India Motor Vehicle Insurance Market: Current Analysis and Forecast (2024-2032)

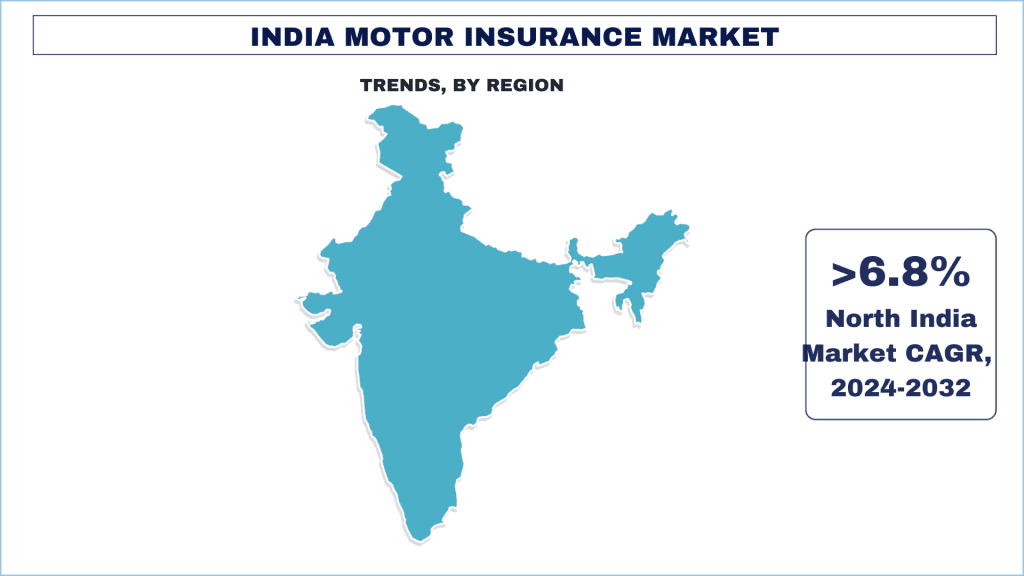

The Indian motor vehicle insurance market is experiencing robust growth, driven largely by the expansion of the automotive sector. This report provides a comprehensive analysis of the market, including key trends, segmentation, and future projections.

Motor insurance is a crucial part of general insurance, designed to safeguard vehicle owners against financial losses resulting from damage, theft, or liability claims. The market is regulated by the Insurance Regulatory and Development Authority of India (IRDAI), with policies offered by various public, private sector financial institutions, and banks. These policies typically cover repair costs and damages for the insured period.

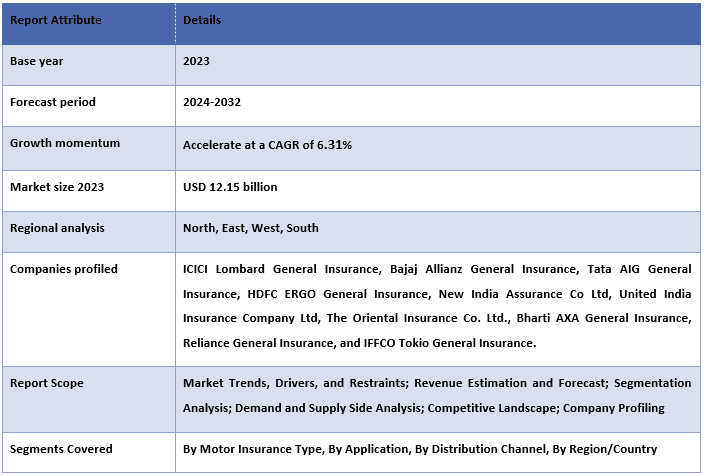

In 2023, the India Motor Insurance Market was valued at USD 12.15 billion. Industry analysts predict a strong compound annual growth rate (CAGR) of approximately 6.31% during the forecast period of 2024-2032. This growth is primarily fueled by the increasing sales of automobiles across the country.

The rising middle-class population and increased disposable incomes in India are major contributors to the booming automotive industry. This has led to a corresponding increase in the demand for both first-party (own damage) and third-party liability insurance, the latter being mandatory along with road tax for all vehicle purchases. Several policy changes are also expected to drive further demand in the coming years.

Motor insurance holds a significant share of the overall general and health insurance market in India. The total premium underwritten for motor insurance in India was INR 70,433.48 crore in 2021-22, increasing to INR 81,280.04 crore in 2022-23, according to IRDAI data. The public sector currently holds the majority of the market share, accounting for approximately 80%.

Key Trends in the India Motor Insurance Market

Here’s a look at some of the major trends identified by research experts:

Rising Trend of Electric Vehicles

The electric vehicle (EV) segment is experiencing rapid growth, driven by increasing customer focus on sustainability. EVs offer numerous advantages over traditional internal combustion engine (ICE) vehicles, including lower operational costs and zero tailpipe emissions.

EV sales in both two-wheeler and four-wheeler categories have been rising. The total sales of electric vehicles in 2023 reached 1.53 million, representing a 50% increase from 2022.

Government initiatives, such as offering free road tax in many states, have further spurred EV sales in cars, two-wheelers, and e-rickshaws. This trend is expected to contribute to a higher number of motor insurance policies in the coming years.

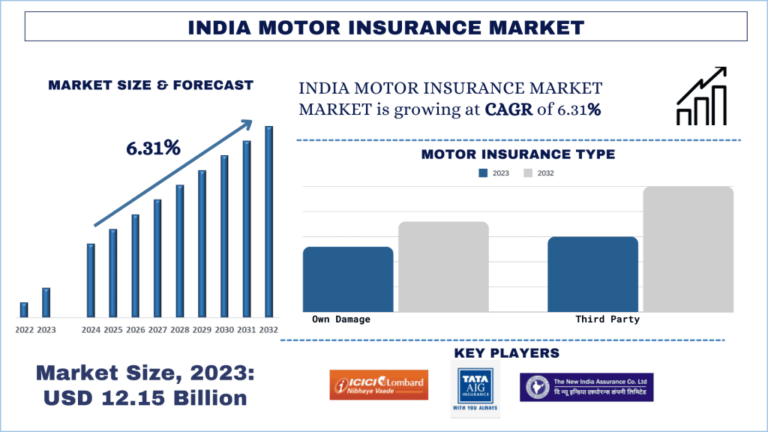

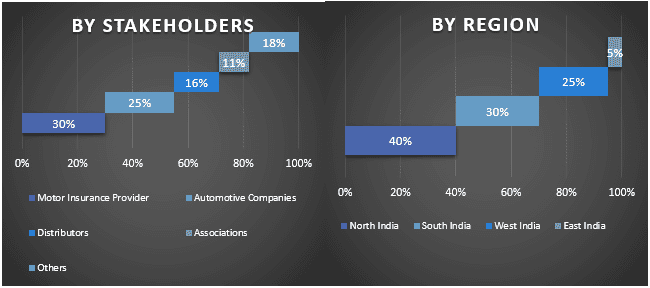

North India’s Dominance

North India currently holds a significant share of the motor insurance market. This is attributed to the high volume of automobile sales in previous years across states like Uttar Pradesh, New Delhi, Punjab, and Haryana. These states have both large populations and rapid vehicle ownership growth.

According to the Society of Indian Automotive Manufacturers (SIAM), Uttar Pradesh, New Delhi, and Haryana held 10.04%, 5.94%, and 6.60% of car sales in India in 2023, respectively. Similar trends were observed in two-wheeler sales, with 14.35%, 2.50%, and 2.89% shares during the same period. Consequently, the demand for motor insurance is expected to continue rising in North India between 2024 and 2032.

India Motor Insurance Industry Overview

The India Motor Insurance market is characterized by a competitive landscape, with a mix of regional and national players. Key players are actively employing various growth strategies to enhance market presence, including partnerships, collaborations, new product launches, geographical expansions, mergers, and acquisitions. Some of the major companies in this market are:

- ICICI Lombard General Insurance

- Bajaj Allianz General Insurance

- Tata AIG General Insurance

- HDFC ERGO General Insurance

- New India Assurance Co Ltd

- United India Insurance Company Ltd

- The Oriental Insurance Co. Ltd.

- Bharti AXA General Insurance

- Reliance General Insurance

- IFFCO Tokio General Insurance

Recent Developments

- In 2022, IRDAI enabled general insurance companies to introduce innovative policies, such as Pay As You Drive, Pay How You Drive, and floater policies, along with two-wheeler and car add-ons.

- In 2023, ICICI Lombard introduced its AI-based “Claim Your Claim” digital campaign, aimed at reaching underpenetrated markets for general insurance in India.