Identity Theft on the Rise in 2024

The latest data paints a concerning picture: identity theft continues to be a significant threat, with credit card fraud remaining a top concern. In the first three quarters of 2024, 842,000 cases of identity theft have already been reported, a trend that could surpass the number of cases reported in 2023. This figure indicates a persistent and evolving problem facing American consumers.

Key Takeaways

- Identity theft cases are on the rise, with reports through Q3 2024 already nearing 2023 totals.

- Credit card fraud remains the most prevalent type of identity theft.

- Americans aged 30 to 39 are the most vulnerable to identity theft.

The Data Speaks: Trends and Numbers

In Q3 2024 alone, 290,000 cases of identity theft and 117,000 cases of credit card fraud were reported. These figures highlight the magnitude of the problem. The Federal Trade Commission (FTC) data reveals that these forms of fraud have been consistently the most common since 2020, with reported instances increasing over the past year.

Identity Theft in the United States

Through the first three quarters of 2024, the FTC recorded 842,000 identity theft cases, putting the year on track to surpass the 1,037,000 cases reported in 2023. It’s important to acknowledge that these statistics are based on consumer reports, so the total number of incidents could be even higher.

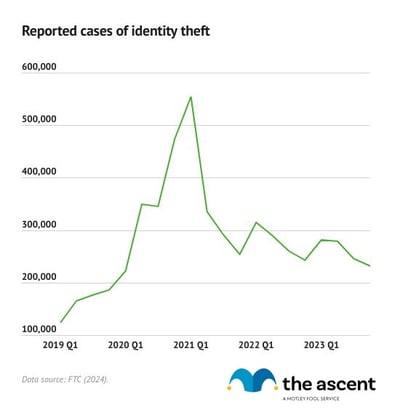

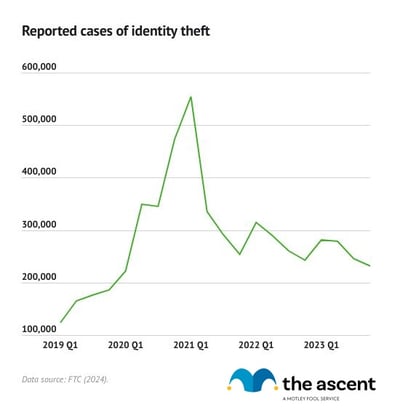

Looking back, the number of identity theft reports climbed rapidly from 2017 to 2021 – growing from 371,000 to 1.4 million. While reports have declined slightly since then, they remain well above pre-pandemic levels. According to a report by Javelin Strategy & Research, identity theft cases resulted in losses of $23 billion in 2023.

Most Common Types of Identity Theft

Credit card fraud continues to be the most prevalent type of identity theft. Approximately 327,000 cases were reported through the third quarter of 2024, a 3% increase compared to the same period in 2023. Other forms of identity theft, including those related to email and social media, online shopping, and investment accounts, were the second most frequently reported type of fraud, with a marked increase.

Reports of various types of loan and lease fraud, such as auto and personal loans, also experienced an uptick. Conversely, instances of bank fraud, government documents or benefits fraud, and employment or tax-related fraud saw a year-over-year decrease.

Credit Card Fraud: A Closer Look

Credit card fraud was the leading form of identity theft during the first three quarters of 2024, with 327,000 reported cases. This rate is similar to 2023, but below the figures reported in 2022. While 2020 and 2021 saw a surge in government-related fraud, credit card fraud retained its prominence in 2024.

Types of Credit Card Fraud:

There are two main types of credit card fraud:

- New Account Fraud: This occurs when an identity thief opens a credit card account using the victim’s personal information.

- Existing Account Fraud: This involves the unauthorized use of an existing credit card.

New account fraud is significantly more common, accounting for 90% of all credit card fraud cases, although existing account fraud is seeing a rise.

Why is new account fraud so dominant? Several factors contribute:

- More Secure Transactions: Credit card chip technology has made it harder to counterfeit cards.

- Data Breaches: Large-scale data breaches expose personal information, facilitating new account fraud.

- Detection Difficulties: New account fraud can be harder to detect initially, as the consumer is unaware of the fraudulent account. The card issuer or consumer may actively monitor existing accounts.

Consumers have protections against fraudulent charges, including the ability to dispute unauthorized transactions with their credit card issuers.

The Growth of Synthetic Account Fraud

Synthetic account fraud is an emerging financial crime, rapidly increasing. This type of fraud involves a combination of real and fabricated personal information, such as a genuine Social Security number with a false name. Criminals utilize these synthetic identities to secure credit cards, loans, and benefits, building credit before abandoning the accounts.

TransUnion data indicates that synthetic fraud attempts grew significantly, with increases between 2019 and 2023. The video game and online community industries are particularly targeted. In the first half of 2024, a significant percentage of transactions related to these industries were suspected to be fraudulent.

Identity Theft by Age

Americans aged 30 to 39 have recorded the highest number of identity theft reports for several years. Conversely, younger and older age groups tend to report fewer incidents.

The most common type of identity theft varies by age group. Credit card fraud is the most common type for those aged 20 to 79, while employment or tax-related fraud is the most common for those aged 19 and under.

Data Breaches and Cybercrime

Data breaches are a key enabler of identity theft and credit card fraud. Hackers steal personal information during these breaches, then sell it on the dark web for fraudulent purposes.

A survey by Nationwide revealed that while 58% of consumers express concern about cybercrime, 69% lack cyber insurance. Common reasons for not having cyber insurance include a lack of knowledge, awareness, or perceived affordability.

Data compromises increased in 2023, from 1,801 in 2022 to 3,205. The Identity Theft Resource Center revealed cybercriminals are focusing on acquiring specified personal information for identity theft, fraud, and scams, instead of broad attacks.

Cyberattacks, including phishing, ransomware, and malware, are the most common causes of breaches. Human and system errors also contribute.

Protecting Yourself

To prevent identity theft, it is crucial to secure personal information, whether online or in physical form, and to be cautious when sharing sensitive details such as your Social Security number.

Sources

- AARP (2024). “Identity Fraud Cost Americans $43 Billion in 2023.”

- Federal Trade Commission (2024). “Identity Theft Reports.”

- Identity Theft Resource Center (2024). “2023 Annual Data Breach Report.”

- Nationwide (2022). “Despite rising concern, Americans leave themselves vulnerable to cyberattacks.”

- TransUnion (2024). “2024 State of Omnichannel Fraud.”