Life Insurance and Annuity Product Development: A Paradigm Shift

The life insurance and annuity sector in the United States is experiencing a period of significant change. Driven by evolving customer expectations, technological advancements, and fluctuating interest rates, industry leaders must rethink their approach to product development to remain competitive. This article highlights the need for a paradigm shift, moving away from legacy systems and toward customer-centric, innovative models.

In a recent study, Deloitte examined product development trends within the individual life insurance and annuity markets. The research, which analyzed 53 product launches—32 in life insurance and 21 in annuities—revealed that insurers are increasingly investing in product development initiatives with dedicated teams. However, many struggle with outdated processes that are time-intensive and inefficient.

Delays in product design, administrative system implementation, regulatory hurdles, and manual processes create significant challenges in bringing new products to market quickly. To meet the growing demands of customers and keep pace with market dynamics, a major transformation is underway across this segment of the financial services industry.

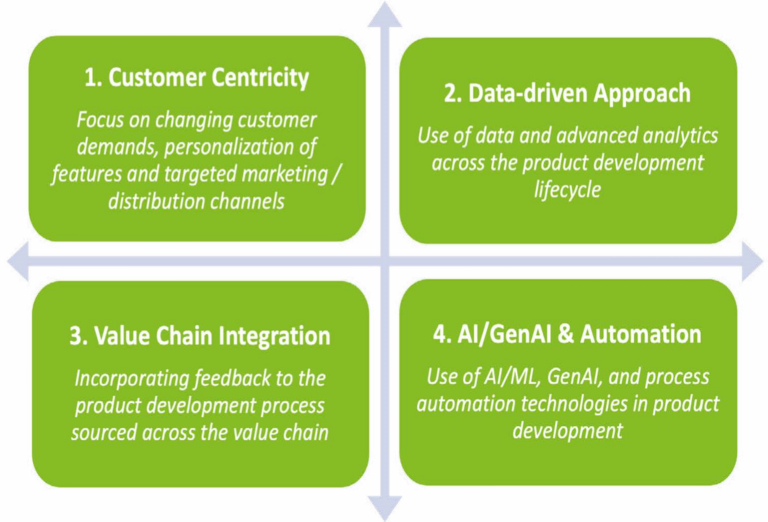

A New Product Development Regime

The current environment offers a critical opportunity for carriers to embrace these shifts and drive the innovation needed in product design. The life and annuity segment sits at a pivotal moment, allowing for the adoption of customer-focused strategies and the integration of new technologies. Through strategic partnerships between various organizational functions, carriers can enhance value for their customers, employees, producers, and the industry as a whole.