GM Vehicle Owners Can Access OnStar Driving Data Reports

Following the discovery that General Motors (GM) has been sharing driving data from its OnStar Smart Driver service with third-party analytics firms and insurance companies, vehicle owners are now able to request free copies of their driving data reports. These reports detail the driving metrics recorded and sold without their explicit permission. This information may have been used by insurance providers to adjust car insurance rates.

Since 2016, GM has promoted its OnStar Smart Driver service, which offers features like automatic crash response, roadside assistance, stolen vehicle tracking, and navigation accessible via a vehicle-mounted button, voice commands, or a mobile app. The OnStar systems use sensors to track vehicle movements and gather data on driver behaviors such as speed, braking patterns, and location.

Lawsuits allege that GM did not adequately disclose that it was compiling comprehensive profiles on its customers’ driving habits. In March 2024, The New York Times reported that GM and OnStar were selling customer driving data to LexisNexis and Verisk, which then passed the data to insurance providers.

What Information Was Collected by GM’s OnStar Smart Driver Service?

The OnStar Smart Driver service uses a telematics system with sensors that monitor and record driving behavior and vehicle status while in operation. This data is transmitted back to GM’s data centers. This data transmission allows GM to collect, analyze, and model data on its customers’ driving habits, including:

- Acceleration Events: Instances of significant speed increases, which could suggest aggressive driving.

- Hard Brake Events: Sudden and intense braking, potentially indicating emergency reactions.

- High-Speed Events: Vehicle speeds exceeding 80 miles per hour.

- Distance Traveled: Total mileage, indicating vehicle use.

- Time of Day Traveled: Used to analyze driving patterns, such as rush hour or late-night travel.

- Vehicle Information: Vehicle Identification Number (VIN) to link driving data to a vehicle.

- Location and GPS Data: Tracking driving routes, locations, and movement patterns.

- Late-Night Driving: Documentation of nighttime driving.

OnStar Driver Data Shared With Insurance Companies Lacks Context

Lawsuits against GM and OnStar have raised concerns about the lack of context surrounding the collected data. Plaintiffs claim that metrics like hard braking or rapid acceleration can be misinterpreted as risky behavior without considering why these actions occurred. For example, a hard brake might be necessary to avoid an animal or pedestrian instead of indicating recklessness. Similarly, rapid acceleration may be required when merging onto a highway.

Insurance companies could use this data from LexisNexis Risk Solutions and Verisk to set premiums based on perceived risks without fully understanding the driver’s actions or situational necessities.

How to Request Your OnStar Driver Data Report

Owners of GM vehicles can request their driving data reports through LexisNexis and Verisk. The reports include data on acceleration events, braking patterns, and GPS locations. Here’s how to request a report from each:

LexisNexis Consumer Disclosure Report

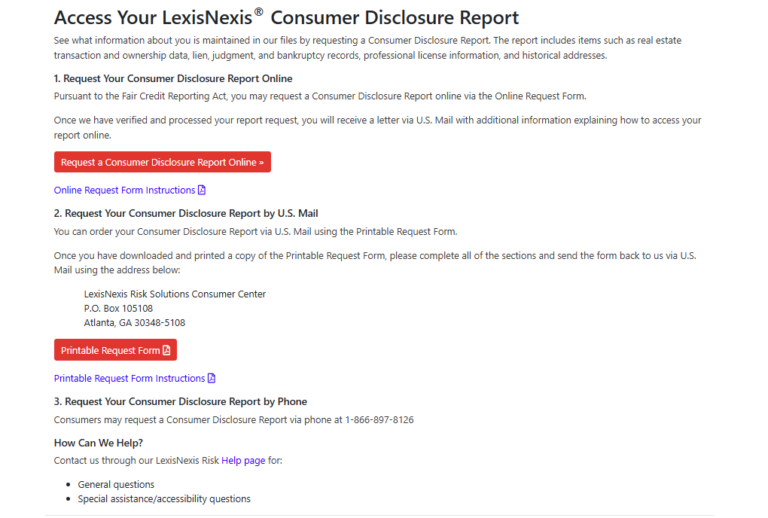

- Online Request: Visit the LexisNexis website and navigate to the Consumer Disclosure section. Complete the online request form to apply for your report. You will receive a letter via U.S. Mail with instructions to access your report online.

- Mail Request: Download and fill out the Printable Request Form from the LexisNexis website and mail to: LexisNexis Risk Solutions Consumer Center Mt. Laurel, NJ 08054 P.O. Box 105108 Atlanta, GA 30348-5108

- Phone Request: Call LexisNexis at 1-866-897-8126 to request the report.

Verisk Driving Behavior Data Report

- Online Request: Visit the Verisk Important Notice to Consumers regarding Driving Behavior Reports web page and click on the blue box for requests for GM vehicles.

- Email Submission: Download and complete the Driving Behavior Data History Report and email it to [email protected].

- Fax Submission: Fax the completed form to 800-955-2422.

- Mail Submission: Mail the completed form to: Verisk Underwriting Solutions Consumer Inquiry Center P.O. BOX 5404 Mt. Laurel, NJ 08054

GM OnStar Class Action Lawsuits

Due to the alleged unauthorized collection of driver data, many individuals are pursuing OnStar class action lawsuits and individual arbitration claims against GM, alleging their private driving data was collected without consent and then used to raise insurance premiums. The U.S. Judicial Panel on Multidistrict Litigation (JPML) has consolidated 32 lawsuits against GM, OnStar, LexisNexis Risk Solutions, and Verisk into a Consumer Vehicle Driving Data Tracking Litigation (MDL No. 3115) in the Northern District of Georgia before Judge Thomas W. Thrash, Jr.

Judge Thrash has ordered the parties to submit a Master Consolidated Complaint by December 13, detailing the allegations in the various GM OnStar lawsuits. Motions to dismiss are due by March 13, 2025, with replies by May 23, 2025, after which fact discovery will commence. The discovery phase is expected to last until mid- to late 2026.

How to Join the OnStar Class Action Lawsuit

To determine eligibility for a GM OnStar class action lawsuit settlement, submit information about your potential claim for review by a lawyer by filling out a form online. All GM OnStar case evaluations are free, and firms work on a contingency fee basis.