Your Money Matters

Last September, Louise and her family received devastating news. Her husband, Alistair, was diagnosed with an aggressive form of mesothelioma, a type of cancer. Doctors predicted he had less than six months to live without treatment.

Ali began immunotherapy in October, which might extend his life, and he has since retired early due to his health. He is 57 years old. The family is experiencing emotional and mental ups and downs, with their three children mourning the loss of future events that won’t include their father.

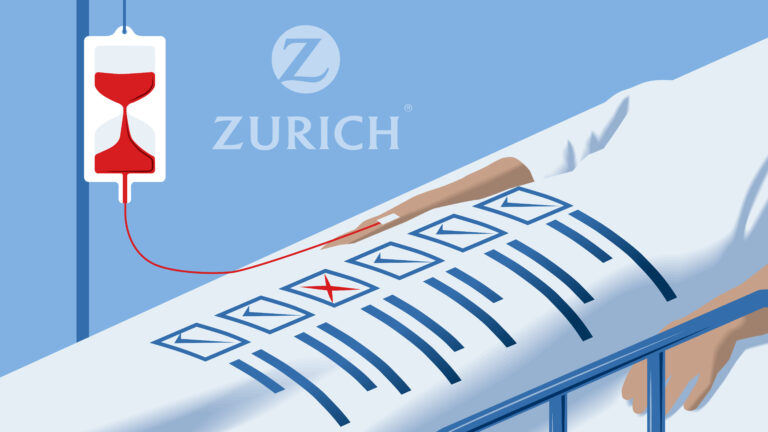

Louise contacted consumer champion Katherine Denham for help because their insurer, Zurich, was delaying payment of the terminal illness claim. In 2004, Louise and Ali took out a decreasing life insurance policy to cover their mortgage in case either of them died or became terminally ill. This policy is worth £44,000, which would significantly reduce their remaining £60,000 mortgage.

The policy states it will pay out for an advanced or incurable illness with a life expectancy of no more than 12 months. They filed the claim in September. Since then, Zurich has repeatedly requested scan results, which were provided, but still refuses to pay. After 26 emails and three phone calls, Ali has grown weary of dealing with the claim, so Louise has taken over.

Zurich is wearing us both down because there is always new information that it wants before it will pay the claim.

Zurich is requesting additional information to determine if Ali’s cancer has shrunk and by how much. Although the cancer has shrunk with immunotherapy, it remains an incurable and aggressive disease. The policy doesn’t mention needing treatments or trials to be eligible for a payout. Given that Ali satisfies the criteria set out in the policy from 2004, Louise believes Zurich is obligated to honour the claim.

The policy expires in November next year, which raises Louise’s suspicion that if Ali lives until then, Zurich might avoid paying the claim, thus saving money.

Dealing with this insurance claim and the uncertainty surrounding Ali’s health is causing the family a great deal of stress. They want to spend the limited time they have left together without arguing with the insurer.

Katherine Denham responds:

“I cannot begin to imagine how difficult this has been for you and your family. You are now relying on your part-time salary and Ali’s pension to support you and your children, so this £44,000 would go a huge way to easing the financial burden.”

Louise mentioned that some years after starting the policy, they moved house but kept the life cover, explaining why the amount doesn’t exactly match the outstanding mortgage. However, a £16,000 loan is far more manageable than £60,000.

Without the payout from Zurich, Louise would not be able to afford the mortgage payments as a teacher. Zurich informed Denham that Ali’s doctor initially gave a prognosis of 12 to 18 months with treatment and six months without. Since Ali was continuing treatment, Zurich initially didn’t approve the claim. As time went on, Zurich continued to request updates on his treatment.

Zurich said it was proactively monitoring Ali’s life expectancy, which caused them to keep asking for more information. It also explained that it had been chasing the oncologist for a prognosis since December. Despite making it clear that the doctor’s opinion was required to assess the claim, Zurich had not yet received it.

The oncologist stated that he had sent all requested information in January.

Considering that Ali’s cancer had spread to his spine, Denham urged Zurich to reassess the claim. Within days, Zurich agreed to pay the claim, and the funds were deposited into the family’s bank account.

Zurich commented: “We have every sympathy with Alistair and his family at what is a very challenging time. His prognosis from the medical report received in November did not trigger a payout. As we’ve continued to assess the claim, his prognosis very sadly now meets the threshold so we have paid the claim in full.”

Louise said:

“Thank you, thank you. We have no doubt that this speedy remedy was down to your intervention so we are really grateful for your support.”