Insurance Denials Leave Palm Springs Businesses Reeling After Terrorist Bombing

By Fred Roggin May 22, 2025

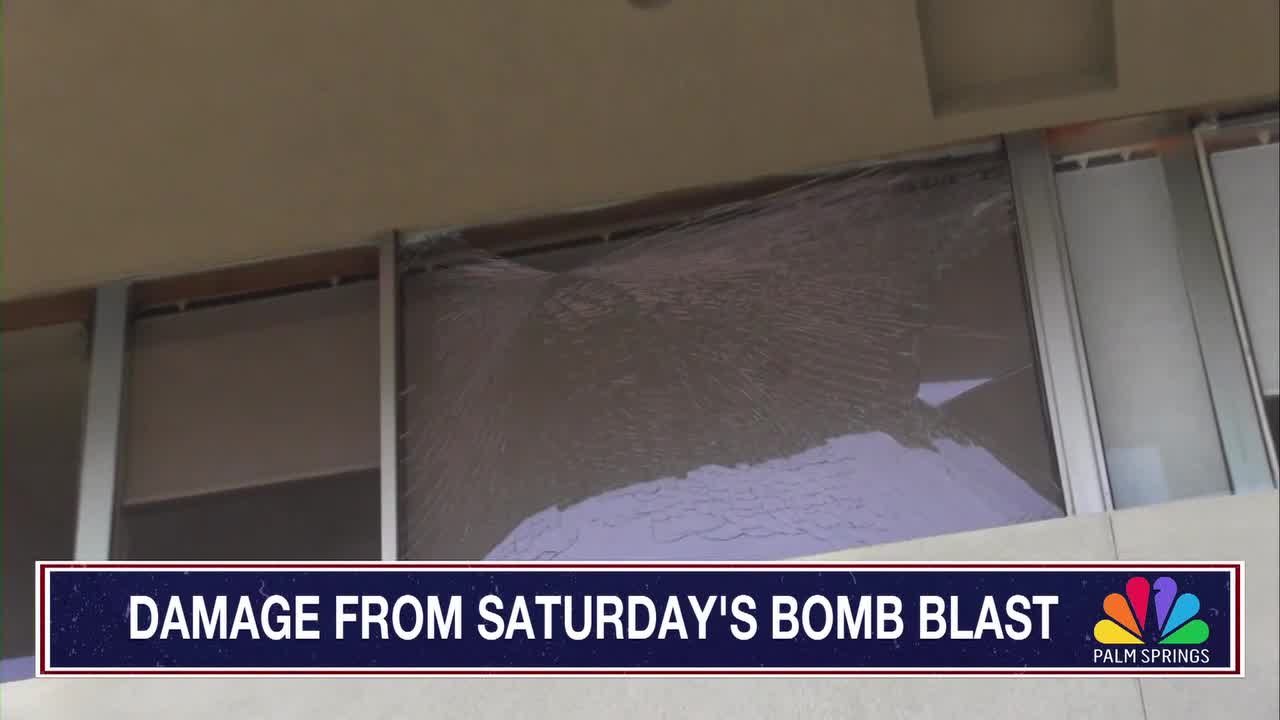

The recent terrorist bombing in Palm Springs has left many local businesses struggling to recover, not just from the physical damage, but also from the financial blow of having their insurance claims denied. The reason behind these denials? The attack’s classification as an act of terrorism.

According to legal expert Walter Clark, the classification of the bombing as terrorism has significant implications for insurance claims. Many businesses in Palm Springs are finding that their insurance policies do not cover acts of terrorism, leaving them with substantial financial losses.

The issue centers around the Business Owner’s Policy (BOP), which is a common type of insurance policy that many businesses hold. While BOP policies typically cover a wide range of risks, they often exclude acts of terrorism due to the Terrorism Risk Insurance Act (TRIA) of 2002, which was enacted in response to the 9/11 attacks.

Walter Clark explains that the TRIA requires insurers to offer terrorism coverage, but it also allows them to exclude certain types of terrorism-related losses. This has led to a complex situation where businesses are left wondering if they are covered.

For small businesses in Palm Springs, the denial of insurance claims due to the terrorism classification is particularly devastating. These businesses often lack the financial resources to recover from such a significant loss without the support of insurance payouts.

As the community continues to recover from the bombing, the issue of insurance denials is likely to remain a major concern. Legal experts like Walter Clark are working to help businesses navigate the complex landscape of terrorism insurance and advocating for clearer policies that protect business owners.

The situation in Palm Springs serves as a stark reminder of the importance of understanding insurance policies, particularly when it comes to acts of terrorism. Businesses must be aware of what is covered and what is not to avoid being caught off guard in the event of an attack.