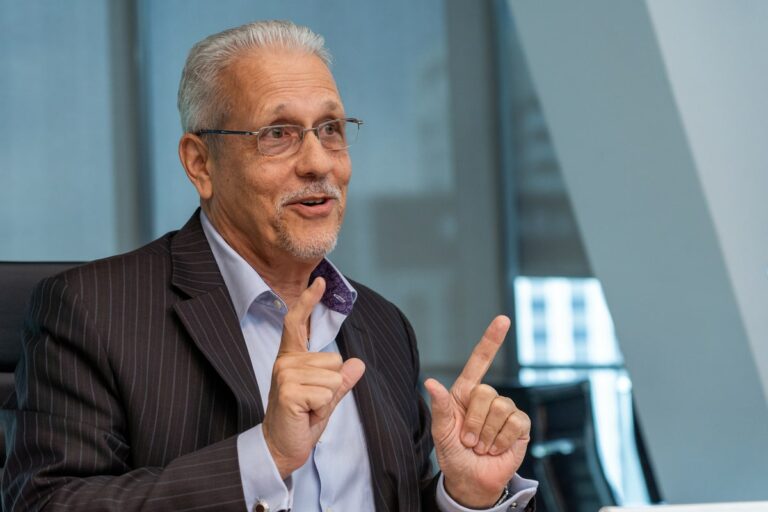

Life insurance companies in Malaysia are reporting losses in their health insurance portfolios despite overall profits, according to Mark O’Dell, CEO of the Life Insurance Association of Malaysia (LIAM). Speaking to CodeBlue, O’Dell cited a significant post-Covid spike in medical claims as the primary reason for these losses.

The industry data revealed that medical claims increased by 73% from 2022 to 2024, while premiums rose by only 21% during the same period. This discrepancy has put considerable pressure on insurers, making their medical insurance business unsustainable.

O’Dell explained that the industry’s biggest cost driver is the sharp increase in medical claims post-Covid, primarily due to a higher volume of hospital admissions rather than the cost of care. “A lot of people have asked, even parliamentarians have asked, insurance companies seem to be making high profit. Why are you raising rates?” O’Dell said. “The medical book of business is a separate line of business and it’s a separate fund.”

To address this issue, LIAM is exploring long-term reforms, including the introduction of co-payments, mandatory use of generic drugs, publishing average costs of common procedures, and redesigning medical plans with more sustainable benefit structures. “Policyholder co-payments are needed to align interest, lower cost, and reduce overconsumption,” O’Dell stated.

The average annual increase in medical claims over the past seven years was 14.34%, excluding inflation. Post-Covid, claims have escalated significantly, with a 33.7% spike in 2022, driven mostly by the volume of claims rather than the cost of care.

O’Dell also highlighted the high number of one-night hospital admissions, which made up 35% of total admissions between 2018 and 2024, suggesting that some of these may not have been medically necessary. “Most plans will not pay a claim because they weren’t admitted. And so the doctor says, ‘Why don’t we admit you overnight for observation?’ and the claim is paid,” he explained.

LIAM has acknowledged past missteps in medical plan design and poor communication regarding premium hikes. O’Dell admitted that the early promotion of cashless medical cards was “missold to some degree,” encouraging overuse of healthcare services. The industry is now working to improve transparency and explanations for rate increases.

To address affordability concerns, LIAM is working with Bank Negara Malaysia (BNM) and the Ministry of Health (MOH) to develop a basic long-term medical insurance plan for those seeking lower-cost coverage. This initiative is similar to models implemented in Hong Kong and Singapore, aiming to provide a lower-end choice that allows people to maintain access to private care.

The association also supports the implementation of diagnosis-related groups (DRG) pricing, which will be used initially in the government’s pilot Rakan KKM programme expected to launch by the end of the year.