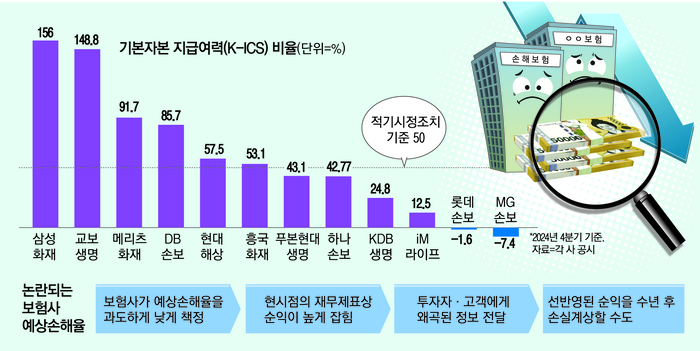

South Korean financial authorities are tightening regulations on the insurance industry to ensure companies maintain sufficient capital reserves and adhere to stricter accounting standards. As of the fourth quarter of last year, several insurance companies, including Fubon Hyundai Life Insurance and MG Insurance, failed to meet the 50% basic capital payment capacity (K-ICS) ratio threshold.

The new regulations aim to prevent insurers from manipulating their financial statements by assuming overly optimistic expected loss ratios, which can artificially inflate their net profits. Financial authorities will scrutinize insurers that consistently report either profits or losses over several years, suspecting that their expected loss ratios may be derived without a clear basis.

To increase their basic capital, insurers will need to focus on generating actual profits and increasing their capital reserves. The financial authorities believe that the soundness of domestic insurers has not yet reached global standards, citing recent cases of insurance company bankruptcies in North America and Japan.

The new regulations are expected to have a significant impact on the domestic insurance market, distinguishing between financially sound companies and those that are not. While some insurers have expressed concerns that the introduction of multiple regulations at once could shock the market, the financial authorities are determined to preemptively block poor management practices.

Key Measures

- Stricter capital requirements: Insurers must maintain a minimum 50% basic capital payment capacity ratio.

- Improved accounting standards: Insurers must derive expected loss ratios based on clear evidence.

- Enhanced scrutiny: Financial authorities will inspect companies with suspicious profit or loss patterns.

The financial authorities aim to promote a more robust and transparent insurance industry by introducing these regulations, ultimately protecting policyholders and maintaining market stability.