HDFC Life Insurance Company Limited Analysis

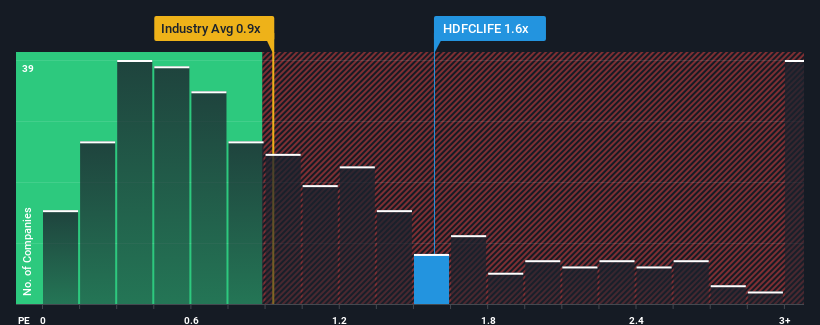

Investors are currently taking a wait-and-see approach with HDFC Life Insurance Company Limited (NSE:HDFCLIFE), given its price-to-sales (P/S) ratio of 1.6x, slightly above the industry median of 1.5x. The company’s recent revenue decline of 4.7% over the last year compares unfavorably to industry peers, who have seen revenue growth on average. However, HDFC Life Insurance’s revenue has still increased by 44% over the past three years, and analysts forecast a 16% annual revenue growth rate for the next three years, outpacing the industry’s predicted 13% growth.

The company’s P/S ratio is currently in line with the industry average, suggesting some investors are skeptical about the revenue forecasts. The balance sheet is another crucial area for risk analysis. While the stock may be undervalued given the positive revenue forecasts, uncertainty seems to be reflected in its stable but potentially undervalued share price.

Key Considerations

- HDFC Life Insurance’s revenue growth forecasts exceed industry expectations

- Current P/S ratio is consistent with industry average despite better growth prospects

- Balance sheet analysis is crucial for understanding potential risks

- Analysts predict 16% annual revenue growth for the next three years