Home Insurance Concerns Addressed at Goleta Town Hall

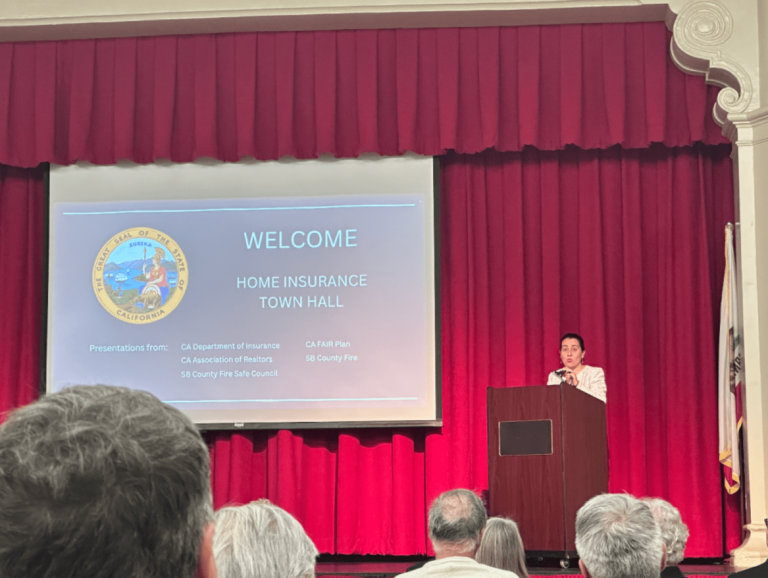

Following the devastating wildfires in Los Angeles, Santa Barbara residents gathered at a home insurance town hall in Goleta on February 27th to address lingering concerns about their own vulnerability and the rising costs of insurance.

Santa Barbara County Fire Chief Mark Hartwig sought to ease fears, stating, “It won’t” happen in Santa Barbara, provided residents and first responders maintain their preparedness and response culture.

The event, which was co-hosted by State Senator Monique Limón and State Assemblymember Gregg Hart, also highlighted the complexities of the property insurance market, specifically the challenges of availability and affordability.

“We know how much insecurity exists in our community because of this,” said Limón.

California Insurance Commissioner Ricardo Lara assured more than 100 attendees that major national insurance providers had recommitted to the state after discussions with Governor Gavin Newsom.

Despite this, Santa Barbara residents continue to face dropped policies and high premiums. The FAIR Plan, California’s “insurer of last resort,” has seen a nearly 50% increase in countywide enrollment in the past year, with over 4,800 properties insured through the plan as of September 2024, up from approximately 3,200 the previous year.

The FAIR Plan has experienced remarkable growth, becoming the third-largest property insurer in California. David Lorenc, Chief of Staff to the president of California’s FAIR Plan, emphasized that their goal is not expansion but instead to provide basic wildfire insurance where private companies will not, and move policyholders back into the private market when feasible.

Commissioner Lara is advocating for legislation to require insurance companies to write at least 85% of their California market share in wildfire-distressed, underserved areas, where the FAIR Plan is often the only option. Currently, only 50% of policies are in these areas.

Assemblymember Gregg Hart acknowledged climate change as a significant challenge, contributing complexity to wildfire insurance.

To mitigate the risk, Chief Hartwig advocates for at least five feet of “defensible space” around homes by eliminating flammable materials. He explained that wind-blown embers can travel long distances, making homes susceptible to ignition.

Lara addressed concerns about insurance payouts for those affected by the Los Angeles fires, vowing to take action against companies that do not fulfill their obligations.