Canadians Express Rising Concerns Over Climate Change’s Impact

MISSISSAUGA, ON – March 19, 2025 – A new survey by First Onsite Property Restoration reveals that nearly three-quarters of Canadians are worried about the effects of climate change on their properties and wallets, coinciding with increasing insurance costs. The annual Weather and Property Survey, which polled over 1,500 adults, highlights growing apprehension regarding severe weather events and their financial repercussions.

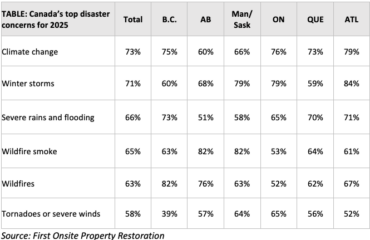

According to the survey, 73% of Canadians are concerned about being affected by climate change, extreme weather, and disasters. This concern is particularly high in Atlantic Canada, where 79% of respondents expressed worry. Manitoba, Ontario, and British Columbia followed closely, with over 75% of residents in each province sharing similar concerns.

Furthermore, the survey indicates that 74% of Canadians are anxious about the rising cost of home or business insurance due to climate change, an increase of eight percentage points compared to the previous year. A significant 36% of respondents reported they have already experienced increases in their property insurance rates.

Record-Breaking Losses in 2024 Drive Concerns

The escalating concerns are underpinned by the record $8.5 billion in severe weather-related property losses across Canada in 2024, as reported by CatIQ. This figure is almost three times the total insured losses in 2023 and exceeds the previous record of $6.2 billion from 2016, a year marked by devastating wildfires in Fort McMurray, Alberta.

Rising Insurance Rates Across the Country

Property insurance rates have already begun to climb in 2025, with a national average increase of 5.28%, according to a study from MyChoice, a Canadian insurtech company. Alberta leads the country with a substantial 9.07% yearly increase, following $4.1 billion in damages, primarily from the Calgary hailstorm and the Jasper fire.

Severe Rains and Urban Flooding Add to Worries

As spring arrives, severe rains and flooding have become a focal point of concern. The survey found that 66% of Canadians are worried about the effects of severe rains and flooding, a 6% increase from last year. British Columbia (73%), Quebec (70%), and Atlantic Canada (71%) are the provinces most concerned about these issues.

Canada has witnessed significant urban flooding events in recent years, including those in the Greater Toronto Area and Montréal in 2024. With 80% of Canadian cities situated on flood plains and aging water infrastructure, these events are expected to become more frequent and intense due to climate change, according to Statistics Canada [1].

“As springtime approaches, one of the biggest threats to property is flooding and water damage,” said Jim Mandeville, Senior Vice President, Large Loss North America for First Onsite Property Restoration.

Winter Storms and Extreme Cold Raise Concerns

Following a winter of snowstorms and fluctuating temperatures, Canadians have also expressed heightened concern about winter-related events. 71% of Canadians are worried about winter storms, a rise from 63% in 2024. The increase is most noticeable in Ontario, where 79% of residents reported concern—an 11% increase over the previous year. Similarly, 68% of Canadians are concerned about extreme cold, freezing, and burst pipes, a 10-point increase from last year. Concerns were also elevated in Ontario, reaching 72%, 15 points higher than last year.

Much of this increased concern can be attributed to the 2023-2024 winter being notably milder than usual. The national average temperature for the December-February period was 5.2°C above the average.

Mould: A Leading Property Fear

The survey also examined people’s top property fears regarding disasters and severe weather events. The development of mould after flooding or severe weather was another significant concern, with 61% of Canadians listing it as a property fear. Water-related events, both natural and mechanical, typically account for almost 70% of all emergency responses by First Onsite.

On properties affected by water damage, mould growth poses a severe threat to sanitation. The excess moisture from spring showers and melting snow can accelerate mould growth, particularly in dark and damp spaces.

Protecting Property from the Seasons

Jim Mandeville added, “The increased occurrence and intensity of weather-related events is a constant driver for homeowners, businesses, and communities to be more resilient and better prepared for tomorrow”.

First Onsite offers resources for homeowners and businesses on preventing property water damage and protecting against mould and mildew.

[1] The intersection of flooding and deprivation: A study of neighbourhoods – https://www150.statcan.gc.ca/n1/pub/75-006-x/2025002/article/00001-eng.htm