Climate-Related Disasters Hit Non-Life Insurers’ Q1 Performance

South Korean non-life insurance companies experienced a significant decline in their first-quarter performance this year due to unexpected large-scale wildfires and heavy snowfall. The climate crisis is beginning to have a noticeable impact on the financial performance of insurance companies.

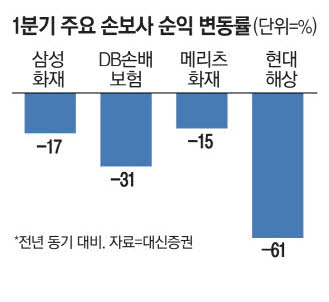

Significant Decline in Net Profit

Daishin Securities predicted that the four major non-life insurers – Samsung Fire & Marine Insurance, DB Insurance, Meritz Fire & Marine Insurance, and Hyundai Marine Insurance – recorded a net profit of 1.583 trillion won in the first quarter. This represents a 30% decrease compared to the same period last year, when the net profit was 2.253 trillion won. Most securities companies that forecasted the first-quarter performance of non-life insurers also expected a 30% drop in net profit for the four major companies.

Wildfires and Increased Insurance Payouts

The frequent occurrence of wildfires was a major factor contributing to the poor performance of domestic non-life insurers in the first quarter. The worst forest fire in history, which started with the Cheongdo bushfire in March, burned over 100,000 hectares of forest across the country. The human toll was also severe, with 33 deaths and 45 injuries, in addition to significant property damage. Non-life insurance companies suffered losses in their long-term insurance products due to the failure to accurately predict insurance payouts.

In the first quarter, Samsung Fire & Marine Insurance reported a loss of 18 billion won, compared to a surplus of 61 billion won in the same period last year. Hyundai Marine Insurance is estimated to have seen its losses expand from 47 billion won to 123 billion won. The damage caused by forest fires was not limited to the four major companies; NH Nonghyup Insurance, which has a large number of farmers among its subscribers, is expected to suffer a loss of 200 billion won due to the forest fire. It is reported that NH Nonghyup’s losses account for 60% of all insurance claims related to forest fire damage in the Yeongnam region.

Heavy Snowfall and Auto Insurance Loss Ratio

The increase in the auto insurance loss ratio due to heavy snowfall in mid-March also contributed to the decline in the net profit of non-life insurers. Insurance companies are now considering ways to minimize potential losses caused by the climate crisis. If non-life insurance companies can incorporate physical losses resulting from climate change into their forecasting models, the climate crisis might present an opportunity for growth.

The insurance industry is closely monitoring the situation and exploring strategies to mitigate the impacts of climate-related disasters on their financial performance.