Home Insurance Market to Soar to $576 Billion by 2033, According to New Report

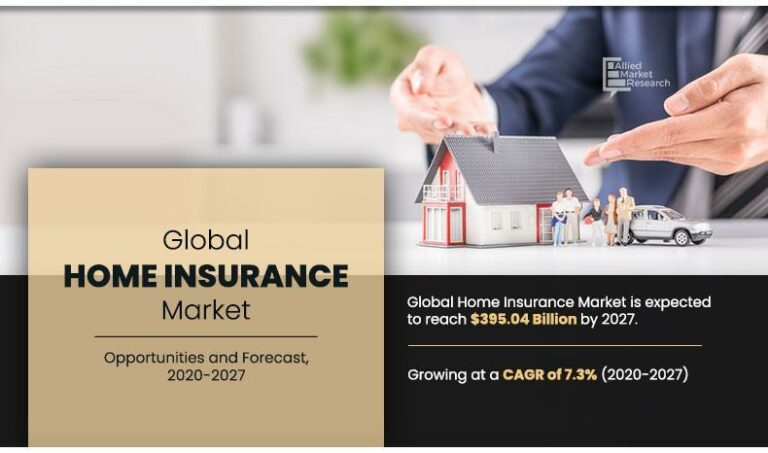

The home insurance market is on track for substantial expansion, with a projected value of $576 billion by 2033. This forecast, released by Allied Market Research, represents a robust compound annual growth rate (CAGR) of 7.6% between 2024 and 2033. The report, titled “Home Insurance Market by Coverage and End User: Global Opportunity Analysis and Industry Forecast, 2024-2033,” highlights key drivers and trends shaping the industry.

The home insurance sector offers financial protection to homeowners and renters, covering potential risks to their properties and belongings. These policies generally cover damage from natural disasters, theft, fire, and other unexpected events. The market caters to a broad customer base, including individual homeowners, landlords, and tenants.

Key Growth Drivers

Several factors are contributing to the market’s anticipated growth:

- Rising Property Values: As property values increase, so does the demand for higher insurance premiums and more comprehensive coverage.

- Increased Frequency of Natural Disasters: The growing incidence of natural disasters is pushing homeowners to seek more robust protection against climate-related risks.

- Regulatory Requirements: Mandatory home insurance for mortgage borrowers, particularly in developed economies, ensures consistent demand.

- Smart Home Technology Adoption: Insurers providing incentives for tech-integrated policies encourages homeowners to adopt risk-reducing devices.

Segment Highlights

The report provides in-depth analysis of various market segments:

- Coverage: The comprehensive coverage segment held the largest share in 2023, accounting for almost two-fifths of the market revenue. This type of coverage provides extensive protection that covers fire, theft, and natural disasters for homeowners.

- End User: The landlords segment dominated in 2023, contributing over three-fourths of the market revenue. This growth is attributed to the increasing demand for rental properties, prompting landlords to safeguard their investments with insurance.

- Growth of Tenant Segment: The tenant’s segment is expected to experience the largest CAGR of 10.1% between 2024 and 2033. This growth is driven by the rising number of rental properties, especially in urban areas.

Regional Analysis

North America dominated the market in 2023, accounting for more than two-fifths, which is driven by increased property values, greater awareness of natural disasters, and stricter regulatory frameworks.

The U.S. has seen a substantial surge in home insurance demand. Increased home values and a greater emphasis on protecting assets from climate-related risks, drive this trend. The region’s established mortgage market also has a prominent role in this dominance.

Leading Market Players

Key players in the home insurance market include:

- Liberty Mutual Insurance Company

- Chubb

- AXA

- ALLIANZ

- Zurich

- ADMIRAL

- Allstate Insurance Company

- PICC

- State Farm Mutual Automobile Insurance Company

- American International Group, Inc.

These companies are employing various strategies, such as new product launches, collaborations, and expansions, to increase market share and maintain their leadership positions.

Report Insights

The report provides a detailed analysis of market segmentation, current trends, and competitive scenarios to help stakeholders make informed business decisions. It also provides a quantitative analysis of market segments, current trends, estimations, and dynamics.

For more details, including the key segments and regional breakdowns, you can visit the Allied Market Research website.