Auto Insurance Shopping Surges as Consumers Hunt for Savings

According to a new report from TransUnion, the second quarter of 2023 saw a notable increase in auto insurance shopping rates, rising 12% year-over-year. The primary driver behind this surge, the company indicated, was consumers actively seeking lower premiums, even as vehicle sales also contributed to the trend.

The findings are detailed in TransUnion’s latest quarterly “Insurance Personal Lines Trends and Perspectives Report,” which examines trends in the auto and property insurance sectors alongside survey data about consumer attitudes and behaviors. This report comes as the consumer price index for motor vehicle insurance increased by 17% in June 2023 compared to June 2022.

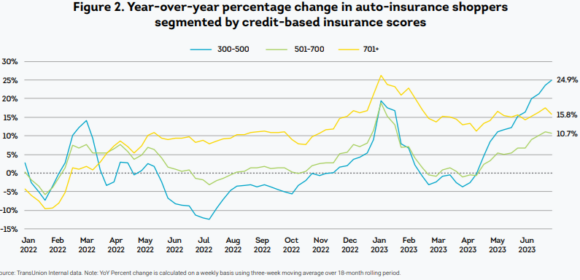

Growth Across All Credit-Based Insurance Score Groups

Despite high vehicle prices and rising auto insurance premiums, new vehicle sales experienced a 23% boost year-over-year in June 2023, according to J.D. Power’s US automotive forecast. Used car sales saw a slight dip, attributable to improved new vehicle inventory. Stothard Deal, the vice president of strategic planning for TransUnion’s insurance business, noted a rebound in shopping activity among riskier consumers in Q2 2023, following insurers’ reduced marketing spend in the previous year. “Lower risk consumers have been consistently shopping at higher rates for the past 12 months,” he observed.

Property Insurance Shopping Slows but Remains Elevated

The report also revealed that homeowners are also proactively seeking lower rates, with property insurance shopping up 13% in Q2 2023 compared to the previous year. However, shopping rates decreased by 7% from Q1 2023, which TransUnion attributes to rising interest rates and high home prices. The company suggests this presents both challenges and opportunities for insurers with Gen Z and Millennial customers. As these groups face obstacles to homeownership, some may choose regions prone to natural disasters. Others may continue renting, creating an opportunity for insurers to modernize their renter’s insurance offerings. Deal emphasized the importance of insurers engaging with their incoming Gen Z customers, noting their reliance on social media for information and their appreciation for personalized offers.

A New World of Risk for Drivers and Insurers

The report also pointed to a deterioration of driving behavior as a potential factor in profitability challenges for the insurance industry. While overall vehicle miles traveled have returned to pre-pandemic levels, moving violation rates are still down nearly 13% compared to the pre-COVID-19 annual average. However, the report warns that fatal accidents are significantly higher than pre-COVID-19 averages, with fatalities resulting from alcohol impairment, speeding, and failure to wear a seatbelt all seeing increases of approximately 20%.

TransUnion attributes the decrease in moving violations not to improved driving behavior, but to shifts in traffic enforcement. Traditionally, insurers use these violations to increase premiums for risky drivers, but with fewer violations, the industry has lost an estimated $200 million per year in premium capture, and an increased rate burden lands on all drivers.

Driver sentiment is also changing. According to the TransUnion Q1 2023 Insurance Consumer Survey, 35% of Gen Z drivers believe that wearing a seatbelt is unnecessary for short trips, while 30% of Millennials think speeding is acceptable – higher rates than in older age groups.

Insurers Implementing Mitigation Strategies, Consumer Landscape Evolving

TransUnion predicts the insurance industry will persist in reacting to profitability challenges. “As insurers seek rate adequacy through price increases, they are taking short-term loss mitigation actions, including limiting distribution channels, strengthening underwriting on new business, selling policies only as part of a multi-line bundle or even withdrawing from some geographic markets,” the report states.

Consumers are expected to continue shopping for better rates as premiums increase; however, the mitigation strategies above “could make switching more difficult.” TransUnion believes that the consumer landscape will evolve as more Gen Z members become credit-active adults and increasingly seek home and auto insurance.