Impact of 2022 Florida Insurance Reforms Comes Under Fire

Florida’s 2022 insurance reforms, aimed at improving home insurance services and reducing consumer bills, are facing intense scrutiny following the devastating hurricanes in 2024. The reforms made it harder for homeowners to sue insurance companies and provided additional state-backed reinsurance to these companies.

Critics, including former Democratic state representative Michael Grieco, have dubbed these changes “corporate welfare” for insurance companies. Grieco argued that the reforms only benefit big businesses while leaving consumers without relief. This criticism gained traction when then-presidential candidate Donald Trump claimed that Governor Ron DeSantis had delivered the “biggest insurance bailout in history,” negatively impacting Florida homeowners whose houses were destroyed during the hurricanes.

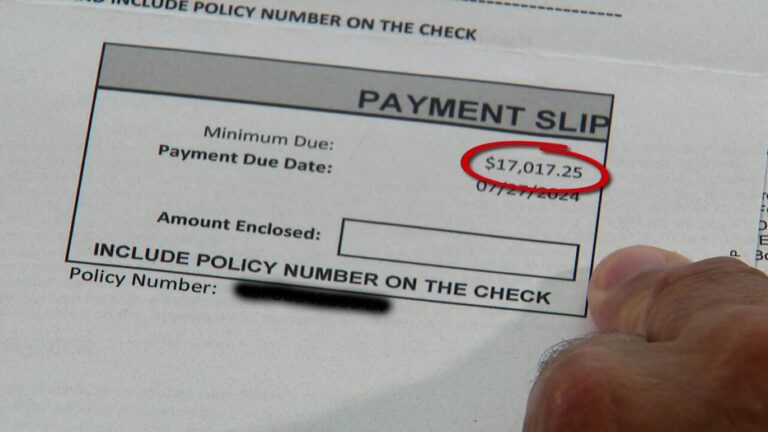

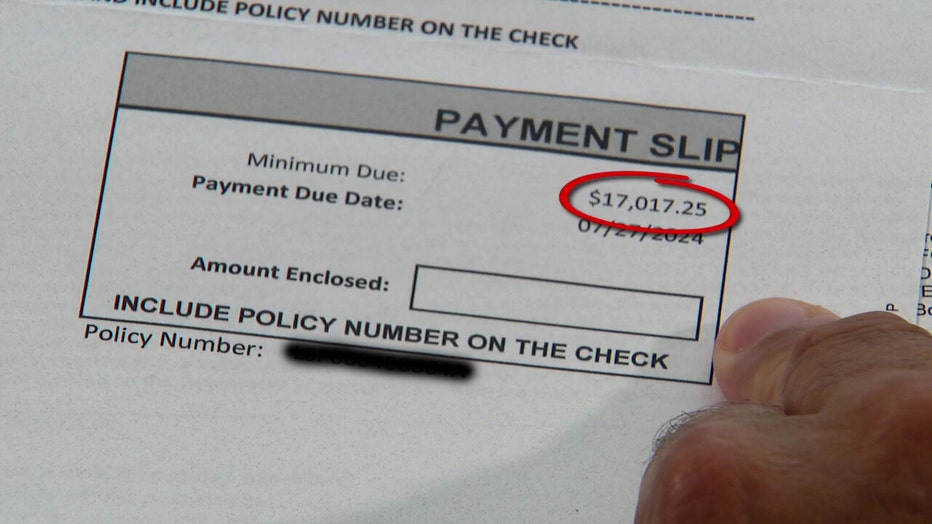

Despite lawmakers’ assertions that it would take time for the reforms to show results, many homeowners reported significant premium increases throughout 2023 and into 2024. For instance, Dave Lesko from Pinellas County saw his home insurance bill skyrocket from $5,500 in 2022 to $7,500 in 2023, and then to a staggering $17,000 in 2024, representing a 120% increase from the previous year.

The situation worsened with Hurricanes Debby, Helene, and Milton hitting Florida. Weiss Ratings found a sharp increase in damage claim denials compared to previous storms in prior years. Dr. Martin Weiss, founder of Weiss Ratings, noted that some major insurance providers in Florida had denial rates close to 50%. The data revealed that 14 property insurers in the state closed more than half of their claims in 2024 without making payments.

The rising denial rates prompted U.S. Republican Senator Josh Hawley to call for a congressional investigation. Louisiana Governor Jeff Landry, also a Republican, cited Florida’s reforms as a cautionary example of what not to do in insurance reform. “They tried wholesale tort reform that insurance companies said would lower rates in Florida, and today, policyholders in Florida struggle to get the very claims paid on the policies they paid for,” Governor Landry stated.

However, Florida’s insurance commissioner, Michael Yaworsky, presents a different perspective. Yaworsky points out that more insurance companies are now operating in Florida, and rates have begun to level off or even decrease in some cases. “We are seeing that stability has emerged throughout the marketplace,” Yaworsky said.

The debate surrounding Florida’s 2022 insurance reforms continues as the state grapples with the aftermath of the 2024 hurricanes and the ongoing challenges faced by homeowners in securing fair treatment from their insurance providers.