Ant Insurance Sees 55% Surge in Health Claim Processing Efficiency with AI in 2024

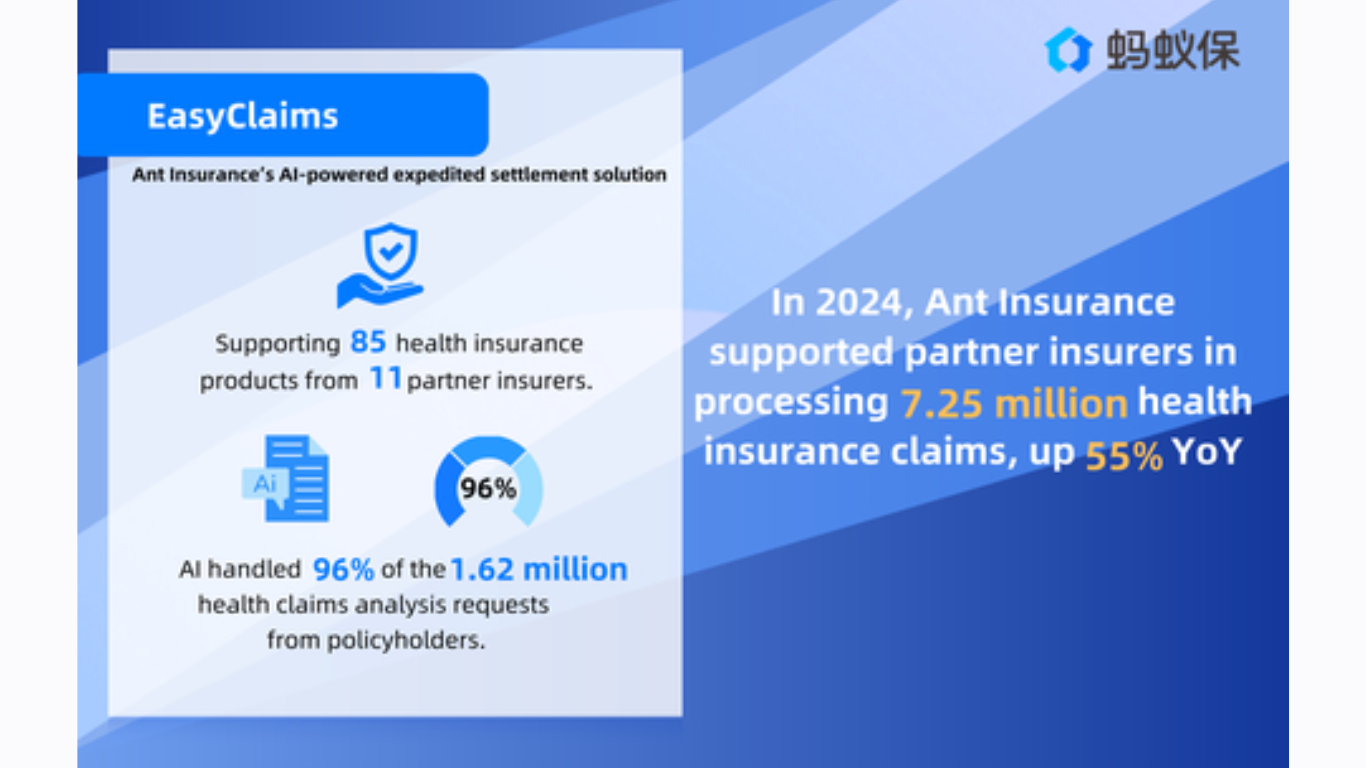

In 2024, Ant Insurance, the online insurance arm of Ant Group, demonstrated impressive growth, processing 7.25 million health claims, a 55% year-over-year increase. This remarkable expansion underscores the effectiveness of the company’s AI-driven solutions and the growing demand for health insurance within China.

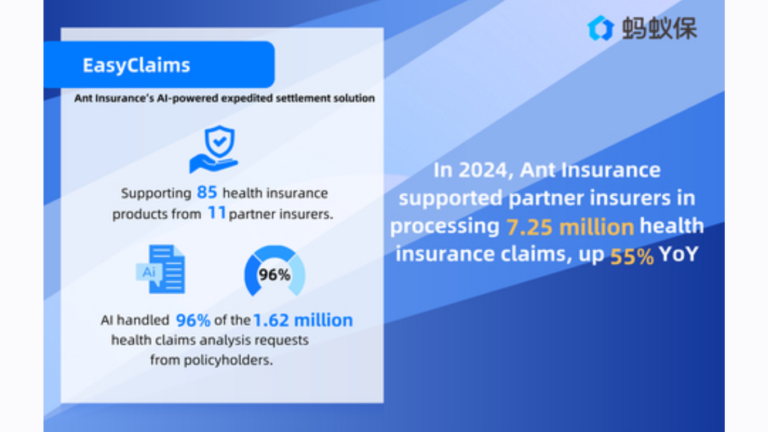

Ant Insurance’s EasyClaims solution facilitated efficient processing for a wide range of products.

Total health claim payouts on the platform for the year reached RMB 9.2 billion (USD 1.3 billion). This surge is driven by a combination of factors, including continuous innovation in product offerings and enhanced user experiences, which build user trust and satisfy their needs. Furthermore, the rising demand for health insurance services, especially in the context of evolving demographic patterns in China, has played a significant role.

China’s demographic shift is expected to further accelerate the adoption of health insurance. Projections from the National Health Commission indicate that by approximately 2035, over 400 million people, representing more than 30% of the population, will be aged 60 or older. As healthcare demands inevitably grow alongside this aging population, commercial health insurance is progressively becoming an essential supplement to China’s existing basic medical system.

Partner insurers experienced significant growth in claims processing.

Ant Group has been a consistent proponent of leveraging cutting-edge technologies to propel the digital transformation of the healthcare sector, and health insurance is at the forefront of this initiative. Early in 2018, Ant Insurance, in partnership with leading insurers in China, launched Haoyibao, a flagship health insurance product. Notably, it was the first in the country to offer guaranteed renewal for six consecutive years, with payouts reaching up to RMB 4 million (USD 550,000). Haoyibao has been consistently refined over time to accommodate a broader spectrum of individuals and health conditions. As a bestseller, it has been instrumental in assisting millions of families in managing the financial burdens associated with medical expenses.

With the integration of technologies like AI, Ant Insurance has streamlined the entire insurance lifecycle – from product selection and policy design to administration and claims processing – thereby enhancing accessibility to insurance services for the general public.

The GoldenChoice feature utilizes the Ant Insurance Multi-factor Model (AIMM) to compare and identify the most suitable insurance products for users. Similarly, the EasyPick AI insurance planner develops tailored plans, assisting users in avoiding both over-purchasing and selecting inappropriate coverage. Demonstrating its commitment to operational efficiency, Ant Insurance’s AI-powered EasyClaims solution facilitated the streamlining of the claims process for over 85 health insurance products offered by 11 partner insurers in 2024. The AI handled an impressive 96% of the 1.62 million claims analysis requests received from policyholders.

Further expanding its capabilities, Ant Insurance launched Ant Bridge in September 2024. This open platform integrates AI models and financial intelligence to help insurers provide real-time, personalized responses to customer inquiries, thereby improving service quality and operational efficiency.

Beyond insurance, Ant Group has been actively contributing to the digital transformation of China’s healthcare industry for over a decade. Since the launch of the nation’s first online hospital appointment booking service in 2014, Ant Group’s Alipay digital platform has played a key role in facilitating hospitals’ transition to digital services. As of January 2025, Alipay had connected more than 800 million users with services from over 3,600 hospitals. In September 2024, Ant Group introduced the AI Healthcare Manager within the Alipay app, providing users with access to over 30 services via voice and text interaction. These services include doctor mapping, medical report interpretation, in-hospital navigation, and personalized medical advice. Through these sustained initiatives, Ant Group is contributing to the more efficient use of limited medical resources, with the ultimate goal of promoting greater medical inclusion.