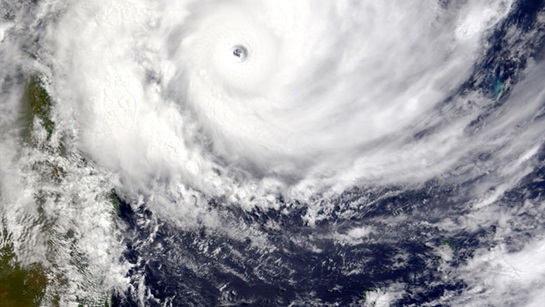

Australia Faces $990m Insured Loss from Extreme Weather Events

New data from the Insurance Council of Australia (ICA) has revealed that the February floods in North Queensland and ex-Tropical Cyclone Alfred in March have resulted in insured losses nearing AUD1.5 billion ($990 million) to date. The ICA has prioritized these two events due to the substantial volume of claims, which has reached 26,000.

Breakdown of Claims and Losses

Ex-Tropical Cyclone Alfred alone contributed an additional 20,000 claims last month, pushing up claims costs by AUD267 million. In total, insurers have received over 116,000 claims related to damage from Cyclone Alfred, amounting to more than AUD1.2 billion. To date, 37% of these claims have been settled, with payouts reaching AUD146 million.

Regarding the North Queensland floods, the ICA reports nearly 11,000 claims have been lodged, with losses exceeding AUD250 million. A detailed breakdown shows 8,725 home insurance claims, 1,192 motor claims, and 960 commercial claims, totaling AUD251 million.

Comparison of Claims from Both Events

Cyclone Alfred led to 104,389 home claims, 3,725 motor claims, and 8,118 commercial claims, bringing the total to 116,232 claims valued at AUD1.236 billion. In comparison, the North Queensland floods resulted in significantly fewer claims but still substantial losses.

Insurer Response

Insurers are continuing to support impacted communities locally by establishing insurer hubs immediately following the events and hosting customer consultations and town halls, according to the ICA.

The ICA’s efforts to address the aftermath of these extreme weather events demonstrate the insurance industry’s commitment to supporting affected regions in Australia.