Identity Theft Protection Services Market: An Overview

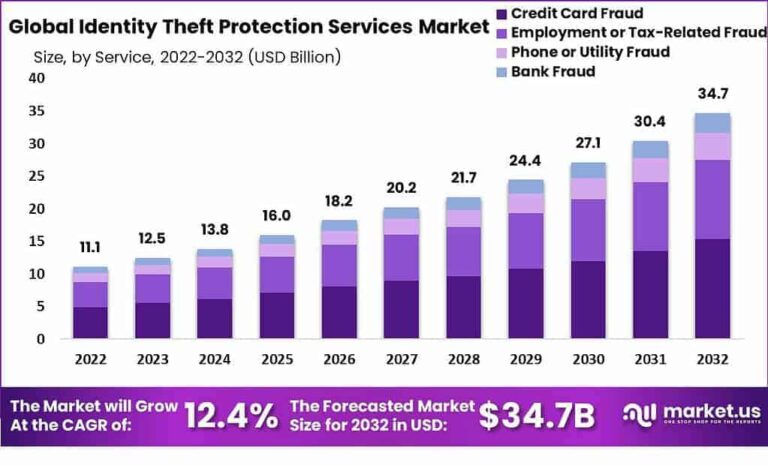

The global identity theft protection services market is experiencing robust growth. In 2022, the market was valued at USD 11.1 billion, and it is projected to achieve a compound annual growth rate (CAGR) of 12.4% between 2023 and 2032. This expansion is primarily fueled by the increasing incidents of identity theft across the digital and financial sectors. While factors like service costs and limited consumer awareness present challenges, the rise in cybercrime provides significant growth opportunities.

Credit card fraud protection is a particularly significant segment within this market, and the integration of artificial intelligence (AI) is a notable emerging trend.

Analyst Viewpoint

The identity theft protection services market is poised for rapid expansion, driven by heightened awareness among consumers and businesses regarding the risks of identity theft. As cybercrime continues to surge, both individuals and enterprises are seeking more comprehensive protection services. The incorporation of AI and machine learning is enhancing fraud detection capabilities, providing a competitive advantage for companies offering advanced solutions. Despite existing challenges, the market’s growth prospects remain strong due to the evolving digital landscape.

Key Takeaways

- Market Size and Growth: Valued at USD 11.1 billion in 2022, with a projected CAGR of 12.4%.

- Dominant Segment: Credit card fraud protection holds a substantial market share.

- Key Trends: AI and machine learning are driving innovation and efficiency in fraud detection and prevention.

- Regional Dominance: North America has a significant market share.

- Growth Driver: Rising cybercrime incidents are increasing demand for these services.

Business Opportunities and Strategies

The identity theft protection services market offers lucrative opportunities for businesses focused on integrating AI and machine learning to improve fraud detection and prevention capabilities. Addressing the limited awareness barrier through innovative consumer education and awareness programs can also be advantageous. Expanding services to cater to small businesses and providing affordable plans for individuals will broaden the customer base. Additionally, focusing on new services centered on multi-factor authentication and encryption technologies will further strengthen market position.

Regional Analysis

North America currently leads the global identity theft protection services market, holding a 32.5% share in 2022. This dominance is attributed to high consumer awareness, the prevalence of credit card fraud incidents, and increasing cybercrime occurrences. The United States, in particular, is witnessing a notable rise in demand for identity theft prevention services in both personal and business sectors. Europe and the Asia Pacific regions are also experiencing growing demand, driven by increased digital adoption and rising instances of online fraud.

Key Segmentation

The market is segmented based on type and application.

Based on Type:

- Credit Card Fraud

- Employment or Tax-Related Fraud

- Phone or Utility Fraud

- Bank Fraud

Based on Application:

- Consumer

- Enterprise

Key Player Analysis

The identity theft protection services market is highly competitive, with major players focusing on integrating AI and machine learning for improved fraud detection. Companies are expanding their service offerings to cover a wide range of fraud protection, including credit card, medical, and social security fraud. Furthermore, strategic partnerships with financial institutions, retailers, and online platforms are crucial for reaching broader consumer bases and enhancing service credibility.

Market Key Players:

- Symantec Corporation

- Experian plc

- Equifax Inc.

- TransUnion

- RELX PLC

- PrivacyGuard

- Identity Guard

- McAfee Corp.

- AllClear ID Inc.

- F-Secure Corporation

- IdentityForce, Inc.

- IDShield and other key players.

Recent Developments

Recent advancements in the identity theft protection market include integrating artificial intelligence and machine learning into services. These technologies are used to detect fraud patterns in real-time effectively, enhancing the accuracy and efficiency of fraud detection. Service providers are improving their mobile applications and offering more user-friendly interfaces to engage consumers better. The growing focus on cybersecurity and multi-layered authentication services further drives innovation in the sector. Also, there is an increasing emphasis on educating consumers about identity theft prevention.

Conclusion

The identity theft protection services market is positioned for considerable growth, primarily driven by growing cybercrime incidents and rising demand for improved protection across different sectors. With a projected CAGR of 12.4%, the market presents valuable opportunities for companies that: integrate AI, provide affordable services and improve consumer awareness. North America is anticipated to maintain its leading position. However, emerging markets are expected to achieve significant growth owing to increased digital adoption and the demand for identity security.