The Quest for Economic Dignity: Atlanta Life Insurance Co. and the Making of a Community

In the aftermath of the Civil War, as the wounds of slavery began to heal, a new challenge emerged for Black communities: economic empowerment. In Atlanta, a city grappling with the lingering effects of racial oppression, the need was clear. However, the path to financial stability was elusive. In an era where opportunities were scarce, a group of forward-thinking reverends sought a leader. Their ideal candidate wasn’t a preacher, but a savvy businessman—respected, wealthy, and Black. This search led them to a man who would not only transform their organization but would cultivate it into a major economic force for Black America.

“The art of separating people from their money is, after all, the most important of all arts.” – Atlanta Mutual weekly bulletin, Oct. 23, 1920

In 1905, just four decades after the Civil War, the Black community in Atlanta struggled under oppression, but a few managed to attain degrees of success. The reverends James Bryant and J.A. Hopkins needed an individual who met a specific criteria. The man they were looking for was Alonzo Herndon.

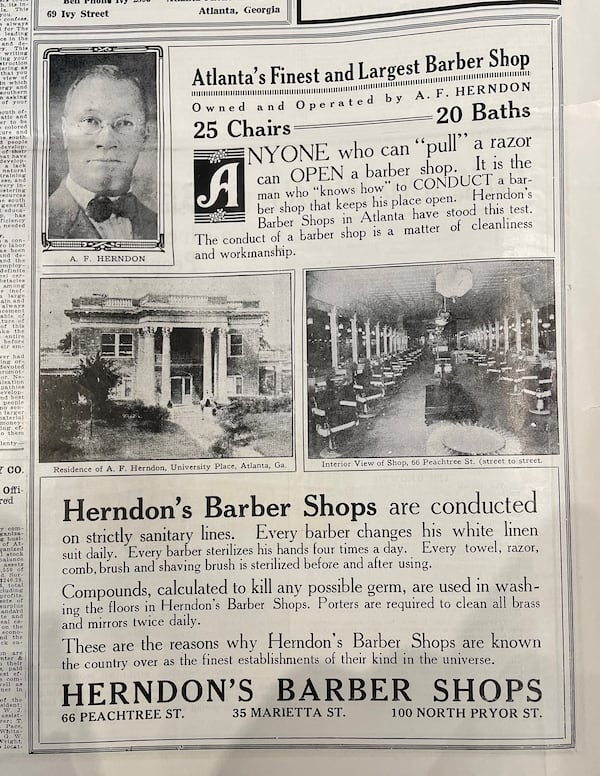

Herndon, a barber by trade, wasn’t the typical savior. Born in 1858 to a white slave owner and an enslaved woman, he started as a sharecropper, saving his pennies to escape the farm. He eventually found success in the barbering trade in the early 1880s in Atlanta. By 1904, he owned three of the most well-regarded barber shops in the country, serving Atlanta’s white elite.

In 1905, the reverends needed someone quickly. Their fledgling Atlanta Benevolent Protective Association, which provided aid to their poor, Black congregants, was at risk of closure. A new Georgia law required mutual aid organizations to deposit $5,000 to protect policyholders. The reverends needed to find a Black entrepreneur who could pay this deposit. The alternative was shutting down the association or selling it to a white-owned business. They approached Herndon.

While Herndon lacked experience in managing a mutual aid association, he was known to be dependable and honest, with the financial resources from his barber shops and real estate to cover the deposit. After convincing him to buy the association, Herndon restructured it to become the Atlanta Mutual Insurance Association in September 1905. This established it as one of the first Black-owned insurance companies under the new law.

The emergence of companies like Atlanta Mutual stemmed from mutual aid traditions among enslaved and formerly enslaved African Americans in the 1800s. These groups provided a framework for supporting their communities during hardship, according to Alexa Benson Henderson’s 1990 book, “Atlanta Life Insurance Company: Guardian of Black Economic Dignity.”

“Indeed, these associations aided significantly in the advancement of a group that was systematically isolated from the mainstream of American society,” – Alexa Benson Henderson

These associations, often tied to churches, collected fees to provide benefits for those who were sick or for burial costs for the family after a member passed. However, as Black populations swelled in cities like Atlanta after Emancipation, the economic needs of the community outgrew that. Larger, independent associations were a must.

White-owned insurance companies often refused to provide coverage to Black Americans. This led to the establishment of Black-owned companies like North Carolina Mutual Life Insurance Co. in 1898, which grew to be one of the largest in the country. Atlanta Mutual provided industrial insurance, that offered smaller premiums, rather than large payments made a few times a year.

When Herndon established Atlanta Mutual in 1905, it had a small team with only three agents. A decade later, it was the largest Black industrial insurance company in the lower South. The leadership encouraged agents to work hard, monitoring their performance through weekly bulletins. In 1922, it was renamed Atlanta Life Insurance Co. and expanded to six additional states by two years later.

Atlanta Life eventually moved from its one-room office to a two-story brick building on Auburn Avenue, becoming a significant presence on the Black business corridor known as Sweet Auburn. Herndon, even though enslaved in his early life, was dedicated to elevating his people. At an Atlanta Life managers’ conference in 1924, Herndon stated,

“An American asked an Irishman, ‘If you were not an Irishman, what would you rather be?’ The Irishman replied, ‘If I were not an Irishman, I would rather be ashamed.’ So it is with me. If I were not a Negro, I would be ashamed.”

He viewed Atlanta Life not as a way to enrich himself, as he was the first Black millionaire in Atlanta, but as a way to help others. He expressed joy in traveling through the states where Atlanta Life had a presence and meeting the young men and women who worked for the company.

“The majority of these young people … own their own homes and are regarded as business factors in the several communities where they live. This is as it should be, and as a result of it I am happy,” – Alonzo Herndon

By the time of his death in 1927, Atlanta Life employed more than 700 people and had over $1 million in assets, which is more than $18 million today. His son, Norris, took over leadership and navigated the Great Depression. He also provided home mortgages and business loans to African Americans, which were crucial to their success.

“I thank God for Atlanta Life Insurance Company and pray that we do those things that are just and right.” – Alonzo Herndon

The company’s commitment to its community was put to a test when the Ku Klux Klan tried to stop voter registration efforts. Henrietta Antoinin, a worker at Atlanta Life, recalled being picketed by the KKK for helping Black activists register voters.

Antoinin, who joined the company in 1962, worked with activist Jesse Hill Jr. to start a voter registration campaign. The company’s leadership supported their employees, paying their full salaries while they worked to register voters. Atlanta Life contributed more than $20,000 to King and civil rights organizations, paying bail for protestors and financing the movement for integration.

“Our switchboard was connected throughout the country, and we got calls all over the country where kids need to be bailed out of jail,” – Henrietta Antoinin

Atlanta Life also helped finance mortgages for Black people, despite the segregation of the time. Antoinin said the company was an expression for Black Americans.

“After working with Atlanta Life, I really saw what they meant when they say Atlanta Life was a quest for economic dignity for Black Americans,” – Henrietta Antoinin

In 1973, Hill became president and CEO of Atlanta Life, and the company continued to expand. By 1979, the company had approximately $107 million in assets. The company began construction of a new headquarters in 1980, marking its 75th anniversary.

However, the economic realities that prompted the company’s founding changed significantly. As the Civil Rights Movement opened up economic opportunities, Black Americans began to move towards the middle class. But Atlanta Life started to face challenges, including poaching of its agents by white companies and growing competition. The company moved away from its insurance focus and restructured into Atlanta Life Financial Group in 2001.

In 2007, Atlanta Life merged with Jackson Securities, a deal Antoinin opposed. The company had become divided and was struggling to compete. In 2010, Atlanta Life sold its Auburn Avenue headquarters. The company moved its headquarters away from the neighborhood where it had been founded to a downtown skyscraper.

“[The company’s] legacy is the legacy of Black institutions after desegregation,” – Mtamanika Youngblood

“I never brag about Atlanta Life being the biggest company in the world, but I am proud and anxious to have it the BEST company in the world.” – Alonzo Herndon

In January 2023, Atlanta Life Insurance Co. was acquired by Atlanta Life Holdings, which is owned by a group of Black entrepreneurs and executives, including Earvin “Magic” Johnson. Today, Atlanta Life has about $400 million in assets and is hoping to start selling insurance directly to consumers.

Even though Atlanta Life is smaller its peers, it has managed to last. For Antoinin, the Atlanta Life she dedicated her life to is gone, but the sentiment remains.

“Atlanta Life brought culture. It brought integrity,” – Henrietta Antoinin

This year marks the 120th anniversary of Herndon’s founding of Atlanta Life. Though the company faced decline, its impact on Atlanta and the Black community is still felt. Its story underscores the importance of economic empowerment and the enduring drive for dignity and opportunity.