Housing market map: How much home insurance is expected to rise by 2055

Federal Reserve Chair Jerome Powell recently warned that some homeowners may struggle to find home insurance in the coming decade or more. Speaking before the U.S. Senate, Powell highlighted the trend of insurance companies pulling out of regions affected by coastal erosion and wildfires. He forecast that this could lead to mortgage availability issues in certain areas.

“Both banks and insurance companies are pulling out of coastal areas or areas where there are a lot of fires. … There won’t be [mortgage] ATMs, there won’t be banks [lending mortgages], so it’ll fall on homeowners and residents.”

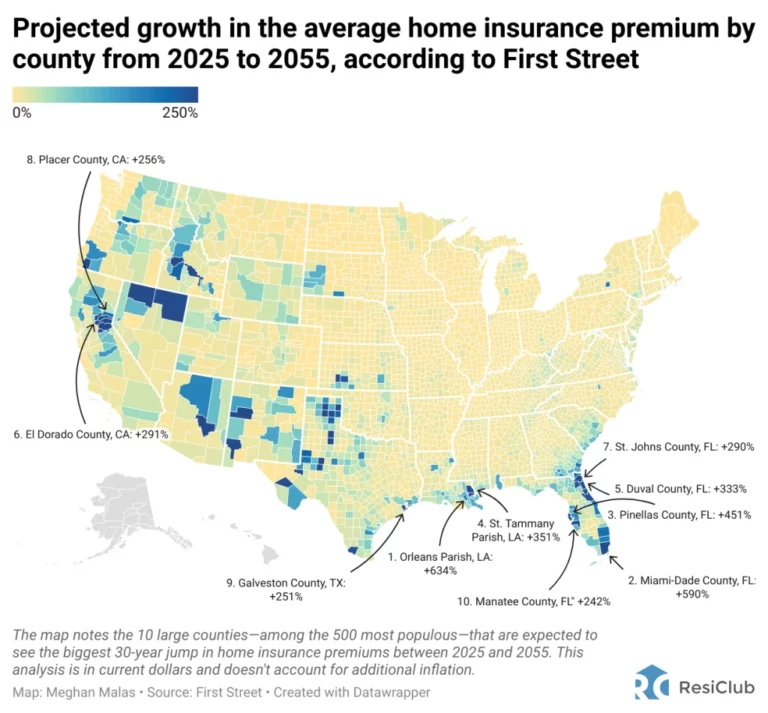

These warnings have raised concerns in the housing sector, prompting questions about which markets are most at risk of insurance and bank pullbacks. ResiClub analyzed a new report by First Street to identify at-risk areas.

First Street’s analysis uses models to assess property-specific and climate-related risks. It projects how much county-level home insurance premiums could change between 2025 and 2055. It’s worth noting that these are forecasts, and long-term predictions, particularly in finance, are subject to change. The analysis accounts for increasing climate exposure but does not adjust for future inflation or market fluctuations, presenting the values in today’s dollars.

Based on First Street’s analysis of the 500 most populous counties, here are the 20 areas expected to see the largest increases in home insurance premiums over the next three decades:

- Orleans Parish, Louisiana: +634%

- Miami-Dade County, Florida: +590%

- Pinellas County, Florida: +451%

- St. Tammany Parish, Louisiana: +351%

- Duval County, Florida: +333%

- El Dorado County, California: +291%

- St. Johns County, Florida: +290%

- Placer County, California: +256%

- Galveston County, Texas: +251%

- Manatee County, Florida: +242%

- Volusia County, Florida: +242%

- Clay County, Florida: +240%

- Palm Beach County, Florida: +195%

- Brevard County, Florida: +189%

- Broward County, Florida: +182%

- Coconino County, Arizona: +173%

- Hillsborough County, Florida: +162%

- Nueces County, Texas: +158%

- Hernando County, Florida: +152%

- Lafayette Parish, Louisiana: +149%

The heightened risk of flooding, hurricanes, and tropical storms underlies the projected insurance increases, particularly in the Gulf region. Florida accounts for 12 of the 20 counties expecting the most significant premium hikes.

Homeowners in these areas are already experiencing rising insurance costs. From the end of 2020 to the end of 2023, the median annual home insurance premium in the U.S. increased by 33%. However, many Florida counties saw premium surges above 80% during the same time period.