Best Free Identity Theft Protection: Protecting Yourself in Today’s World

Identity theft is a serious concern, and it’s getting more prevalent as our lives become increasingly digital. The good news? You don’t always need to pay a fortune to protect yourself. Several excellent, free identity theft protection services are available, offering valuable tools and resources.

Content Analysis

This article is a guide/review, targeting individuals concerned about their online security and identity theft. The writing style is informative and straightforward, aiming to provide clear and concise information. The tone is helpful and reassuring, intended to empower readers to make informed decisions about their identity protection.

Main Points Summary

- Identity theft is a growing threat in the digital age.

- Free identity theft protection services provide essential security measures.

- AAA ProtectMyID provides solid free identity theft protection for AAA members, including credit monitoring and insurance.

- Experian offers free credit monitoring and credit checks.

- Credit Karma provides free credit monitoring and financial tools.

- Aura offers a 60-day money-back guarantee and comprehensive identity protection with insurance.

- EverSafe offers identity theft protection tailored for seniors.

- Users should regularly monitor accounts and financial statements for suspicious activity.

Initial Draft

In this digital era, identity theft poses a significant risk. However, several free services can help you secure your personal information.

This article reviews the best free identity theft protection options, including:

- AAA ProtectMyID:

- Free for AAA members.

- Offers credit monitoring through Experian.

- Includes $10,000 in identity theft insurance.

- Experian:

- One of the major credit bureaus.

- Provides free credit reports and monitoring.

- Credit Karma:

- Offers free credit monitoring and financial tools.

- Aura:

- Offers a 60-day money-back guarantee.

- Includes comprehensive protection and insurance.

- EverSafe:

- Designed for seniors.

- Offers a free trial.

Choosing the right service is vital. Consider each service’s strengths and weaknesses to find the best fit for your needs.

Regularly monitoring financial statements and utilizing resources through the FTC can also provide additional layers of protection.

Writing Style Customization

The content will maintain a clear and accessible tone suitable for a general audience. Industry-specific terminology will be explained in layman’s terms. The structure will favor bullet points and clear headings to make the information easily digestible.

Final Polished Version

Keep Your Identity Safe with the Best Free Protection

In today’s digital world, protecting your identity is more crucial than ever. With data breaches and online scams becoming increasingly common, it’s important to take proactive steps to safeguard your personal information. Thankfully, you don’t have to spend a lot of money to get quality identity theft protection. This article highlights the best free services available, giving you the peace of mind you deserve.

What’s the Big Deal About Identity Theft?

Identity theft happens when someone steals your personal information—like your Social Security number, credit card details. They then use it to open new accounts, make purchases, or even file taxes in your name. The results can be damaging, leading to financial losses, a damaged credit score, and a whole lot of stress. Free identity theft protection is a smart move, especially considering the resources available.

Why Free Identity Theft Protection Matters

While many services can help, the best free services act as an early warning system for possible threats. They monitor your credit reports, financial accounts, and personal data for signs of unusual activity. The goal? To help you catch any issues early and take action before things get out of control. Taking precautions and keeping a close eye on your information can help prevent a bad situation down the line.

Top Free Identity Theft Protection Services

Here are some outstanding options to consider. The level of protection varies, so evaluate what works best for you:

-

AAA ProtectMyID Essential – Top Pick (For AAA Members)

If you’re already a AAA member, this is a fantastic free option. AAA ProtectMyID Essential includes credit monitoring, a free Experian credit report on enrollment, and helps you replace lost cards if your wallet goes missing. Plus, it offers $10,000 in identity theft insurance. It is a basic plan, lacking features like dark web monitoring or child monitoring. Still, it’s a great starting point for AAA members looking for basic protection.

Pricing: Free for AAA members

Pros: Trusted brand, monitoring through Experian, and $10,000 in theft coverage

Cons: Only available to AAA members

-

Experian – Best For Free Credit Monitoring

Experian, one of the major credit bureaus, offers a free plan that includes credit monitoring, fraud alerts, and a personal privacy scan. This is a reliable way to keep tabs on your Experian credit report. It features a completely free option, but the free plan includes credit checks from Experian only.

Pricing: Free

Pros: Reliable and easy to use

Cons: Free plan limited to Experian

-

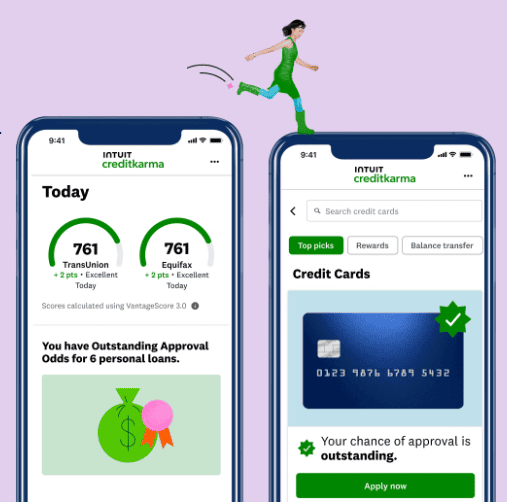

Credit Karma – Smart Credit Score Tracking

Credit Karma is a popular free service that tracks your credit scores from Equifax and TransUnion. It’s a good tool for credit scores and offers useful resources. Keep in mind that this service doesn’t offer comprehensive identity theft protection, but it does help you keep tabs on your credit health.

Pricing: Free

Pros: Includes credit-building tools and a free TransUnion credit check

Cons: Doesn’t offer identity theft protection;

-

Aura – Excellent Guarantee

Aura isn’t free in the long run, but it offers a generous 60-day money-back guarantee, giving you a chance to try the service before committing. Aura is an excellent service that provides credit monitoring from all three major bureaus and offers $1 million in identity theft insurance. Plus, it features real-time alerts and recovery support. While not free, the extended money-back guarantee provides a great trial period.

Pricing: Paid service, but with a 60-day money-back guarantee.

Pros: Three-bureau credit monitoring, insurance coverage, and a generous guarantee.

Cons: No free services.

-

EverSafe – Focused on Seniors

EverSafe is a paid service with a free trial offering a 20% off discount if you are over 60. The product focuses on supporting seniors, including tools to help them monitor their finances and accounts. EverSafe keeps tabs on credit reports, financial accounts, and will alert you of suspicious activity. They give the option to allow family to have ‘caregiver’ access and view all activity.

Pricing: Paid, with a free trial and senior discounts.

Pros: Excellent for seniors, includes a caregiver tool.

Cons: No free plan.

How to Choose the Best Free Identity Theft Protection

When choosing a FREE service, here are some things to consider:

- Monitoring: Does the service keep an eye on your credit reports from the major bureaus, bank accounts, and more?

- Alerts: How quickly will you be notified of any suspicious activity, and how easy is it to understand the alerts?

- Support: Does the service offer help if identity theft happens, like helping with paperwork?

- Reviews: Read what other people say about the service. High ratings often indicate a good service.

Other Ways to Protect Your Identity (Even if it’s Free!)

You can take steps to prevent identity theft.

- Monitor Your Financial Statements: Review your bank and credit card statements regularly for unauthorized transactions.

- Freeze Your Credit: Freezing your credit with the credit bureaus prevents anyone from opening new accounts in your name. It’s easy to ‘thaw’ your credit when you need to apply for a loan or mortgage.

Final Thoughts

Protecting your identity doesn’t have to break the bank. The free identity theft protection services outlined above offer valuable tools and resources. The best option depends on your individual needs, but taking action is always better than doing nothing. Stay vigilant, stay informed, and keep your personal information safe. Don’t forget that the services that offer recovery assistance can make the process of handling identity theft much easier.