The Changing Face of Life Insurance

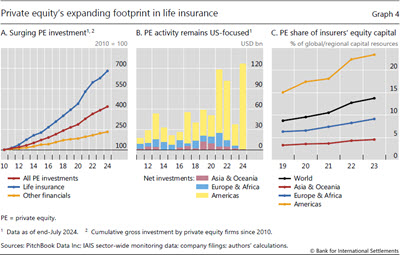

Years of low interest rates have significantly altered the landscape of the life insurance industry. Insurers, seeking to maintain profitability, have increased their exposure to more volatile and less liquid assets, and have increasingly turned to asset-intensive reinsurance (AIR). Private equity (PE) firms have played an important role in accelerating these shifts, acquiring life insurers or partnering with them to funnel investments into private markets.

The life insurance sector is a cornerstone of the financial system, offering critical financial protection and savings products. In 2022, the industry managed roughly $35 trillion in assets, which is about 8% of all global financial assets. However, the prolonged period of exceptionally low interest rates, lasting from the Great Financial Crisis until late 2021, created challenges for traditional life insurance business models.

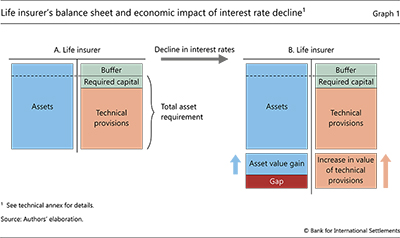

The Impact of Low Interest Rates

Low interest rates affected the long-term viability for insurance policies with guaranteed returns. Furthermore, the adjustments made to mitigate the impact on returns reduced the demand for new policies. This pressure on existing business led to two main trends.

First, low rates incentivized insurance companies to reduce overhead and economize on capital, spurring risk-sharing strategies. This resulted in the transfer of risks to other insurers, including those located in offshore centers. Second, by intensifying investors’ search for yield, low rates propelled the expansion of private markets. Life insurers responded by allocating more funds to these markets to enhance and diversify returns, investing in riskier and less liquid assets.

These trends have continued even as rates have risen, and are set to keep shaping the industry’s future.

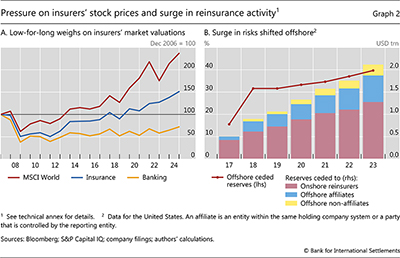

Asset-Intensive Reinsurance and Risk Sharing

AIR seeks to free up capital by transferring risks associated with capital-intensive policies to other insurers. In an AIR agreement, the reinsurer assumes all risks – those inherent in the policies, as well as those relating to the assets backing the policies.

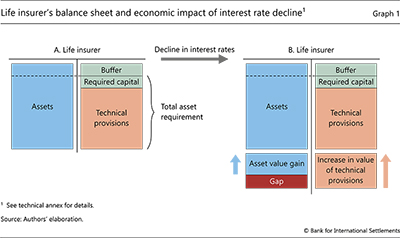

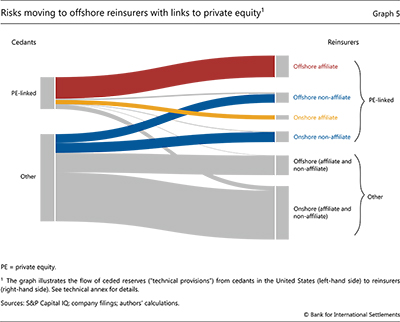

This has led to significant growth in reinsurance activity in major insurance markets over the past decade. For instance, in the United States, major life insurers had ceded reserves totalling $2.1 trillion by the end of 2023, representing about a quarter of their total assets. Approximately 40% were assumed by reinsurers in offshore centers, a substantial increase.

Private Equity’s Growing Role

PE firms have significantly increased their investments in the life insurance sector. They have facilitated insurers’ investments in private markets and acquired insurance portfolios through affiliated reinsurers, becoming key players.

PE firms acquire primary insurers, invest in existing reinsurers, or establish new ones. They also offer asset management services in private markets for insurers to generate fee income. Several factors drive their increased involvement, including the willingness of traditional life insurers to divest from capital-intensive business, and the attractive investment opportunities presented by depressed stock market valuations.

PE firms stand to benefit three ways: by channeling predictable cash flows from insurance premiums into assets, by exploiting cross-jurisdictional differences in regulatory frameworks and corporate taxation and by leveraging their investment expertise and management capabilities.

Financial Stability Implications

The growing reliance on AIR, increased exposure to private markets, raises several financial stability concerns. Complexity from these arrangements makes it increasingly difficult to assess how risks could spread through system. The complexity of AIR suggests its economic viability depends on scale, potentially concentrating risks in a limited number of reinsurers and jurisdictions.

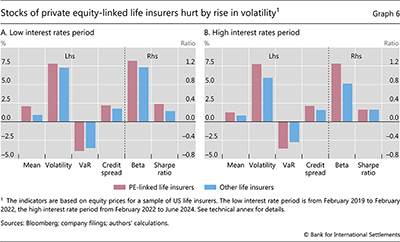

Conflicts of interest could also raise additional risks. Some PE-linked life insurers’ greater vulnerability to market downturns could pose an additional risk for financial stability. International supervisory cooperation and internationally agreed regulatory standards are critical.

These firms could prove more vulnerable than peers in difficult market conditions.