Allstate Identity Theft Protection: A Detailed Look

Allstate, known for its insurance products, also offers identity theft protection. This review breaks down its features, pros, cons, and overall value.

Allstate, a company with nearly a century of experience in protecting people and property, has expanded into the digital world with its identity theft protection services. The Allstate Blue plan is their latest offering, designed to safeguard customer identities. But does it measure up to its competitors?

What We Appreciated

- Established Reputation: Allstate has a long history of customer service.

- Digital Footprint Monitoring: Allstate’s feature helps you find all your online accounts.

- Social Media Awareness: The service monitors social media accounts for potential threats.

Areas for Improvement

- Limited Credit Bureau Monitoring: Allstate only uses one credit bureau.

- No Credit Reports or Scores: The service doesn’t provide credit reports or scores.

- Lack of Detail on Monitoring: The exact methods of identity monitoring aren’t specified.

Key Features

Allstate offers various monitoring services. These include:

- Dark web monitoring for individuals and families.

- Alerts for personal information leaks, email address leaks, and credit card information leaks.

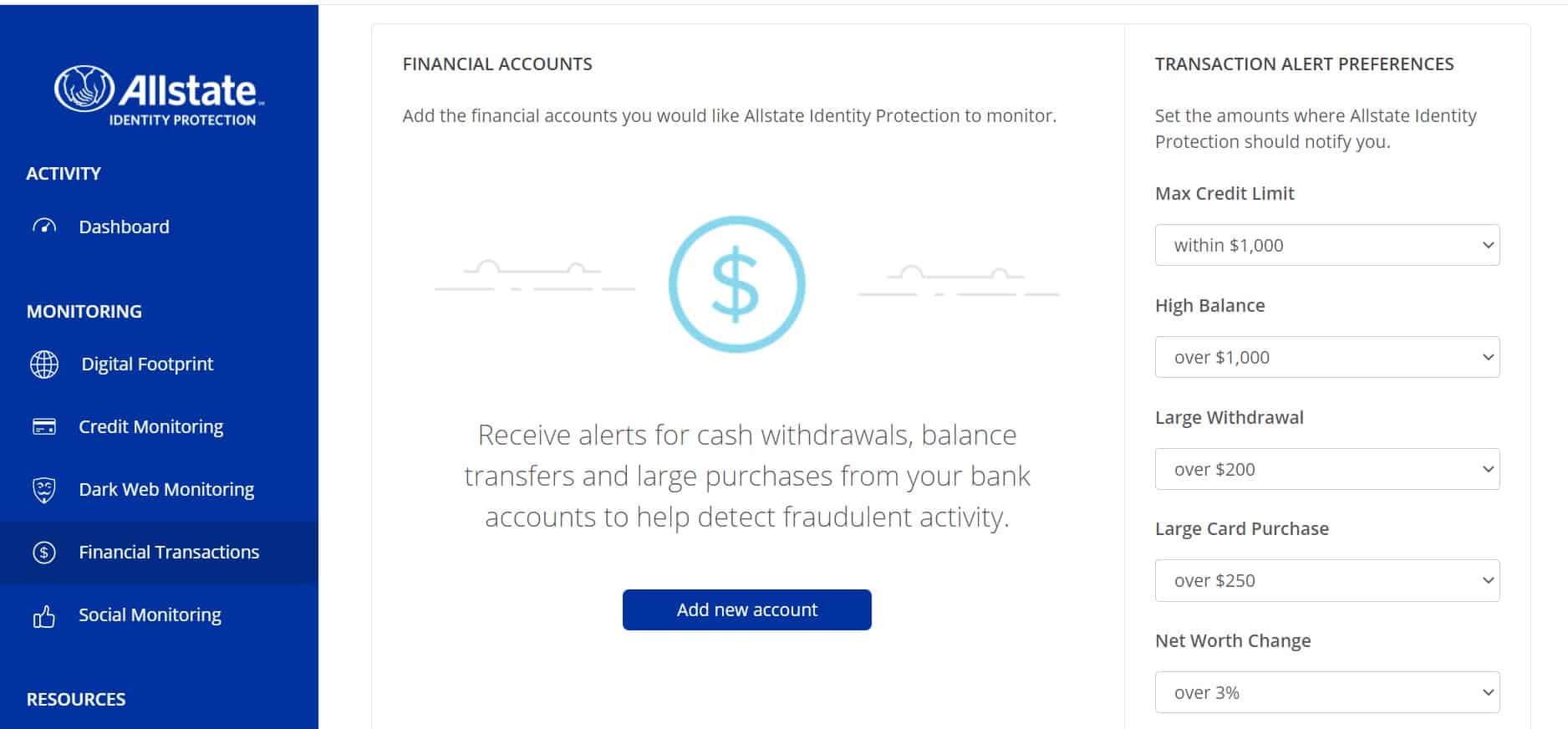

Financial Monitoring

Allstate monitors financial activity across different categories. These categories include:

- Credit monitoring (using TransUnion).

- Student loan monitoring.

- Credit card monitoring.

- Bank account monitoring.

- 401(k) monitoring.

- High-risk transaction monitoring.

However, it’s worth noting that Allstate doesn’t provide credit reports or scores.

Identity Monitoring

Allstate monitors your identity by keeping track of your Social Security number, driver’s license number, birthdate, and address. They scan the web, including the dark web, for any suspicious activity.

Social Media Monitoring

Available with the Premier subscription, this feature monitors LinkedIn, Twitter, Facebook, and YouTube. It alerts you to any offensive posts or account takeovers.

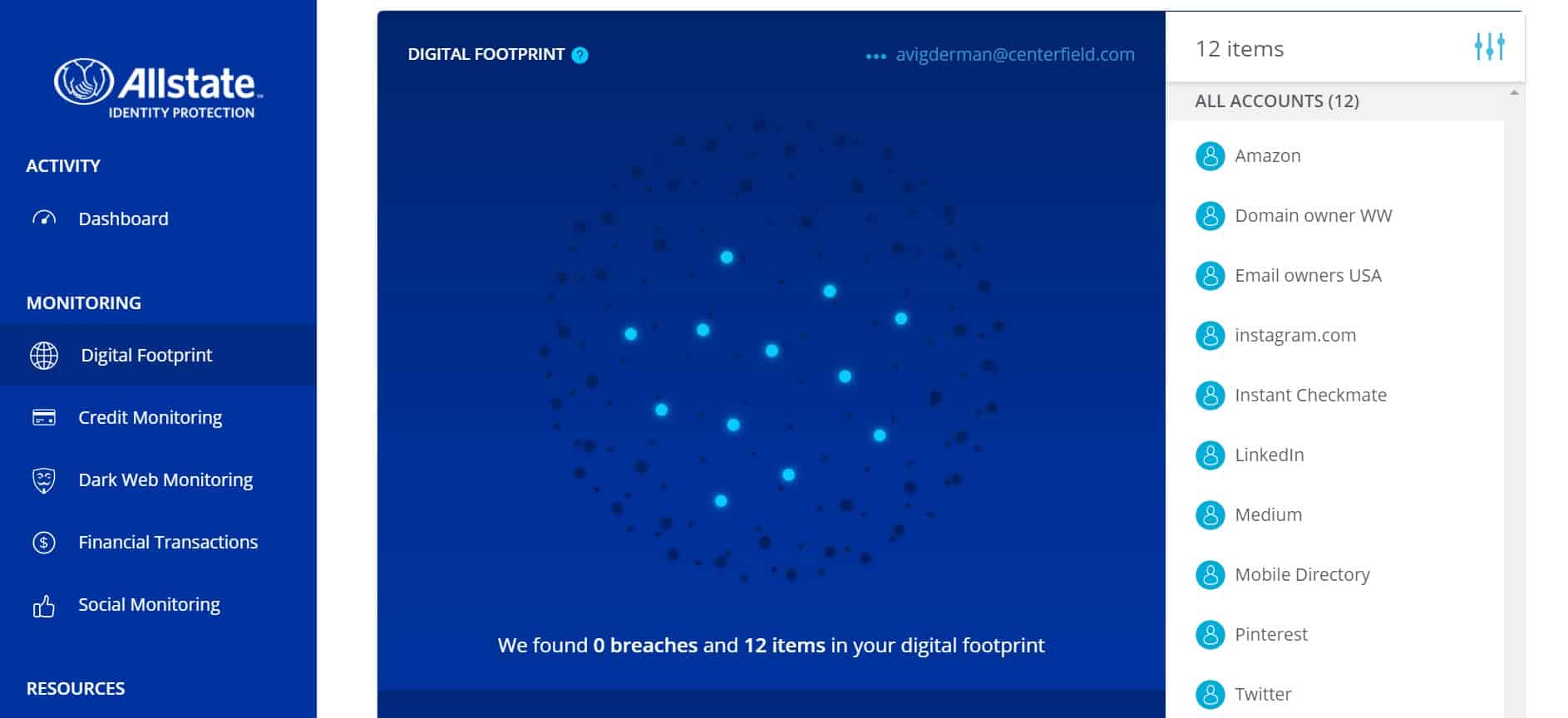

Digital Footprint Monitoring

Allstate’s Digital Footprint feature scans the web for your accounts. It helps you find accounts you might have forgotten about and alerts you if any of them have been breached.

Remediation and Insurance

Allstate’s identity theft protection includes:

- Expert assistance to handle identity theft cases.

- Reimbursement for stolen funds (up to $50,000).

- Reimbursement for out-of-pocket expenses (up to $1 million).

- Tax refund coverage.

- Lost wallet services.

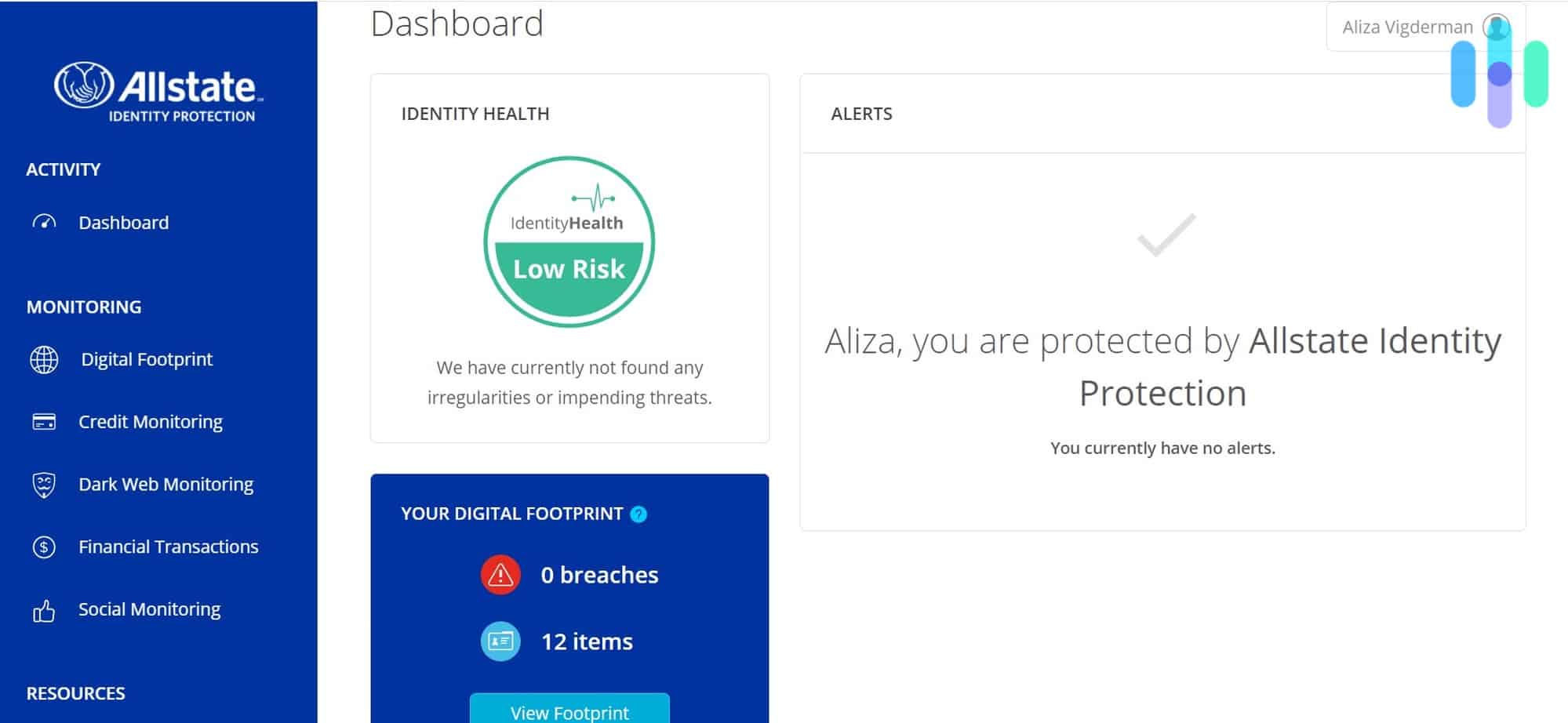

The Allstate Dashboard

Allstate’s online dashboard is straightforward. The homepage displays your identity health, Digital Footprint summary, and alerts.

On the left side is a menu with links to additional items, such as:

- Digital Footprint

- Credit monitoring

- Dark web monitoring

- Financial transactions

- Social media monitoring

Mobile App

Allstate has a mobile app for both Android and iOS. While the app is free to download, you need a paid plan to access its features. The app is useful for checking status updates and getting alerts, but you typically need to log in on a computer to take action based on the information.

Cost

Allstate offers three plans with varying features. They offer individual and family plans:

Essentials

- Individual Price: $9.99 per month

- Family Price: $18.99 per month

Premier

- Individual Price: $17.99 per month

- Family Price: $34.99 per month

Blue

- Individual Price: $19 per month

- Family Price: $36 per month

Allstate also provides bundling discounts for customers who use their other insurance services.

Final Thoughts

Allstate’s identity theft protection provides solid features like credit monitoring, digital footprint tracking, and social media monitoring. Its historic reputation is commendable, but the reliance on a single credit bureau and lack of credit scores is a drawback. The family plan also doesn’t cover many family members.

If you’re looking for identity theft protection, it’s wise to look at other top services that have comprehensive credit monitoring, wider family coverage, and greater transparency.