The Price of Paradise: How Natural Disasters and Population Growth Are Driving Up Insurance Costs

It’s a simple equation: more people, more buildings, and more severe weather events equal higher costs. This reality is playing out across the United States, where population booms in areas prone to natural disasters are contributing significantly to the rising cost of home insurance.

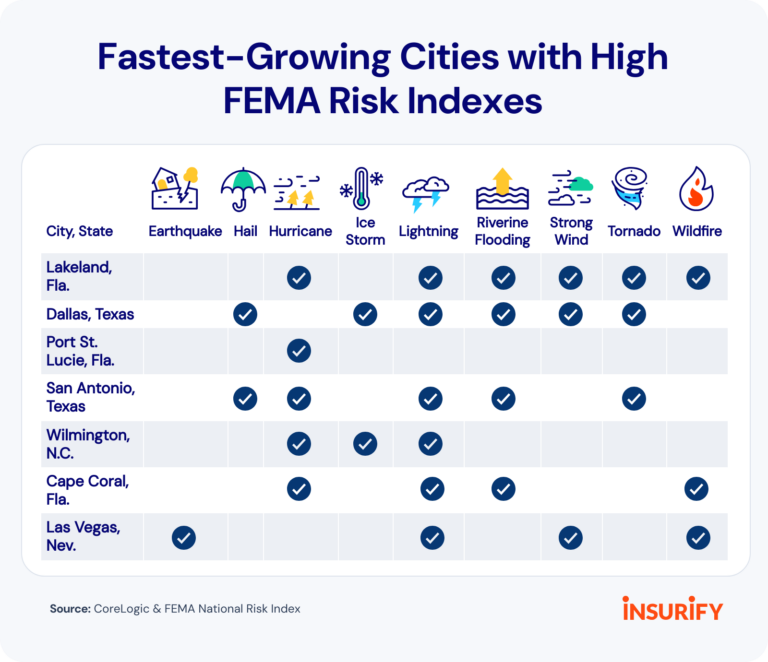

Data from Insurify highlights this trend, revealing that some of the fastest-growing areas in the country are also those that experience frequent severe weather. This confluence of factors is creating a perfect storm for homeowners, leading to escalating insurance premiums.

Whether the intensity of wildfires is exacerbated by climate change is an open question…the main reason catastrophe severity has risen is an increase in the built environment — there is simply more stuff now to be destroyed. – Jerry Theodorou, R Street

Florida and Texas, two states experiencing rapid population growth, are prime examples. The U.S. Census Bureau reports these states had the second- and third-fastest population growth rates between 2023 and 2024. CoreLogic’s analysis, which takes into account new construction and land-use changes, also identifies several cities in these states as among the fastest-growing in the nation.

Seven of the top 10 fastest-growing cities identified by CoreLogic are located within counties facing “relatively high” climate-related risks, according to the Federal Emergency Management Agency (FEMA) National Risk Index. These cities include Lakeland, Austin, and Port St. Lucie, among others. Home insurance costs in these areas reflect that risk, with annual averages far exceeding the national average.

For example, the national average annual cost of home insurance hovers around $2,584. However, in Port St. Lucie, costs skyrocket to $13,157, while Cape Coral residents pay approximately $8,961 annually. Dallas and San Antonio are also significantly above the national average, at $4,978 and $3,443, respectively, according to Insurify.

Mark Friedlander, chief communications officer for the Insurance Information Institute, notes that a variety of factors influence these rates, including catastrophe loss costs, reinsurance costs, replacement costs, and the volume of claims. These are all impacted by severe weather events, from hurricanes to wildfires.

The trend of more people living in harm’s way of catastrophes plays a role in the cost and availability of property insurance across the country…More Americans than ever before want to live near the coastline, but it comes with a price. – Mark Friedlander, Insurance Information Institute

Even major cities are feeling the pressure. Los Angeles, recovering from devastating wildfires that caused billions in insured losses, is just one example. All of the top 10 most populous U.S. cities are situated in counties with high climate-related risks, according to the U.S. Census Bureau and FEMA.

While industry leaders debate the precise role of climate change in the increasing frequency of extreme weather events, the trend of billion-dollar climate events is undeniable. The National Oceanic and Atmospheric Administration (NOAA) suggests that for hurricanes, the rising impact on society stems largely from increased populations and infrastructure in coastal regions.

Looking ahead, it remains to be seen whether this situation changes. A survey by the U.S. Census Bureau in 2022 showed that while only 0.3% of people moved due to natural disasters, a much larger percentage (almost 8%) cited housing costs and homeownership desires as their primary motivations.

Despite the financial burden that comes along with living in high-risk areas, population continues to grow in states like Texas and Florida. As Friedlander points out, this trend plays a significant role in determining property insurance costs and availability across the country, especially in coastal communities.