Cincinnati Financial’s Surplus Lines Strategy: A Winning Combination of Relationships and Control

The Cincinnati Insurance Companies have cultivated business for 75 years by nurturing relationships with a select group of independent agents. This strategy has extended to the surplus lines segment, according to company executives.

Don Doyle Jr., the architect of Cincinnati Specialty Underwriters (CSU), a subsidiary of Cincinnati Financial Corporation, highlighted this distinction. “If you look over the last 15 years, a lot has changed in the E&S market. Today, more than 75% of the E&S market is controlled by three large wholesale brokers,” he told analysts and investors at Cincinnati Financial’s first Investor Day. “We distribute only through the agents of Cincinnati insurance. No wholesalers, no MGAs, managing general agents, or managing general underwriters,” Doyle stated, emphasizing a key differentiator for the company in the E&S market.

Doyle, who led CSU for 17 years before stepping down in anticipation of his retirement, believes the distribution model and CSU’s control over its business have been vital to maintaining consistent profitability. “Those three large wholesale brokers have a lot of control on where the business is going. They have a bit of control over the risk takers, yet they take no risk,” Doyle explained, without naming the specific firms.

President and Chief Executive Officer Steve Spray and other executives detailed the process for vetting qualified agencies for personal and commercial lines during the Investor Day, which now totals over 2,000. They also discussed the day-to-day activities that build close relationships between agents and Cincinnati’s field representatives.

CSU’s founding philosophy was to create consistent and manageable growth along with maintaining consistent and manageable profitability, Doyle said. Despite the fluctuating nature of the E&S market, CSU has achieved a combined ratio of 94 or better for 12 consecutive years.

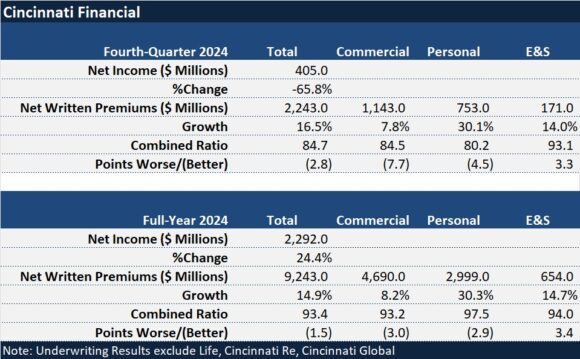

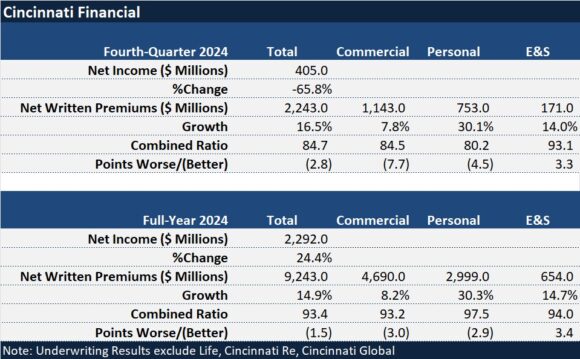

Cincinnati Financial’s most recent financial report indicates the 94 combined ratio was the result for the full 2024 year, with CSU increasing premiums by nearly 15%. Over the last 12 years, CSU has averaged an 81.8 combined ratio, with the years between 2020 and 2023 averaging around 90.

Key Drivers of Success: Distribution and Underwriting

Doyle pointed to the distribution model as the primary driver of better-than-breakeven results. He further noted that “CSU does not cede underwriting authority to anyone,” referring to brokers, wholesalers, and MGAs. “We are operating only through those independent agents…We want to eat our own cooking,” Doyle stated. Independent agents have access to Cincinnati Specialty Underwriters’ product line through CSU Producer Resources, a wholly-owned insurance brokerage subsidiary of Cincinnati Financial Corporation, according to the group’s annual report. CSU Producer Resources possesses binding authority on all classes of business written through Cincinnati Specialty Underwriters and maintains the necessary agent and surplus lines licenses.

Another critical factor in CSU’s E&S success is an underwriting approach that prioritizes accounts with a low-risk profile and maintains a diversified spread of risk that reflects the broader company approach. CSU’s typical risk profile consists of limits of $1 million or less, with the average policy size around $10,000, focusing on classes of business outside of mass tort. In other words, CSU prefers not to underwrite challenging long-tail classes common in the E&S market, like product liability for pharmaceutical companies and medical malpractice, instead focusing on contracting-type risks or property management firms, hotels, motels, bars, and taverns, as well as professional liability excluding public company directors and officers (D&O).

Doyle characterized the company’s appetite as being in the “low-to-moderate range in the E&S market.”

Cincinnati Financial’s 2024 10K annual statement reveals that the insurer markets E&S products in 44 states where it offers standard market commercial lines insurance. The top five states—Illinois, New York, Ohio, Texas, and North Carolina—account for roughly one-third of CSU’s E&S premiums written.

Advantages for Agents

Doyle mentioned that CSU’s underwriters average over 20 years of experience in the business, which rounds out the reasons the E&S segment of Cincinnati’s business has remained profitable.

Regarding the advantages for agents working with CSU, he emphasized that eliminating middlemen – wholesale brokers – via “operating both as the broker and the underwriting company…means we can provide higher commission to our agent.” Doyle estimated that brokers typically pay 8-10% commissions on E&S business. Agents working with Cincinnati receive a 15% base commission on E&S business and also have the opportunity to earn profit-sharing commissions. “So, in total they could earn 18-20% or more in commission with us vs. 8-10% with a traditional E&S wholesaler.” “[Agents] can increase their revenue 50-100% by doing business with somebody they see as a true partner,” Doyle concluded, continuing to describe the various attributes of this successful partnership.