Growing Concerns Over AI-Powered Fraud

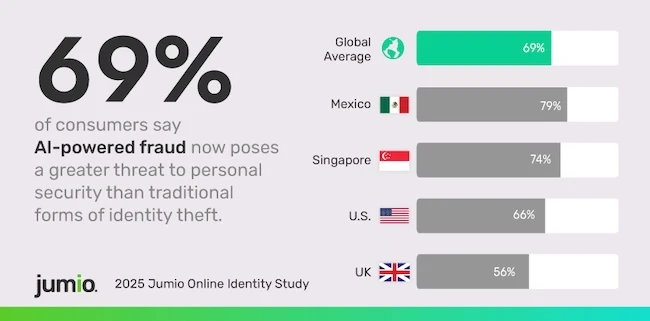

A recent Jumio survey has revealed that digital trust is deteriorating globally due to increasing concerns about AI-powered fraud and deepfakes. The survey found that 69% of global respondents believe AI-powered fraud now poses a greater threat to personal security than traditional forms of identity theft. This concern is even more pronounced in Singapore, where 74% of respondents share this view.

The erosion of digital trust is evident in the growing skepticism towards online content. Globally, 69% of consumers indicated they are more skeptical of online content due to AI-generated fraud than they were last year. This skepticism extends to social media accounts and news encountered online, with only 37% and 36% of consumers, respectively, believing in their authenticity.

Key Concerns Among Respondents

The survey highlighted several AI-powered fraud tactics that concern consumers, including:

- Fake digital IDs generated with AI (76% globally, 84% in Singapore)

- Scam emails using AI to trick people into giving away passwords or money (75% globally, 82% in Singapore)

- Video and voice deepfakes (74% globally, 83% in Singapore)

- Being fooled by manipulated social media content (72% globally, 81% in Singapore)

“As generative AI continues to lower the barrier for sophisticated scams, Jumio’s findings highlight an urgent need for businesses to rethink digital identity protection — not only to reduce fraud, but also to preserve customer trust and digital engagement itself,” said Bala Kumar, chief product and technology officer at Jumio.

Consumer Trust and Responsibility

In the absence of strong regulatory protections, consumers are taking matters into their own hands. When asked who they trust most to protect their personal data from AI-powered fraud, 93% said themselves. However, when asked who should be most responsible for stopping AI-powered fraud, 43% pointed to big tech, compared to just 18% who chose themselves.

“Our industry must develop the tools we need to stay ahead of the AI-fraud arms race, because traditional identity verification isn’t going to cut it anymore,” concluded Jumio CEO Robert Prigge.

The survey also found that most respondents globally are willing to spend more time completing comprehensive identity verification processes, especially in high-stakes sectors like banking and financial services (80%), government services (78%), and healthcare (76%).