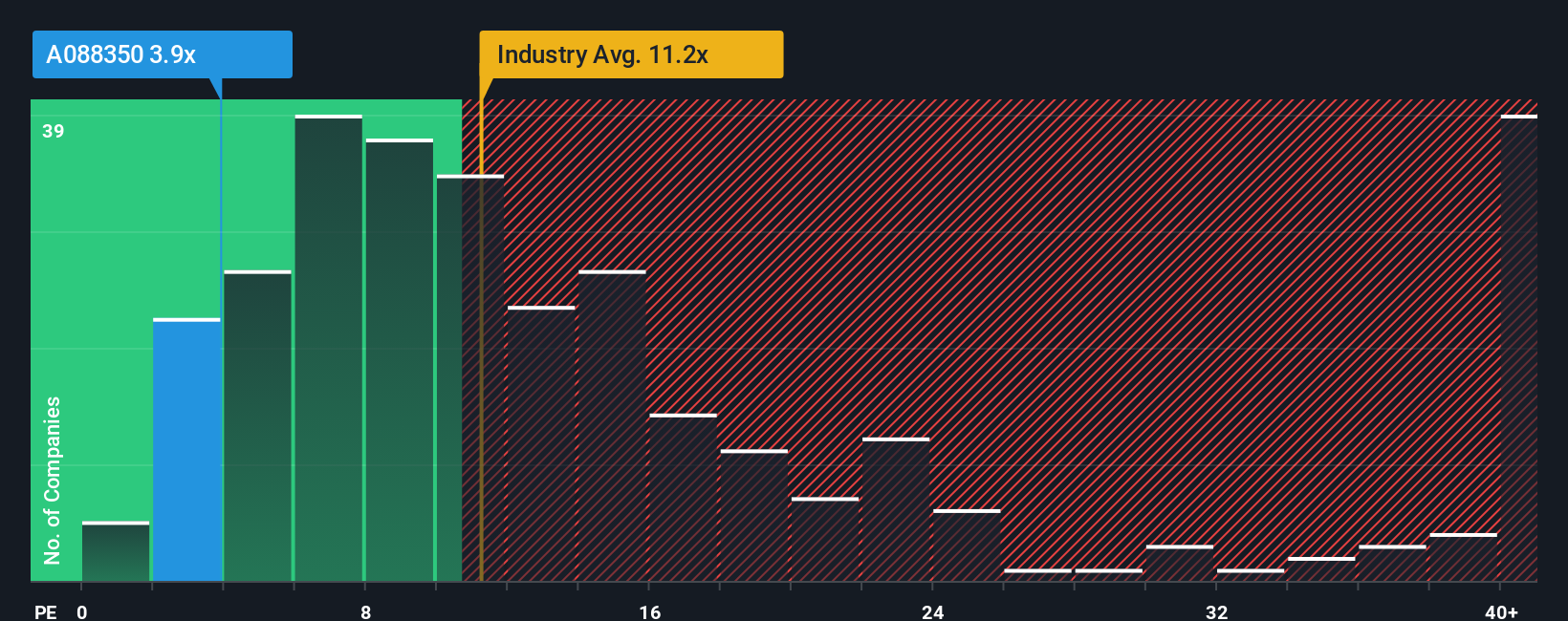

Hanwha Life Insurance Co., Ltd. (KRX:088350) has seen its shares jump 25% in the last month, with a 20% rise over the past twelve months. Despite this surge, the company’s price-to-earnings (P/E) ratio remains low at 3.9x, significantly below the Korean market average where almost half of the companies have P/E ratios above 13x. The low P/E could indicate that investors are skeptical about the company’s future earnings growth.

Recent Earnings Performance

Hanwha Life Insurance has shown strong earnings growth in the recent past, with a 36% gain in the last year. However, its earnings per share (EPS) have dropped by 53% over the last three years. Analysts estimate that the company will grow its earnings by 3.8% annually over the next three years, which is lower than the market’s expected growth of 17% per year.

Market Expectations and P/E Ratio

Investment Considerations

While Hanwha Life Insurance’s current valuation may seem attractive, it’s essential to consider the investment risk. The company’s weaker growth outlook and lower P/E ratio compared to its peers suggest that there might be better investment opportunities elsewhere. For investors looking for undervalued companies with growth potential, there are other options available in the market.

Conclusion

Hanwha Life Insurance’s recent stock price increase has not been accompanied by a significant change in its P/E ratio, which remains low compared to the market average. The company’s weaker earnings growth prospects justify this low valuation. Investors should carefully evaluate the company’s future potential and consider alternative investment opportunities before making a decision.