Shifting Sands: How Interest Rates and Private Equity Reshaped the Life Insurance Sector

Years of exceptionally low interest rates have spurred significant changes within the life insurance sector. These shifts, including increased investment in riskier assets and the rise of asset-intensive reinsurance, have introduced complexities that necessitate a closer look at potential financial stability concerns.

The Life Insurance Landscape: A Primer

The life insurance and annuity sector is a cornerstone of the financial system, managing approximately $35 trillion in assets as of 2022. This represents roughly 8% of global financial assets and highlights the sector’s critical role in providing financial protection and savings products to households. These institutions also furnish substantial funding to governments and the broader economy.

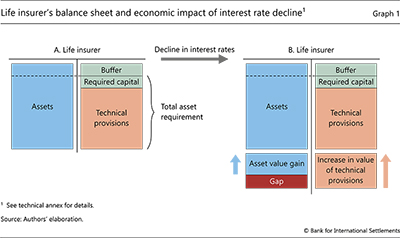

Historically, life insurers have relied on a model built on the promise of stable, often high, guaranteed rates of return. However, the era of low interest rates, which lasted from the aftermath of the 2008 Global Financial Crisis until late 2021, presented considerable challenges to this traditional business model. Low rates eroded the sustainability of legacy policies offering high guaranteed returns while, subsequently, reductions in guarantees reduced demand for new policies.

Adjusting to a New Reality

Facing squeezed profit margins, life insurers have accelerated two interconnected trends:

- Risk-Sharing Strategies: These strategies aim to cut costs and efficiently use capital. This is spurring risk transfer to other insurers via asset-intensive reinsurance (AIR), often involving offshore centers.

- Private Market Growth: Low interest rates have fueled investors’ search for higher yields, leading insurers to increase investments in private markets as a way of raising and diversifying returns.

These trends go on, even as interest rates rise, lessening pressure on profit margins.

The Role of Private Equity

Private equity (PE) firms have become key players in this transformation. They have facilitated insurers’ investments in private markets by either acquiring or partnering with them. PE firms have also fueled increasing reliance on asset-intensive reinsurance (AIR) agreements, where PE-linked life insurers take on liabilities from other insurers. These agreements involve the reinsurer, often PE-linked, assuming responsibility for risks and the assets backing them.

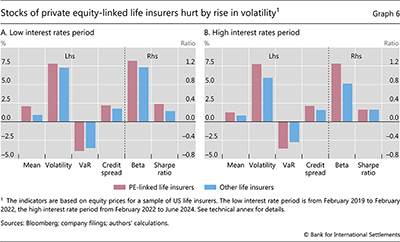

While the entry of PE firms has injected capital into the life insurance sector, it has also changed business models. This, in turn, raises potential risks, particularly in a higher-interest-rate environment. Over the past decade, PE firms have heavily invested in the insurance sector, relying on their expertise to boost insurers’ profits. While this has helped stabilize life insurers, the increased exposure to illiquid assets raises concerns about losses and liquidity challenges. Furthermore, greater reliance on AIR creates interconnectedness and complexity.

Understanding the Dynamics: Interest Rates and Profitability

Life insurance companies offer various contracts, such as term life insurance, which protects against mortality risk, and fixed annuities, which guarantee payments for the policyholder’s lifetime. Policyholders pay premiums, which are invested in assets like bonds, stocks, and real estate.

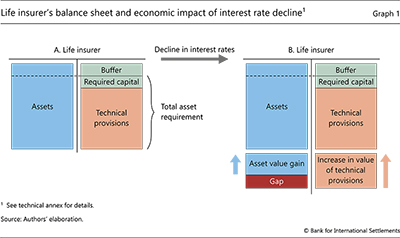

Technical provisions, which include policy reserves, represent the majority of liabilities. These provisions often exceed the initial funds received from the policyholder because insurers must meet future payment obligations while typically collecting premiums over many years. They use their own equity capital to cover this gap.

The interest rate environment has a significant impact on the financial condition of life insurers. They are exposed to a decline in interest rates, due to a “negative duration gap”. A fall in interest rates raises the value of the technical provisions by more than the value of assets. This can deplete capital, particularly when accounting rules do not immediately recognize the loss. Persistently low rates also reduce future revenue from fixed-income investments, which can weigh on profit margins.

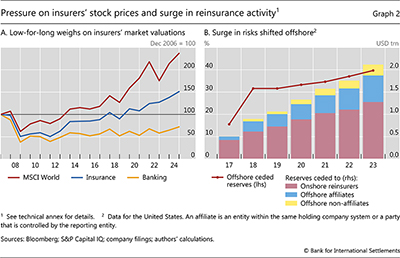

Asset-Intensive Reinsurance: Risk Sharing and Incentives

Asset-intensive reinsurance (AIR) – sometimes called “funded reinsurance” – allows life insurers to free up capital by transferring the risks associated with capital-intensive policies to other insurers. Under an AIR agreement, the reinsurer assumes all risks from the insurer. These risks include the inherent risks of the issued policies, and those related to the assets backing the policies. Following investment guidelines, the reinsurer manages the assets, which act as collateral to the cedant.

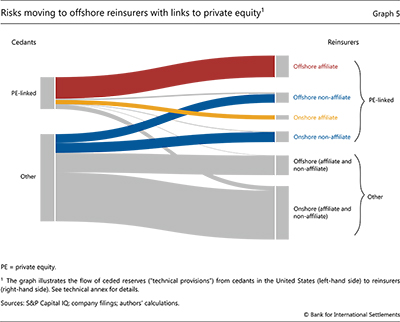

Reinsurance activity has increased substantially in key insurance markets, showing the importance of this tool. In the United States, major life insurers had ceded reserves totaling $2.1 trillion by the end of 2023, which is about a quarter of their total assets. Offshore centers assumed about 40% of those risks, which is nearly three times the share reported in 2017.

AIR serves several objectives:

- Centralized Management: When risks are transferred across a group of affiliated companies, it allows for centralized asset and capital management, helping to cut costs and improve operational efficiency.

- Leveraging Jurisdictional Differences: Cross-jurisdictional AIR can take advantage of variations in corporate and dividend taxes, valuation of technical provisions, and capital requirements.

- Higher Returns: These agreements can allow the reinsurer to generate higher returns on the assets backing the deal compared to the cedant.

Private Equity’s Expanding Footprint

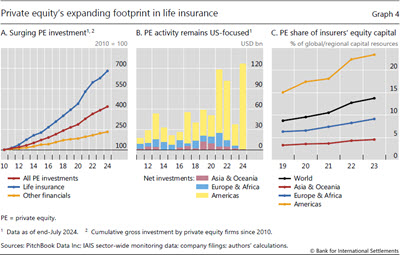

PE firms have been increasingly active in the life insurance sector.

PE firms have used a variety of strategies: acquiring primary insurers; investing in or establishing reinsurers; and providing asset management services to generate fee income. Several factors have increased PE involvement, including traditional life insurers’ efforts to divest their capital-intensive businesses and the attractive investment opportunities offered by depressed stock market valuations.

PE firms can provide three main benefits:

- Access to Predictable Cash Flows: They can channel funds from insurance premiums into PE-originated assets, like structured credit and direct lending.

- Exploiting Jurisdictional Differences: PE firms can take advantage of cross-jurisdictional regulatory and tax differences.

- Leveraging Investment Expertise: They use their expertise to improve life insurers’ returns, particularly in opaque private markets.

Potential Financial Stability Concerns

Life insurers’ increasing reliance on AIR, combined with greater exposure to private markets and interconnections with PE firms, raises several financial stability concerns. Reinsurance chains have become more complex, making it challenging to assess how risks might spread through the system.

If not properly addressed by group-wide supervision, cross-border AIR could be particularly concerning. Differences in legal and regulatory frameworks across jurisdictions could hamper the ability of cedants to recover assets if an AIR contract is terminated or the reinsurer fails.

AIR agreements may result in less capital backing the same amount of risk, accompanied by riskier assets. The concentration of AIR-related risks in a small number of reinsurers and jurisdictions could prove problematic in the event of market downturns. Finally, conflicts of interest, particularly where asset managers allocate insurers’ funds to assets they originate, could create further risks.

Conclusion: Navigating a New Landscape

The life insurance sector has undergone immense changes in recent years. The migration of risks from balance sheets and the increasing involvement of PE firms have supported the sector’s growth. Policy challenges exist, especially concerning supervisory monitoring and data gaps. The resilience of private markets, which expanded considerably under ample global funding conditions, remains to be tested. Increased investment in less liquid assets suggests that PE-linked firms could be more vulnerable in turbulent market environments.