Pet Insurance: Protecting Your Canine Companion

When Lassie, the famous TV Collie, became the first dog insured in the United States, it was a groundbreaking moment. However, even then, like humans, dogs often couldn’t get coverage for pre-existing conditions. Today, with advances in veterinary medicine and the rising cost of care, pet insurance is becoming increasingly popular.

The American Pet Products Association (APPA) reports that the proportion of dog owners with pet insurance has risen; in 2021-2022, 20% of dog owners insured their pets, an increase from 15% In 2018. The North American Pet Health Insurance Association (NAPHIA) data from 2020 indicated that approximately 3.1 million pets were insured, with dogs representing about 83% of the total.

Why the Growing Interest?

Several factors drive the rising demand for pet insurance. Veterinary costs are increasing as medicine advances, offering new treatment options. Everything from chemotherapy and cataract surgery to orthopedic interventions like hip dysplasia treatments are now possible, yet they frequently come with a hefty price tag.

The APPA survey shows that more than 90% of respondents take their dog to the vet at least once a year, with some making three visits. Consumer spending on veterinary care and medical products has steadily increased for the past two decades.

Paying for Peace of Mind

Pre-Existing Conditions: A Critical Consideration

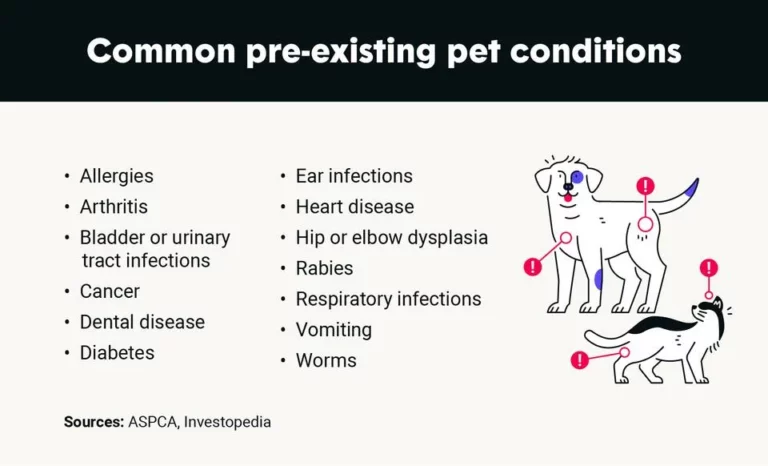

Before signing up, the American Veterinary Medical Association (AVMA) recommends understanding how a provider defines and handles pre-existing conditions. These are generally not covered. The National Association of Insurance Commissioners also states that most pet insurance companies exclude pre-existing, hereditary, and congenital conditions.

Key terms to understand when researching pet insurance plans:

- Pre-existing conditions: These are illnesses or injuries that existed, reoccurred, or showed symptoms before enrollment or during the waiting period of the insurance policy.

- Medical history reviews: Insurance companies will review your dog’s medical history, including veterinary records and examinations, to determine coverage costs and identify any uncovered pre-existing conditions.

- Curable vs. Chronic Conditions: Some insurers differentiate between curable conditions that have been resolved and chronic, incurable conditions that may recur.

- Bilateral Injuries: Many policies exclude coverage for a bilateral condition on the second side of the body if the injury was present before policy commencement. For example, if a dog has a cruciate ligament rupture in one knee before coverage, a rupture in its other knee might not be covered.

Examples of Potentially Excluded Conditions

It’s crucial to read each insurance company’s policy, as the following examples may not apply to every plan:

- Allergies: If your dog frequently licks their paws before the policy and is later diagnosed with allergies, the allergies will likely be considered a pre-existing condition and excluded from coverage.

- Chronic Conditions: Conditions such as arthritis, diabetes, epilepsy, thyroid problems, heart conditions, and various skin, ear, and gastrointestinal conditions might not be covered if previously diagnosed.

- Degenerative Conditions: Degenerative conditions, like joint or ligament deterioration, might be specifically excluded.

- Recurrent issues: If a dog has shown symptoms of the following conditions prior to the policy, any related recurrence of respiratory infections, urinary tract infections, bladder infections, vomiting, diarrhea, other gastrointestinal disorders, or canine cancer, may be excluded for 12 months from the last recorded episode.

- Undetermined Underlying Causes: Conditions that occurred in a particular area of the body where the cause was undetermined, may not be covered should the condition reoccur within 12 months.

Most Common Claims

Making the Right Choice

The AVMA notes that there is no simple answer to whether pet insurance is right for you. Discussing your needs with your veterinarian, as well as carefully researching any policy’s definition of pre-existing conditions, is essential.

Disclaimer: This information is for general guidance only and does not constitute professional advice. Laws vary by jurisdiction, and you should consult qualified professionals. We are not liable for damages resulting from the use of information in this article.