Auto Insurance Shopping on the Rise

According to a recent TransUnion report, auto insurance shopping rates experienced a significant surge in the second quarter of 2023, increasing by 12% year-over-year. While rising vehicle sales contributed to the increase, the primary driver was the consumer’s pursuit of more affordable insurance premiums.

This trend coincides with a considerable rise in the consumer price index (CPI) for motor vehicle insurance, which jumped 17% in June 2023 compared to June 2022. These findings are detailed in TransUnion’s latest quarterly Insurance Personal Lines Trends and Perspectives Report, which also examines property insurance and consumer attitudes.

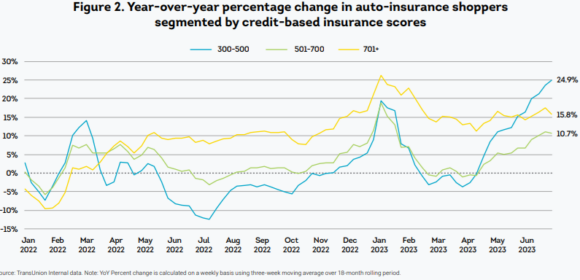

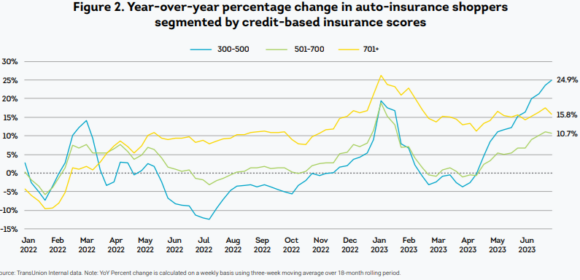

Growth Across Different Risk Groups

Despite historically high vehicle prices and escalating auto insurance premiums, the U.S. automotive forecast for June 2023, compiled by J.D. Power, forecasted a 23% rise in new vehicle sales compared to the previous year. At the same time, used car sales slightly decreased because of improved new vehicle inventory.

Stothard Deal, the vice president of strategic planning for TransUnion’s insurance business, commented, “There was a drop in shopping activity among riskier consumers in Q2 2022, partly due to insurers’ reduced marketing spend; however, we saw a rebound in activity from that segment in Q2 2023. Lower risk consumers have been consistently shopping at higher rates for the past 12 months.” These changes suggest a dynamic shift in consumer behavior within the auto insurance market.

Property Insurance Shopping Also Elevated

The report also found that homeowners are actively seeking lower property insurance rates, with a 13% increase in shopping activity during the second quarter of 2023 compared to the same period last year. However, this rate was down 7% compared to Q1 2023, possibly due to climbing interest rates and persistent high home prices. TransUnion suggests that these changes could present both challenges and opportunities for insurers, particularly regarding Gen Z and Millennial customers.

As homeownership becomes less attainable for certain groups, some may choose to live in regions more susceptible to natural disasters, resulting in significant implications for insurance losses. Others may opt to continue renting, opening up an opportunity for insurers to modernize their renter’s insurance products, TransUnion noted.

Deal added, “It’s time for insurers to start thinking about how to most effectively engage with their upcoming Gen Z customers. We know they are more likely to learn about new products and services from social media and appreciate receiving personalized offers.”

A Shifting Landscape of Risk

TransUnion’s full report also raised concerns about driving behavior, suggesting that changes in these patterns could impact the profitability of the insurance industry. While overall vehicle miles traveled initially plummeted early in the pandemic and have since returned to pre-pandemic levels, moving violation rates are still down nearly 13% compared to the pre-COVID-19 annual average. “While that may sound like good news, a look at the details reveals a different story,” reads the report. “Fatal accidents are at their highest level in decades — 22% higher than pre-COVID-19 averages. Fatalities resulting from alcohol impairment, speeding and failure to wear a seatbelt are all up by approximately 20%.”

TransUnion suggests that the decrease in moving violations is more related to changes in traffic enforcement than any real change in driving behaviors. Because insurance carriers often use those violations when assessing risk, this has translated into an estimated $200 million annual loss in premium capture for the auto insurance industry. This loss is likely passed onto consumers in the form of increased rates.

Driver attitudes are also changing. According to the TransUnion Q1 2023 Insurance Consumer Survey, 35% of Gen Z drivers feel that seat belts aren’t essential for brief trips, and 30% of Millennials think speeding is acceptable, figures that are higher than in older age groups.

Insurers Adapt to a Changing Market

TransUnion predicts the insurance industry will continue to respond to profitability challenges. As insurers seek sufficient rates through price increases they are taking short-term loss mitigation actions, including limiting distribution channels and strengthening their underwriting processes for new business, They may also sell policies only as part of a multi-line bundle or even withdraw from certain geographical markets, according to the report.

Consumers are expected to continue shopping as rates increase, although these mitigation strategies “could make switching more difficult,” as mentioned in the company’s report. TransUnion believes the consumer landscape will develop as more members of Gen Z enter credit-active adulthood and increasingly search for home and auto insurance.