Vehicle Risk Ratings: The Future of UK Car Insurance

The UK car insurance sector is undergoing a significant change with the introduction of Vehicle Risk Ratings (VRR). This new system replaces the longstanding car insurance group system, providing insurers with a more thorough risk assessment. For drivers, it offers a clearer picture of the strengths and weaknesses of different vehicles.

The new insurance model considers multiple factors, such as performance, repairability, and safety. These factors are assessed and scored, which then determines the insurance policy.

Thatcham Research, the automotive risk organization overseeing this transition, recognized the need for a new system because of rapidly developing automotive technology. These technologies include advanced safety systems, electric vehicle (EV) powertrains, and over-the-air (OTA) software updates. As VRR is rolled out, it’s important to understand how your car insurance could change. Read on to discover which cars will likely cost the least and most to insure.

How Vehicle Risk Ratings Work

Before delving into the new system, let’s review how the old car insurance group system worked. Since 2006, vehicles have been categorized into groups from one to 50, with group one being the most affordable to insure. Thatcham Research decided a vehicle’s insurance group based on data, including cost, performance, safety tech, and repair costs. Until recently, this, combined with insurers’ historical knowledge of different vehicle types, determined a customer’s premium.

According to Thatcham Research CEO Jonathan Hewett, “this is no longer viable in today’s fast-paced environment where it’s important to understand the influence of rapidly developing ADAS [advanced driver-assistance systems] on accident frequency and severity, the impact of new security technology in staying ahead of the criminal gangs and the challenges electrification and new vehicle structures present to sustainable repair.”

The Vehicle Risk Rating system addresses this by providing a more granular risk assessment. It takes into account rapidly evolving automotive technologies. The system uses five categories:

- Performance: This considers factors such as acceleration, top speed, drivetrains, powertrains, and list price.

- Damageability: This concerns how vehicle materials and design affect the severity and cost of repairs.

- Repairability: This assesses how easily a car can be repaired, considering a “transparent and accessible repair strategy.”

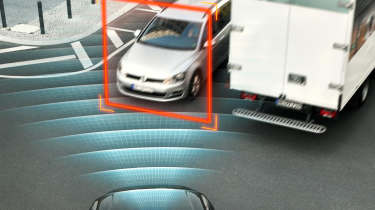

- Safety: Considers any active and passive safety systems, as well as factors such as kerb weight.

- Security: This category assesses both physical and digital systems designed to prevent theft.

A vehicle receives a Vehicle Risk Rating from one to 100 for each category, with a low score indicating low risk. For example, a car with the latest active safety system will likely score low in the Safety category. Conversely, a supercar will likely score high in the Performance category. Insurers use these five individual scores to customize an appropriate insurance premium for each vehicle.

Unlike the old system, where a car’s insurance group was fixed, the new Vehicle Risk Rating system is dynamic. These scores can change following software updates, changes to repair strategies, and theft data for each car.

Thatcham Research hopes this new system allows customers and manufacturers to compare the strengths and weaknesses of different models. This should help customers make more informed vehicle purchasing decisions and encourage manufacturers to prioritize insurability when designing and developing new technologies.

Rollout and Impact

The VRR system was launched in September 2024. It applies to all new cars sold in the UK from August 1st, 2024. However, a transition period of at least 18 months is in place to allow insurers and stakeholders to adapt. During this transition, insurers will use both the old insurance group system and VRR to determine insurance costs. After the transition, all new cars will be insured based on their five VRR scores.

There are no plans to apply the VRR system to older cars. All cars sold before August 1st, 2024, continue to be categorized under the old insurance group system.

It’s hard to predict whether insurance premiums will increase or decrease. The system is still transitioning. However, some models currently in higher insurance groups may receive a lower VRR score, and vice-versa, as the new system considers more data.

When fully implemented, the five individual VRR scores will help buyers understand why one car is more expensive to insure than another. However, Thatcham Research emphasizes that buyers shouldn’t directly compare old insurance group numbers to VRR scores, as they’re different systems.