Insurance Company Rejects Air Ambulance Bill, Despite Saving Patient’s Life

HANOVER, Ind. — Amanda Boley’s experience on October 24, 2024, began like any other day. She went to work, walked her dog, and was texting a coworker when she suddenly collapsed. That’s the last thing she remembers.

“My dog was acting a little weird and I looked at her and said, ‘What do you want?’ and I kinda played with her a little bit,” she recounted in an interview with 13News. “And then I was gone.”

Gone, as in clinically dead. Just after 6:00 p.m., Boley collapsed in her living room. Her family member heard the dog barking and discovered her unconscious.

Hanover Police Sgt. Kyle Pence arrived within minutes after a frantic 911 call. “She was not conscious, not breathing … I did not feel a pulse while I was there,” said Pence, who administered CPR and used an AED until paramedics took over.

Paramedics made critical decisions that saved Boley’s life, but it also started a battle with her insurance company. The situation raises troubling questions about how insurance companies are operating.

Boley suffered sudden cardiac arrest, the abrupt loss of all heart function caused by an irregular heart rhythm. A doctor at Norton King’s Daughters’ Hospital in Madison, Ind., recognized that the medical help Boley needed wasn’t available locally and promptly instructed paramedics to transport her to a full-service hospital. The closest one was in Louisville. However, the EMS team estimated the drive would take about an hour — time Boley didn’t have, given her critical medical condition. Therefore, the doctor directed paramedics to transport Boley to Madison Municipal Airport, where an air ambulance was waiting to take her to Norton Brownsboro Hospital in Kentucky in under 20 minutes.

Surgery to implant a defibrillator took place once Boley arrived. She woke up in the hospital two days later, surrounded by IVs and monitors. Her family explained what had occurred. She credits her dog, family, and first responders with getting her immediate care that saved her life. However, she said that without the air ambulance, all those efforts would have been in vain. “If it weren’t for the helicopter, I’d be dead,” she told 13News.

The $65,000 Bill and the Denial

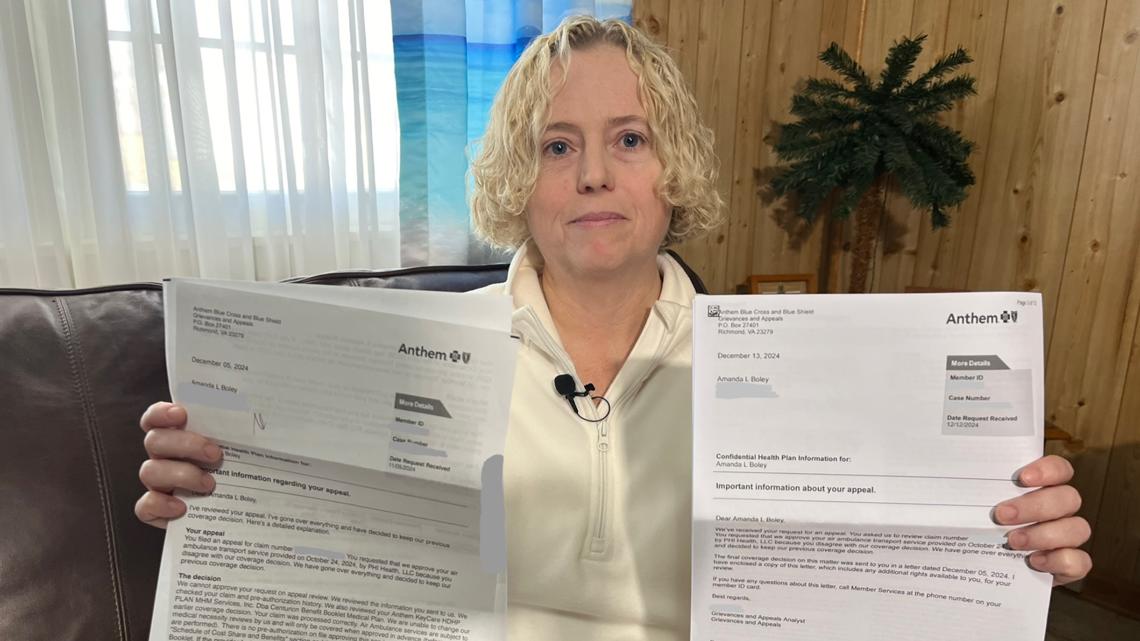

Imagine Boley’s shock when, while reviewing her medical bills, she found that the air ambulance transport was denied. “They were denying the claim because it didn’t get preapproved,” she explained. Boley showed 13 Investigates an Explanation of Benefits from Anthem Blue Cross and Blue Shield, stating the company would not cover the air ambulance, because “This service requires preapproval. Your plan doesn’t cover this service without it. You are responsible for this amount.” The amount was $64,998.

After Boley appealed, Anthem refused to pay for the air ambulance, even after 13 Investigates intervened. Anthem ultimately admitted its error and agreed to cover the cost.

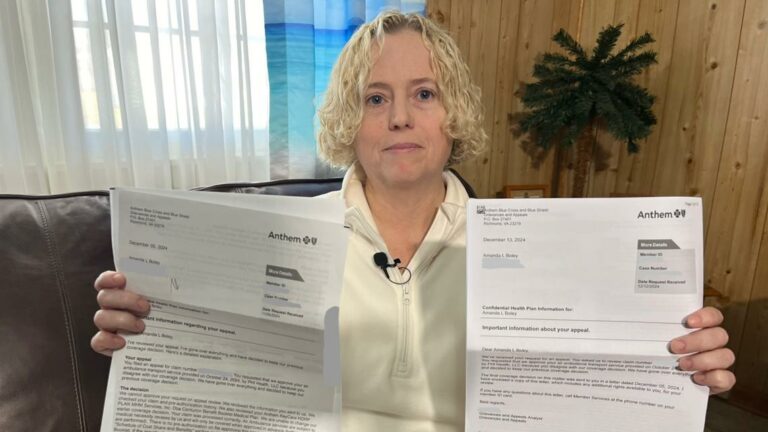

Boley appealed, offering details and documentation related to her critical medical condition that showed the necessity of the helicopter and her inability to obtain preapproval. The insurance company denied her appeal—not once, but twice.

“I appealed and they denied, and I appealed and they denied,” Boley explained, holding two denial letters from Anthem.

Anthem doubled down on its preauthorization requirement, asserting, “Your claim was processed correctly. Air ambulance services are subject to medical necessity reviews by us and will only be covered when approved in advance (before services are performed). There is no preauthorization on file approving this service.”

“That night I was dead and then I was unconscious. I don’t know how I’m supposed to get preapproval,” Boley said as she looked at her denial letters. “It’s outrageous.”

Pence agreed. “She was in no way, shape or form able to call to get preauthorization. She was unresponsive,” the officer said.

Anthem Admits Errors and Agrees to Pay

Boley contacted 13 Investigates in early January, 2025, and 13News then contacted Anthem, seeking clarification and a reversal of its decision. An Anthem spokesman did not grant an interview, but the company sent a statement admitting to several errors in processing Boley’s claim.

Jeff Blunt, Anthem’s senior director of corporate communications, stated that, “Emergency treatment never requires prior authorization, and our members can access emergency services 24/7 at any facility, regardless of network status. In this case, coverage decisions were made without the necessary information from the provider to recognize that this was an emergency. Once we became aware of the circumstances, we should have acted immediately to obtain that documentation and approve the claim—but we did not. We deeply regret the mistakes that led to the incorrect determinations and our leadership has been in touch with our member to offer our sincere apologies.”

The company also stated they are taking immediate steps to prevent such issues in the future.

After 13News’ inquiry, Boley received a call from an Anthem representative who apologized and informed her that Anthem would cover the air ambulance bill in full.

Concerns Over Review Processes

This case raises concerns about how insurance claims are handled. Patricia Kelmar, senior health care campaign director at the U.S. Public Interest Research Group (PIRG), stated that she regularly hears about patients like Boley struggling with insurance companies over incorrect denials. She expressed concern that some insurance companies may be using artificial intelligence to deny claims. She noted that approximately 450 million health insurance claims are denied each year and that number is increasing.

The question remains whether artificial intelligence or a human made the mistakes that led to Boley’s claim denials. Anthem has not responded to 13 Investigates’ question on this matter.

Kelmar advises patients to appeal claim denials. “They should certainly appeal. What we’ve seen in studies is at least 50% — and there have been reports of as high as 75% — of the time, patients will win that appeal. So it’s absolutely worth filing the paperwork, going through the application process to get your insurance to cover your claim,” Kelmar told 13News.

Boley believes an appeal should never have been necessary in her case. “It’s appalling. It’s outrageous,” she said. “When people need help in a crisis situation like that, they have insurance for a reason. It’s to help when those situations happen.”

What to Do If Your Claim Is Denied

Kelmar suggests several steps consumers can take if their healthcare claim is denied:

- Review your policy: Understand what is covered and what is not.

- File an appeal: Providing all supporting documentation.

- Involve your employer: Your HR department may advocate on your behalf.

- Appeal again: Persistence can pay off.

- File a complaint: If all else fails, file a complaint with regulators.