Insurance Denials Leave Palm Springs Businesses Reeling After Terrorist Bombing

By Fred Roggin May 22, 2025

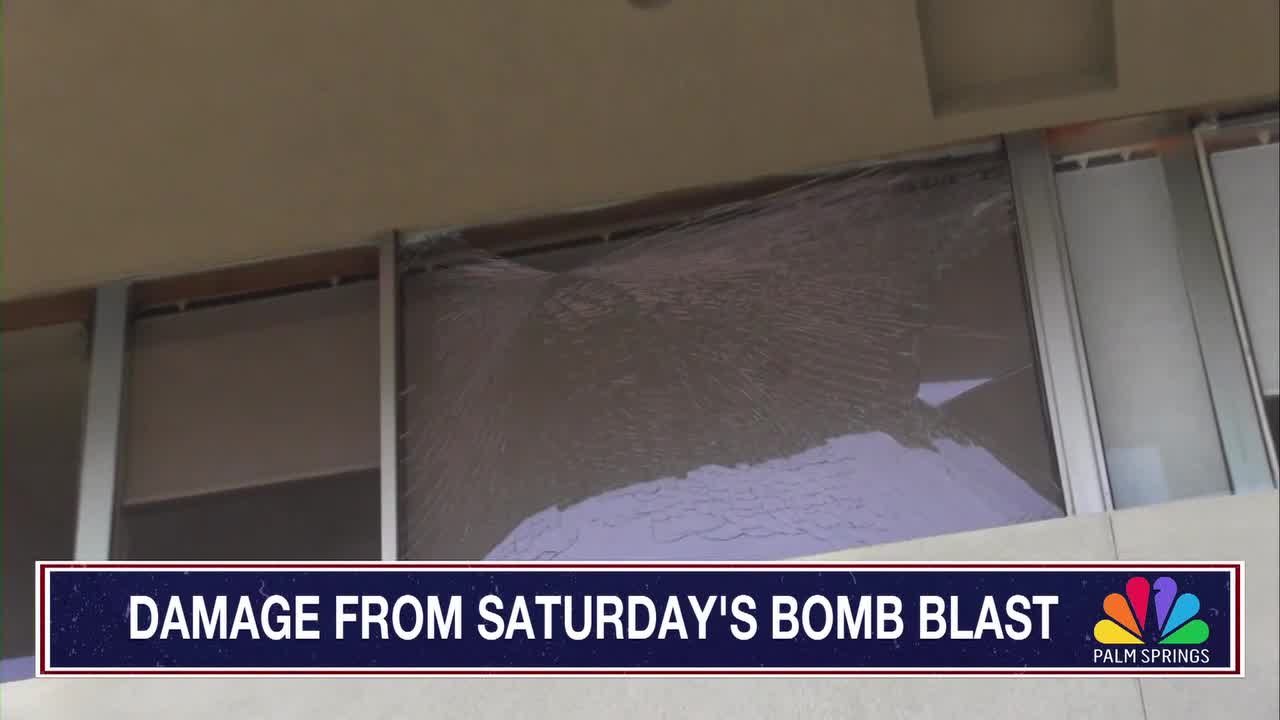

The recent terrorist bombing in Palm Springs has left many local businesses struggling to recover, as they face denial of their insurance claims due to the attack being classified as a terrorist act. According to legal expert Walter Clark, the classification of the bombing as terrorism has significant implications for business owners’ insurance coverage.

Many business owners are finding that their insurance policies do not cover damages resulting from terrorist attacks, leaving them with significant financial losses. The Business Owner’s Policy (BOP) typically includes coverage for various risks, but the specifics of terrorism coverage can vary. Walter Clark explains that the Terrorism Risk Insurance Act (TRIA), enacted after the 9/11 attacks, provides a federal backstop for insurance claims related to terrorist acts. However, the application of TRIA and the interpretation of what constitutes a terrorist act can be complex.

The denial of insurance claims has left many Palm Springs businesses facing significant challenges in their recovery efforts. The impact of the bombing, combined with the insurance denials, has created a difficult situation for local business owners who are trying to rebuild and recover.

Legal experts like Walter Clark are working with affected businesses to navigate the complex insurance landscape and fight for the coverage they need to recover. The outcome of these efforts could have significant implications for businesses affected by the bombing and for the broader community.