Soaring Insurance Costs Eat into Commercial Property Income

As property-insurance costs surge, a crucial shift is occurring in the commercial real estate sector. The primary driver of this trend is the increasing frequency and intensity of extreme weather events, a direct consequence of climate change. Asset managers are acutely aware that higher insurance premiums are increasing operating expenses and reducing net operating income (NOI). The impact is also clearly visible at a broader market level.

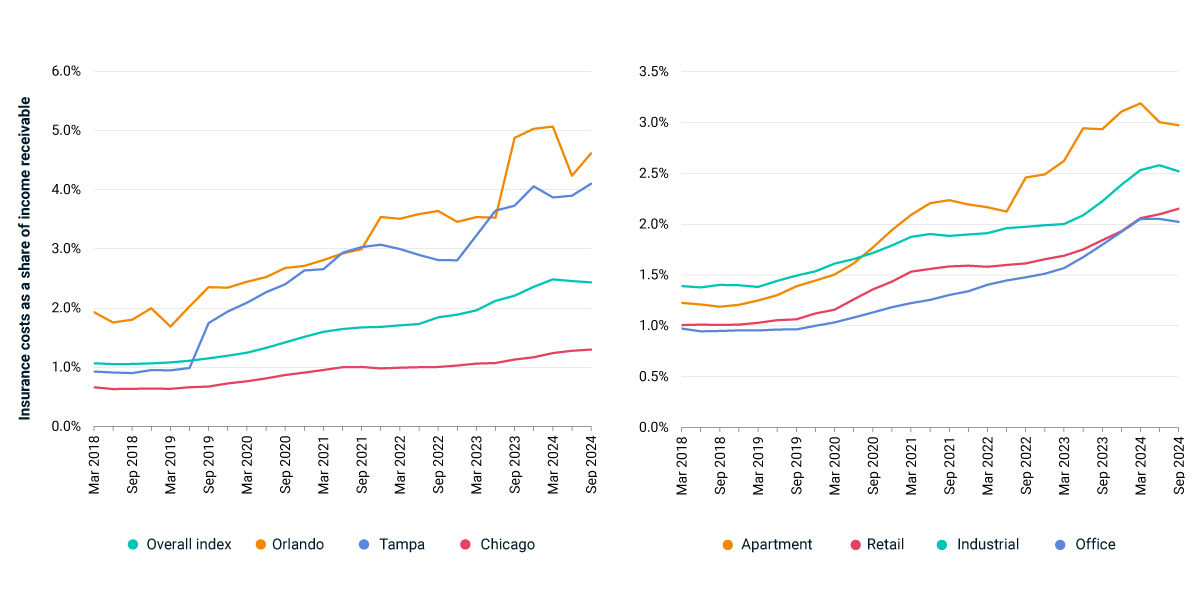

For properties tracked by the MSCI U.S. Quarterly Property Index, insurance costs as a percentage of income have doubled over the last five years. These costs reached 2.4% in the 12 months leading up to Q3 2024. While the impact is not uniform across the country, with regulations and rebuilding costs also playing a role, the correlation with climate-change risk is evident.

Regions susceptible to hurricanes, such as Orlando and Tampa, face some of the highest insurance costs relative to income, at 4.6% and 4.1%, respectively. In contrast, Chicago, a market with a lower exposure to physical climate risks, has one of the lowest rates among U.S. metros, at 1.3%.

Across different property types, the apartment market has shown the sharpest rise in insurance costs over the past five years, climbing to 3.0% of income from 1.4% five years prior.

The risks to commercial property, and the resulting pressures on the insurance industry, were further highlighted by the impact of Hurricanes Milton and Helene in late September and early October. Rising insurance premiums are prompting investors to re-evaluate their underwriting assumptions and implement strategies to mitigate these escalating expenses.

Source: MSCI U.S. Quarterly Property Index

Note: The author would like to thank Bryan Reid for his contributions to this analysis.

- “Climate change impacts elevate US commercial real estate insurance costs,” Deloitte, May 29, 2024.

- In MSCI’s real estate Climate Value-at-Risk (VaR) model, under a 3°C scenario to 2050 with aggressive outcomes, Chicago scores an aggregated physical VaR of -0.1% compared to Tampa at -3.0% and Orlando at -2.1%.