IAIS Consults on Structural Shifts in the Life Insurance Sector

The International Association of Insurance Supervisors (IAIS) released a draft consultation paper on March 19, 2025, examining significant structural changes within the life insurance sector. These shifts primarily concern two key areas: the growing investment in alternative assets and the increasing use of asset-intensive/funded reinsurance (AIR) transactions. The IAIS paper highlights both the benefits and risks associated with these trends, emphasizing the need for robust risk management and supervisory oversight to ensure the stability of the global insurance market.

Key Points

The IAIS paper, an important appraisal of current and likely future regulatory trends, underlines the importance of macroprudential and financial stability.

Alternative Assets

Life insurers are increasingly allocating investments to a range of alternative assets, including private equity, real estate, and infrastructure. This shift is driven by the need for higher returns and diversification, especially in a persistently low-interest-rate environment. While offering benefits, such as diversification and higher potential returns, these assets also introduce significant risks. These include valuation uncertainty, illiquidity, and complexity.

To address these challenges, the IAIS proposes a principles-based definition for alternative assets to help with cross-border risk assessments.

Asset-Intensive/Funded Reinsurance (AIR)

AIR transactions involve transferring significant investment risks associated with insurance liabilities to a reinsurer. These arrangements are common in asset-intensive products, such as annuities and universal life insurance. AIR offers potential benefits, including risk reduction, capital relief, and indirect access to a broader range of investable assets. However, risks related to recapture, concentration, and increased complexity are also present.

Macroprudential and Financial Stability Considerations

The IAIS is examining the macroprudential and financial stability implications of increased investments in alternative assets and the use of AIR transactions. Given the interconnectedness of life insurers with other financial institutions, the IAIS emphasizes the importance of these considerations. Enhanced frameworks and international cooperation are essential to managing the evolving risks.

Review of IAIS Supervisory Materials

The IAIS’s review of its supervisory materials found that its Insurance Core Principles (ICPs) and Common Framework for the Supervision of internationally active insurance groups address the risks that could potentially arise from the increased capital allocation to alternative assets and AIR. The review identifies areas for enhancement, including improving information sharing amongst supervisors and adapting supervisory review and reporting to monitor complex assets and reinsurance agreements.

AIR Transactions

The International Association of Insurance Supervisors (IAIS) has monitored structural changes over the last four years within the life insurance sector through its Global Monitoring Exercise (GME).

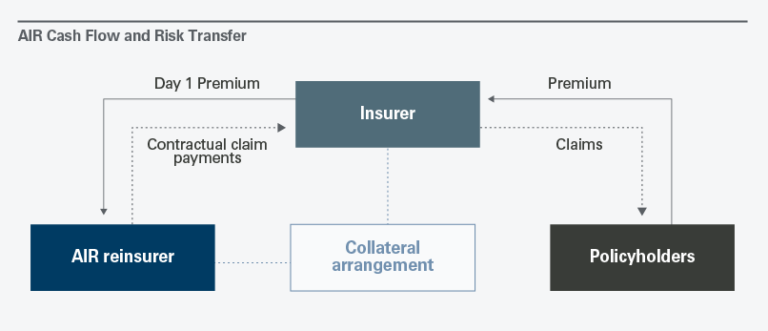

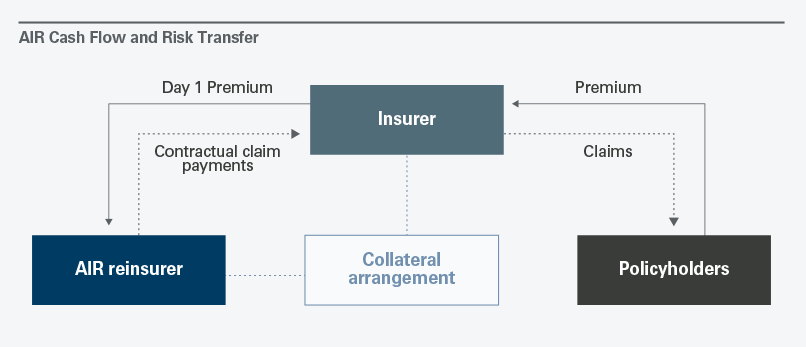

A chart shows the cash flows between policyholders, insurers and AIR reinsurers, and their relation to collateral and claims.

AIR is a reinsurance risk-transfer arrangement whereby significant investment risks associated with insurance liabilities (such as longevity or mortality) are transferred to a reinsurer. These arrangements are typically associated with insurance products that expose the insurer to relatively more significant investment risk than biometric risk, and which involve large upfront premium payments.

IAIS’s Consultative Approach

The IAIS encourages stakeholders to provide feedback on the draft paper by May 19, 2025, to refine its approach and ensure the stability and resilience of the global insurance market.

This article provides an overview of the IAIS consultation paper. For a detailed analysis, insurers, reinsurers, and asset managers are encouraged to review the paper itself.