Goose Creek Man’s Fraud Conviction Sparks Claims of Government Negligence and Identity Theft

CHARLESTON, S.C. – A Goose Creek man, Henry Troy Wade, convicted of wire fraud related to COVID-19 relief, is fighting to clear his name, asserting he is a victim of identity theft. Wade insists his former caretaker was responsible for fraudulently obtaining loans in his name, leaving him “discouraged and broken.”

A jury found Wade guilty on September 30, 2024, of six counts of wire fraud, potentially totaling $524,000. Each count carries a maximum sentence of 20 years in federal prison.

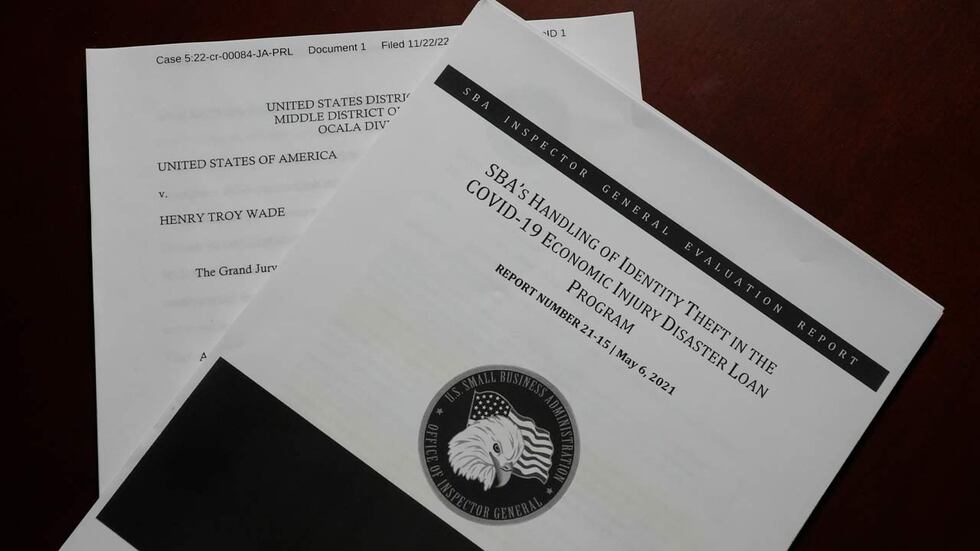

Wade’s case highlights the ongoing issue of identity theft associated with the COVID-19 Economic Injury Disaster Loans Program (EIDL), which he allegedly misused. Wade’s defense argues that the Small Business Administration (SBA) failed to properly handle reported complaints of identity theft, suggesting Wade’s claims may have been overlooked.

In 2019, a workplace injury left Wade blind in one eye, necessitating a caretaker’s assistance. During his recovery, Wade discovered outstanding loans in his name. According to Wade, his caretaker admitted to filing the loans but refused to explain the details or the purpose of the funds. Tragically, the caretaker died before providing further information.

“My only crime was trust; I trusted him. I saw him as a brother and I had taken care of him before when he had had some rough times,” Wade said. “He was a wonderful brother and I had no knowledge that he even had that ability to do such a thing.”

Wade stated that he never applied for the loans, prompting him to question the situation. He said his inquiries led him to the SBA.

SBA Investigation and Wade’s Claims

Wade claims he filed a written complaint with the SBA in October 2021, reporting his identity had been stolen. He stated the agency acknowledged it by calling him for follow-up. The government, however, claims that no records support his communication with the SBA. The government also noted that the SBA’s record-keeping practices had shortcomings.

“I was devastated because I felt that the government let me down; I felt that the SBA let me down,” Wade said. “No one says anything because the federal government is a hammer, and it smashes the small people, the little people, unfortunately.”

The majority of the funds Wade allegedly obtained originated from the COVID-19 EIDL program. The SBA referred 846,611 EIDL applications to the U.S. Inspector General’s Office, many of which were associated with identity theft complaints.

In 2021, U.S. Inspector General Hannibal “Wade” Ware initiated an investigation into the SBA’s handling of the EIDL program. The investigation found the SBA “did not know the exact number of individuals who had filed an identity theft complaint because they did not track each complaint” and failed to provide updates to those reporting identity theft.

“We live in a country where this should not occur and if it does occur, it should be rectified very quickly,” Wade said. “And I just haven’t seen that; I’ve seen none of that. I’ve seen a judicial system that is broken and it does not work for all Americans.”

Concerns Over Procedures and the Investigation

By January 2021, the SBA estimated it had received over 150,000 loan statements returned due to incorrect or fraudulent addresses. This raises the possibility of unreported cases of identity theft. The South East National Action Network is reviewing Wade’s case and believes further investigation is necessary before his sentencing.

South East National Action Network Crisis Director Travis Stinney said, “There’s a lot of due process violations in this particular case, and on top of the due process violations, you would see that it is extreme negligence on the part of both the government and his council. “This should have never gotten this far,” added South East National Action Network President Jacqualin Yeadon. “We feel it looks like he was targeted, and then they targeted him and this was retaliation because it was identity thief.”

Wade hopes to be an advocate for others in similar circumstances. “I think at some point we have to stand up. A crime against one of us is a crime against all of us,” he said.

Details of Federal Charges and Defense Efforts

Wade’s federal indictment states that he devised a scheme to defraud the SBA by applying for six separate loans and grants for various businesses. The funds were paid into five Florida bank accounts allegedly belonging to Wade. The U.S. District Court asserted that federal dollars were used for non-business expenses, including hotel bookings and Amazon purchases.

His legal team attempted to dismiss the testimony of investigator Matthew Rosado, claiming he misled the Grand Jury by stating that no one else had access to Wade’s bank accounts, which he later acknowledged was incorrect. The motion to dismiss failed, with the judge determining the inaccurate testimony did not meet the burden of proof for perjury.

Wade’s sentencing is scheduled for March 18. “This has taken a part of me because my caretaker did something that he shouldn’t have done, but greater than that, the government who we count on, who we believe will help us, will have our back, will protect us, is the very entity whose borders were lowered and allowed this to happen to people like me,” Wade said.

SBA’s Work to Improve

The 2021 U.S. Inspector General’s investigation into the SBA included five recommendations: Maintain and track all identity theft complaints, provide status updates to complainants, formalize a process to restore the identity theft victims, remove fraudulent loans from financial records, and review returned billing statements. A follow-up verification on December 19, 2023, showed that four of the five recommendations were fully implemented, while the fifth was only partially addressed. The department will work with the SBA to establish a target date for enacting corrective actions through the audit follow-up process. The SBA and the Department of Justice’s Middle Florida District did not comment on the situation.