The automobile insurance sector continues to dominate the US property and casualty insurance market, maintaining its position as the largest line of business for over a decade. As of 2024, automobile insurance held a 41.6% market share, peaking at 43.4% in 2018. The total direct premiums written for private passenger auto insurance reached $344 billion as of March 3, 2025, accounting for approximately 35% of all written premiums.

Several factors contribute to automobile insurance’s commanding position in the US insurance market. These include legal necessity, widespread vehicle ownership, high claim volume, regular policy renewals, and the potential for strategic bundling with other insurance products. The industry’s visibility and consistent marketing efforts also play a role, as virtually every adult household requires some form of automobile insurance.

Market Share and Premiums

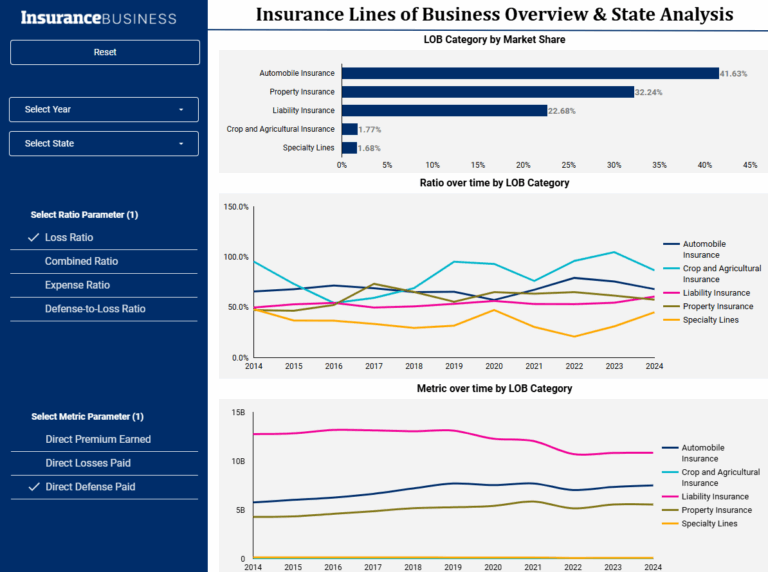

The market share distribution across different lines of property and casualty insurance in 2024 was as follows:

- Automobile insurance: 41.6%

- Property insurance: 35.7%

- Liability insurance: 19.5%

- Crop and agricultural insurance: 1.8%

- Specialty lines: 1.7%

Private passenger auto insurance accounted for the largest portion of direct premiums written, totaling $344 billion. Automobile insurance also had the highest premium earned and the highest direct losses paid in the market.

Impact of Tariff Announcements

Recent tariff announcements by President Donald Trump are expected to impact the auto insurance market significantly. The proposed 25% tax on all cars and car parts imported into the US could lead to increased repair and replacement costs. Insurers may pass these additional costs onto consumers in the form of higher premiums. According to forecasts by rate comparison site Insurify, the full impact of these tariffs could push yearly auto insurance costs for a single vehicle to as much as $2,750, up from around $2,300.

Market Trends and Future Outlook

The property and casualty insurance market is characterized by intense competition, particularly in pricing, underwriting discipline, and claims efficiency. Emerging risks such as advanced driver-assistance systems, autonomous vehicles, and evolving fraud schemes are adding complexity to the market. Brokers will need to adapt their strategies to navigate these changing conditions.

The data suggests potential growth opportunities in commercial lines, particularly for businesses scaling up fleets and seeking customized coverage. Conversely, decreasing demand in no-fault jurisdictions may require insurers to educate clients and adjust their service offerings accordingly.