DeSantis’s Continued Opposition Challenges Florida’s No-Fault Auto Insurance Repeal Efforts

Efforts to dismantle Florida’s no-fault automobile insurance system face a significant hurdle: Governor Ron DeSantis’s continued opposition. The governor, who previously vetoed a bill aiming to transition the state to a fault-based system, has shown no indication of changing his position. This stance could effectively block current legislative attempts to repeal the law.

Speaking following his State of the State address, DeSantis reiterated his position. “If they have a reform where we can show that it’s going to lower rates, it’s fine,” he said. “But let’s just be clear. I mean, you know, we know that’s something that people from the legal and the trial bar have wanted to do. And so why would they want to do that? Obviously, they see that there’s opportunities for them to make money off of it.” He added, “I don’t want to do anything that’s going to raise the rates.”

Proposed Legislation

Legislation proposed by Senator Erin Grall (R-Vero Beach) and Representative Alex Andrade (R-Escambia County) seeks to eliminate the requirement for personal injury protection (PIP) insurance. Instead, it would mandate bodily injury liability coverage with limits of $25,000 per individual, $50,000 per incident, and $10,000 in property damage liability. The House version (HB 1181) has been assigned to committees on Civil Justice & Claims, Insurance & Banking, and Judiciary. The Senate version (SB 1256) needs to pass through the Banking and Insurance, Appropriations on Agriculture, Environment, and General Government, and Rules committees before heading to the Senate floor.

Understanding PIP and the Current System

Currently, Florida law mandates that drivers carry a minimum of $10,000 in PIP and an additional $10,000 in property damage liability coverage. PIP insurance is designed to cover medical costs, lost wages, and related expenses for those injured in car accidents, regardless of who is at fault. The existing system also limits lawsuits against at-fault drivers, preventing claims for non-economic damages, such as pain and suffering, unless the injured party suffers a permanent injury, disfigurement, or death.

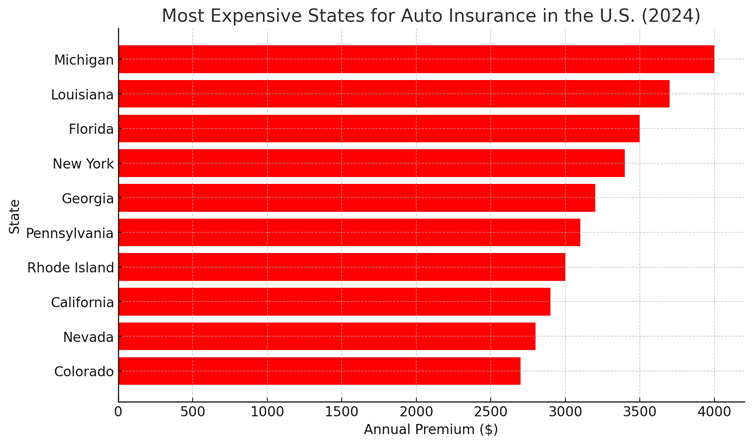

The Florida Justice Association, representing trial lawyers, has long supported repealing PIP, citing high insurance costs in the state. Conversely, opponents, including insurance industry lobbyists, argue that lawmakers should allow more time to evaluate the impact of previous legislative changes, particularly the elimination of one-way attorney fees, enacted in 2023, before considering a full overhaul. Historically, Florida law allowed policyholders to recover attorney fees from insurers if they had to sue to obtain claim payments; this was amended in 2023 to require both parties to cover their own legal expenses.

A History of Debate

The debate over no-fault insurance in Florida is not new. In 2021, a bill (SB 54) that would have replaced PIP with a fault-based system was passed by the legislature, but DeSantis ultimately vetoed it. While acknowledging flaws in the PIP system, he expressed concern that a repeal could have unintended consequences for consumers and the market.

With legislative efforts once again underway, DeSantis’s opposition could prove to be a significant barrier, keeping Florida’s no-fault system in place for the foreseeable future.

The Evolution of Florida’s PIP System

Florida’s Personal Injury Protection (PIP) system, which was introduced in 1971, has a complex history marked by legislative changes, legal challenges and ongoing debates regarding its efficacy. It was originally designed as part of the state’s no-fault auto insurance to provide accident victims with medical coverage and lost wage benefits, regardless of liability. Over the years, the system has faced issues linked to rising costs and fraud, prompting further legislative action.

Key Moments in the History of PIP:

-

1971: Implementation. PIP was introduced in 1971 to lessen litigation by providing up to $10,000 for medical costs, lost wages, and death benefits.

-

2003: Anti-fraud measures. Reforms were introduced to combat fraud and staged accidents, increasing penalties for fraudulent claims.

-

2007: Sunset and Reinstatement. The law briefly expired but was reinstated due to concerns over lawsuits and lack of coverage.

-

2012: House Bill 119 (PIP Reform Law). This significant reform included a 14-day limit to seek treatment to retain benefits, limited medical benefits absent emergency conditions, and excluded massage therapy and acupuncture coverage.

Legal Challenges

Several legal cases have significantly affected the interpretation and enforcement of PIP insurance in Florida.

-

Kingsway Amigo Insurance Co. v. Ocean Health, Inc. (2011): The court ruled that insurers could not limit PIP payments to a Medicare fee schedule unless clearly stated in the policy.

-

2013 – Constitutional Challenge to PIP Reform: A group of healthcare providers sued to challenge the limits introduced by the 2012 reforms, but the changes were allowed to stand by an appeals court.

-

Progressive Select Insurance Co. v. Florida Hospital Medical Center (2017): The Florida Supreme Court ruled that insurance companies must clearly state how PIP benefits would be reimbursed in their policies.

Attempts to Repeal PIP

-

2018: Failed PIP Repeal Attempt: Governor Rick Scott opposed a bill to eliminate PIP because of the concern of higher premiums.

-

2021: Senate Bill 54 (PIP Repeal Bill): Governor DeSantis vetoed the bill, citing the potential for increased costs to consumers.

Current Challenges and the Future

Fraud remains a significant issue, contributing to high auto insurance premiums in Florida. Lawmakers continue to explore potential alternatives to PIP. However, there remains concerns regarding the impact on low-income drivers and uninsured motorist rates.

Conclusion

Florida’s PIP system, which has undergone several reforms, legal actions, and repeal attempts over the past fifty years, has been a contentious subject. Despite efforts to reduce fraud and control costs, the issue of PIP insurance remains. With DeSantis in opposition, the immediate future of the system’s landscape appears stable, as Florida drivers continue to use one of the most complex no-fault insurance systems in the US.