China Life Insurance First Quarter 2025 Earnings Report

China Life Insurance (HKG:2628) has released its first quarter 2025 financial results, showing significant growth in earnings per share (EPS). The company reported an EPS of CN¥1.02, up from CN¥0.73 in the same period last year.

Key Financial Results

- Revenue: CN¥64.3 billion, down 11% from 1Q 2024

- Net income: CN¥28.8 billion, up 40% from 1Q 2024

- Profit margin: 45%, up from 29% in 1Q 2024

- EPS: CN¥1.02, up from CN¥0.73 in 1Q 2024

Earnings Insights

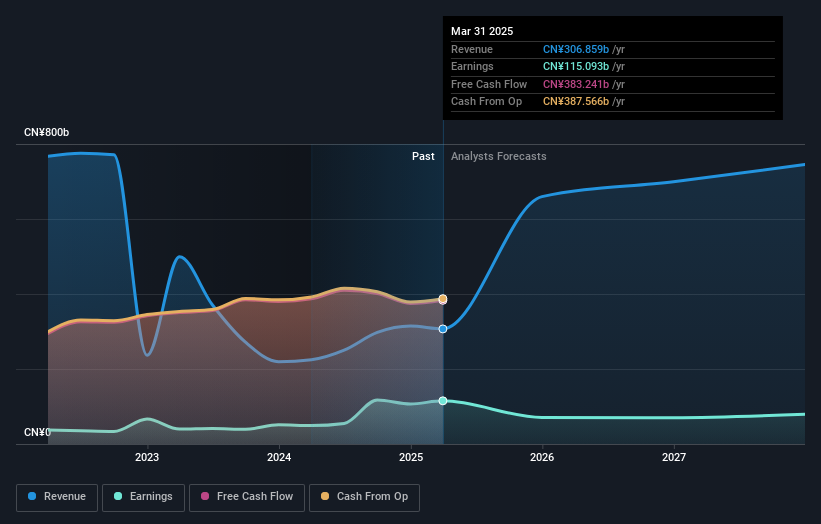

Looking ahead, analysts forecast that China Life Insurance’s revenue will grow at an average annual rate of 20% over the next three years. This compares favorably to the 11% growth forecast for the Insurance industry in Hong Kong. The company’s shares have seen a 1.4% increase over the past week.

Risk Analysis

Investors should be aware of potential risks. China Life Insurance has 2 warning signs (including 1 that shouldn’t be ignored) that investors should consider. For those interested in trading China Life Insurance shares, Interactive Brokers offers a low-cost trading platform trusted by professionals.

About China Life Insurance

China Life Insurance operates as a life insurance company in the People’s Republic of China. The company has shown an outstanding track record and pays a dividend, making it an attractive option for investors looking for stable returns.

It’s important to note that this analysis is based on historical data and analyst forecasts and does not constitute financial advice. Investors should consider their objectives and financial situation before making any investment decisions.