{ “title”: “Family Feud: Life Insurance, Step-Siblings, and Fair Play”, “description”: “A Reddit user and their siblings face a difficult decision about their mother’s life insurance payout, sparking a family debate about fairness and inheritance.”, “tags”: “inheritance, step-siblings, life insurance, family dispute, Reddit”, “rewritten_content”: “When a loved one passes, settling their estate is rarely straightforward. This is especially true when blended families and step-relationships come into play. One Reddit user is grappling with such a dilemma, and the online community is chiming in to help.

The Inherited Complication

The original poster (OP), in their late 30s, shared their story on the r/AITA (Am I The Asshole) subreddit. Their mother recently passed away, leaving behind a life insurance policy.

The complicating factor?

Step-siblings. OP’s mother had remarried when they were young, and their siblings from that marriage are now part of the inheritance equation. Adding to the complexity, the OP and some of their siblings provided the bulk of their mother’s care during her illness.

“I (in my late 30s) have several older siblings and step-siblings. My mom married their dad when I was very young. Our dad passed several years ago, and my mom had early dementia. After, she lived with my two eldest siblings for three and a half years. They were her primary caregivers. I and one other sibling live out of state but helped with her physical care when we could and also monetarily.”

When their mother’s health declined, she moved into a memory care facility. The original poster and one of their siblings largely covered the costs, with others contributing what they could.

The Unexpected Payout

The life insurance policy proved to be more substantial than anticipated. Initially, the mother had designated OP’s father as a 40% beneficiary, and her children as the remaining 12%. After their father’s passing, his share was divided among the other beneficiaries: the OP and their siblings.

“When our dad passed, we liquidated their major assets and used them for care costs. His possessions were divided, but many high-value tools, etc, went to his children.”

The siblings planned to reimburse those who had provided care and cover funeral expenses, then divide the remainder. However, the step-siblings, who had provided little to no care, now expected a share of the inheritance.

“Her assets went quickly in the care center since it was almost 7k a month. When she ran out of money, one sibling and I covered most of the rest, with the others giving what they could afford. One step-sibling contributed a couple hundred dollars at one time, and the others did not respond and did not contribute at all.”

The Core of the Dispute

The OP’s siblings now want to keep the inheritance within the immediate family, arguing that the step-siblings didn’t contribute to their mother’s care. The OP, however, believes the inheritance should be split equally to honor their deceased father’s memory, as he always tried to treat everyone fairly.

“I pushed for an equal split. They argue that the step-siblings did not help at all with her care, while the two oldest siblings spent years caring for her almost every single day with some help from the rest of us, and that she didn’t put them as beneficiaries when she was very much in her right mind. I’ve argued that our dad would’ve wanted it equally split between all of us (he and my mom tried to be very fair and really did a lot for our step-siblings).”

Reddit Weighs In

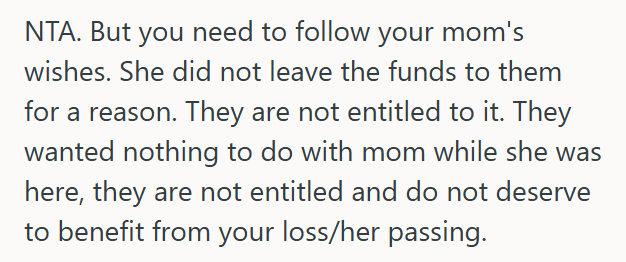

The Reddit community offered diverse perspectives on the situation. Some users believed the siblings who provided the care should receive the larger share to honor the mother’s wishes and reflect the contributions made. Others sided with a more even distribution, emphasizing family harmony. The comments highlight the complexities of inheritance:

While the OP sought an “Am I the A-hole” verdict, the responses show clearly this situation has no simple right or wrong answer, but rather a complex mix of legal and emotional considerations.

The situation underscores the importance of open communication, legally sound estate planning, and the potential for conflict when step-relationships and inheritance are involved. “}